Lower US Treasury Yields Follow Fed's Indication Of One 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lower US Treasury Yields Follow Fed's Indication of One 2025 Rate Decrease

US Treasury yields tumbled following the Federal Reserve's (Fed) latest policy statement, which hinted at a single interest rate cut in 2025. This shift in expectation sent ripples through the financial markets, impacting everything from bond prices to the dollar's value. The move reflects a growing belief that inflation is cooling and the aggressive rate hike cycle is nearing its end.

The Fed, in its September meeting, maintained its benchmark federal funds rate in the 5.25%-5.5% range. However, the accompanying statement subtly altered the outlook, suggesting a less hawkish stance than previously anticipated. This subtle shift, though seemingly small, carries significant weight for investors and significantly impacts US Treasury yields.

What Drove the Decline in Treasury Yields?

Several factors contributed to the drop in US Treasury yields:

-

Softening Inflation Data: Recent inflation figures, while still above the Fed's target, show a consistent downward trend. This easing of inflationary pressures reduces the need for further aggressive interest rate hikes, lessening the appeal of higher-yielding assets. The Consumer Price Index (CPI) and Producer Price Index (PPI) reports are key indicators closely watched by the Fed and market analysts alike.

-

Market Expectations: The market had been pricing in the possibility of further rate hikes, anticipating persistent inflation. The Fed's suggestion of only one rate cut in 2025 surprised some, prompting a reassessment of future interest rate trajectories. This reassessment directly influenced the demand for US Treasury bonds, pushing yields lower.

-

Reduced Demand for Higher Yields: With the expectation of lower future interest rates, the demand for higher-yielding assets decreased. Investors started shifting their focus towards bonds, increasing demand and thereby lowering yields. This shift represents a significant realignment of investment strategies within the current economic climate.

Implications for Investors

The lower Treasury yields present both opportunities and challenges for investors. For example:

-

Bondholders: Existing bondholders see an increase in the value of their holdings as yields fall. However, future returns from new bond purchases will be lower.

-

Stock Market: Lower yields can be positive for the stock market, as lower borrowing costs can stimulate economic growth and corporate investment. However, the relationship isn't always straightforward and depends on various other economic factors.

-

Dollar Value: The decreased yields can potentially weaken the US dollar relative to other currencies, impacting international trade and investment flows.

Looking Ahead: Uncertainty Remains

While the Fed's statement offers a degree of clarity, uncertainty remains. The path of inflation and the economy’s overall health will continue to influence future monetary policy decisions. Analysts will be closely scrutinizing upcoming economic data releases, particularly inflation reports and employment figures, to gauge the Fed's future moves and their impact on Treasury yields. The next few months will be crucial in determining the trajectory of interest rates and their implications for the broader economy.

Call to Action: Stay informed on the latest economic news and updates by regularly checking reputable financial news sources. Understanding these shifts can help you make informed investment decisions. Consider consulting with a financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lower US Treasury Yields Follow Fed's Indication Of One 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Novavax Covid 19 Vaccine Fda Approval And The Specific Use Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval And The Specific Use Restrictions

May 21, 2025 -

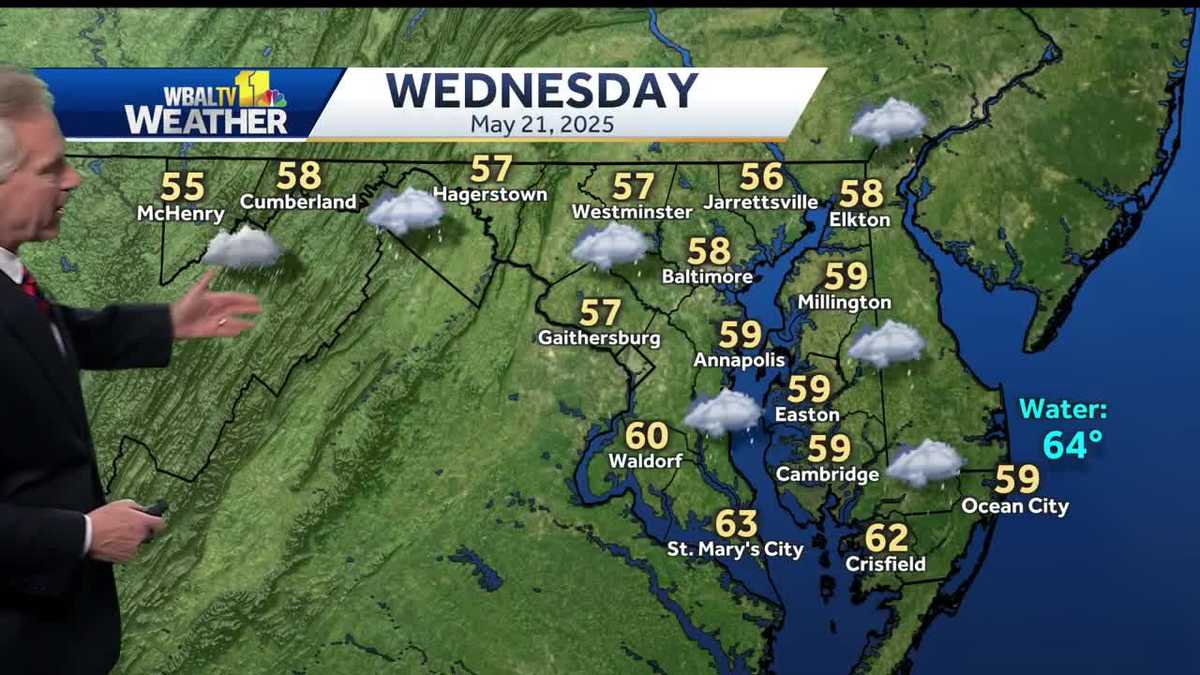

Cold Front Brings Rain And Chilly Temperatures Wednesday

May 21, 2025

Cold Front Brings Rain And Chilly Temperatures Wednesday

May 21, 2025 -

Always Kept It Real Jamie Lee Curtis On Her Longstanding Bond With Lindsay Lohan

May 21, 2025

Always Kept It Real Jamie Lee Curtis On Her Longstanding Bond With Lindsay Lohan

May 21, 2025 -

Trump To Intervene Direct Talks With Putin And Zelensky Sought To Achieve Ukraine Cease Fire

May 21, 2025

Trump To Intervene Direct Talks With Putin And Zelensky Sought To Achieve Ukraine Cease Fire

May 21, 2025 -

Supreme Court Greenlights End To Venezuelan Migrant Protections Trump Era Policy Restored

May 21, 2025

Supreme Court Greenlights End To Venezuelan Migrant Protections Trump Era Policy Restored

May 21, 2025