Lower Mortgage Refinance Rates: Check Today's Rates (May 19, 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lower Mortgage Refinance Rates: Check Today's Rates (May 19, 2025)

Are you paying too much for your mortgage? With mortgage refinance rates dipping lower than we've seen in months, now might be the perfect time to explore your options and potentially save thousands of dollars over the life of your loan. Today, May 19th, 2025, presents a unique opportunity for homeowners to significantly reduce their monthly payments and improve their financial well-being.

Why are Refinance Rates Dropping?

Several factors contribute to the recent decline in mortgage refinance rates. These include, but aren't limited to:

- Easing Inflation: A slowdown in inflation often leads to lower interest rates as the Federal Reserve adjusts its monetary policy.

- Increased Competition: Competition among lenders is fierce, driving down rates to attract borrowers.

- Shifting Market Conditions: Fluctuations in the overall economic climate can influence the availability and cost of borrowing.

Understanding these market dynamics is crucial for making informed decisions about refinancing. Staying updated on economic news and interest rate trends is key to seizing the best opportunities.

How to Check Today's Refinance Rates:

Finding the best refinance rate requires research and comparison. Here's how to get started:

-

Check Online Mortgage Calculators: Many reputable financial websites offer free mortgage calculators that allow you to estimate your potential savings based on your current loan and desired refinance terms. Be sure to use several calculators for a comprehensive overview. (Example: [Link to a reputable mortgage calculator website])

-

Contact Multiple Lenders: Don't rely on just one lender. Shop around and compare offers from various banks, credit unions, and online lenders. This will help ensure you secure the most competitive rate possible.

-

Review Your Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for. Improving your credit score before applying can result in lower rates and better terms. (Learn more about improving your credit score: [Link to a reputable credit score improvement resource])

-

Consider Your Loan Type: Different loan types (e.g., fixed-rate, adjustable-rate, FHA, VA) come with varying interest rates and terms. Choose the loan type that best suits your financial situation and long-term goals.

What to Look For in a Refinance Offer:

Beyond the interest rate, pay attention to these key aspects of a refinance offer:

- Closing Costs: These fees can vary significantly between lenders. Negotiate to minimize these costs whenever possible.

- Loan Terms: Understand the length of the loan, the repayment schedule, and any prepayment penalties.

- APR (Annual Percentage Rate): This figure represents the total cost of your loan, including interest and fees. Compare APRs from different lenders to get a complete picture.

Is Refinancing Right for You?

Refinancing isn't always the best option. Weigh the potential savings against the closing costs and other factors. If you are unsure, consider consulting a qualified financial advisor. They can help you determine if refinancing aligns with your financial goals and risk tolerance.

Act Now:

Mortgage rates are dynamic, so don't delay. Today's lower rates present a valuable opportunity to save money and potentially reduce your monthly mortgage payments. Take advantage of this window by researching your options and contacting lenders today. Remember, acting swiftly could translate into significant long-term savings.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial professional before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lower Mortgage Refinance Rates: Check Today's Rates (May 19, 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Accused By Jon Jones Of Withholding Aspinall Fight Information

May 20, 2025

Ufc Accused By Jon Jones Of Withholding Aspinall Fight Information

May 20, 2025 -

Billions Flowing Into Bitcoin Etfs A Look At The Recent Surge

May 20, 2025

Billions Flowing Into Bitcoin Etfs A Look At The Recent Surge

May 20, 2025 -

Trump Announces Call With Putin On Monday To Stop The Violence In Ukraine

May 20, 2025

Trump Announces Call With Putin On Monday To Stop The Violence In Ukraine

May 20, 2025 -

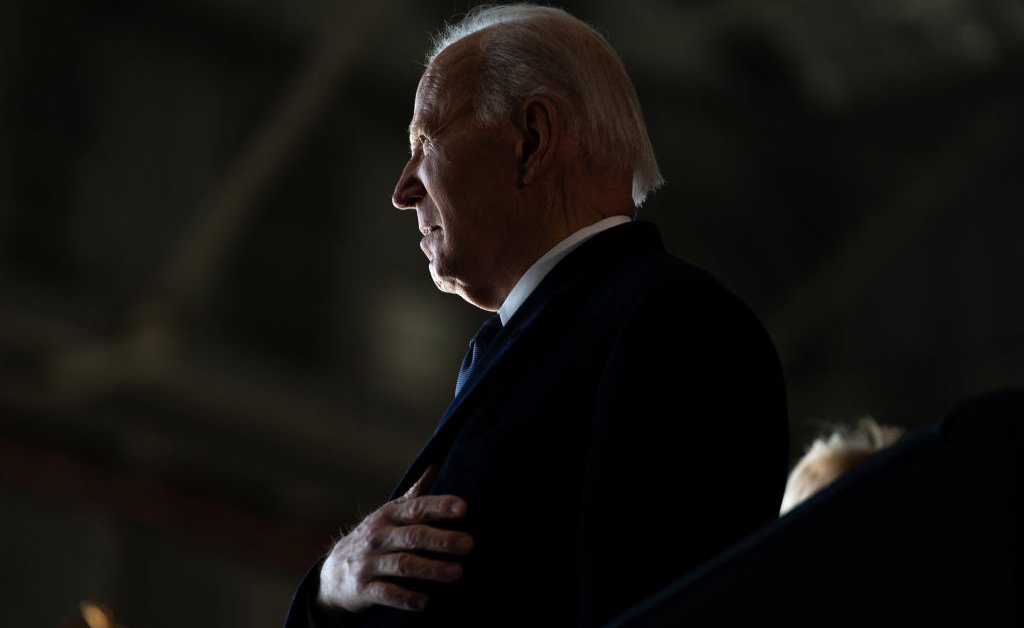

Global Leaders Offer Prayers And Support For President Bidens Cancer Battle

May 20, 2025

Global Leaders Offer Prayers And Support For President Bidens Cancer Battle

May 20, 2025 -

Post Pectra Upgrade Ethereum Attracts 200 Million In Investor Funding

May 20, 2025

Post Pectra Upgrade Ethereum Attracts 200 Million In Investor Funding

May 20, 2025