Billions Flowing Into Bitcoin ETFs: A Look At The Recent Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flowing into Bitcoin ETFs: A Look at the Recent Surge

The cryptocurrency market is buzzing with excitement as billions of dollars pour into Bitcoin exchange-traded funds (ETFs). This recent surge marks a significant milestone for Bitcoin's mainstream adoption and signifies a growing confidence in the digital asset's long-term potential. But what's driving this influx of investment, and what does it mean for the future of Bitcoin and the broader crypto landscape?

The Rise of Bitcoin ETFs:

The launch of the first Bitcoin futures ETF in the US in 2021 paved the way for a wave of similar products. These ETFs offer investors a relatively straightforward and regulated method to gain exposure to Bitcoin's price movements without the complexities of directly purchasing and storing the cryptocurrency. This accessibility is a major factor contributing to the current surge in investment. However, it's crucial to understand that these ETFs typically don't hold Bitcoin directly; instead, they track the price of Bitcoin futures contracts.

Factors Fueling the Investment Surge:

Several key factors are driving the billions flowing into Bitcoin ETFs:

-

Increased Institutional Adoption: Large institutional investors, including hedge funds and asset management firms, are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential inflation hedge and a diversifier in a volatile market. This institutional interest lends significant credibility to Bitcoin's value proposition.

-

Regulatory Clarity (or the Lack Thereof): While regulatory uncertainty remains a concern in the crypto space, the slow but steady progress in regulatory frameworks, particularly in the US, is contributing to investor confidence. The approval of Bitcoin futures ETFs is a significant step in this direction. However, the lack of a spot Bitcoin ETF remains a point of contention.

-

Growing Mainstream Awareness: Bitcoin's profile has grown significantly over the past decade, moving beyond the niche community of early adopters. Increased media coverage, educational resources, and the overall growth of the cryptocurrency market have all contributed to greater public awareness and understanding.

-

Macroeconomic Factors: Global macroeconomic uncertainty, including inflation and geopolitical instability, is pushing investors to seek alternative assets. Bitcoin, with its decentralized nature and limited supply, is seen by some as a safe haven asset, potentially mitigating the risks associated with traditional markets.

What the Surge Means for the Future:

The massive influx of capital into Bitcoin ETFs signifies a significant shift in the perception of Bitcoin. It indicates a growing acceptance of cryptocurrencies as a legitimate asset class within the mainstream financial system. This trend is likely to continue, potentially leading to:

-

Increased Price Volatility: Increased investment can lead to short-term price fluctuations. While this might concern some investors, it's a natural consequence of increased liquidity and trading activity.

-

Further Institutional Adoption: The success of Bitcoin ETFs will likely encourage more institutional investors to enter the market, further driving up demand.

-

Development of Innovative Products: The success of Bitcoin ETFs could inspire the creation of other innovative cryptocurrency investment products, further broadening access to the market.

Navigating the Market:

While the current surge in investment is positive, it's crucial for investors to approach the Bitcoin market with caution. Understanding the risks associated with cryptocurrency investments, including price volatility and regulatory uncertainty, is paramount. Consult with a financial advisor before making any investment decisions.

Conclusion:

The billions flowing into Bitcoin ETFs represent a major milestone in Bitcoin's journey towards mainstream adoption. While challenges and uncertainties remain, the trend suggests a growing acceptance of Bitcoin as a viable asset class, paving the way for further innovation and growth within the cryptocurrency ecosystem. Keep your eye on the regulatory landscape and market trends to navigate this exciting evolution.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flowing Into Bitcoin ETFs: A Look At The Recent Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tariff Showdown Trump Tells Walmart To Absorb Increased Costs

May 20, 2025

Tariff Showdown Trump Tells Walmart To Absorb Increased Costs

May 20, 2025 -

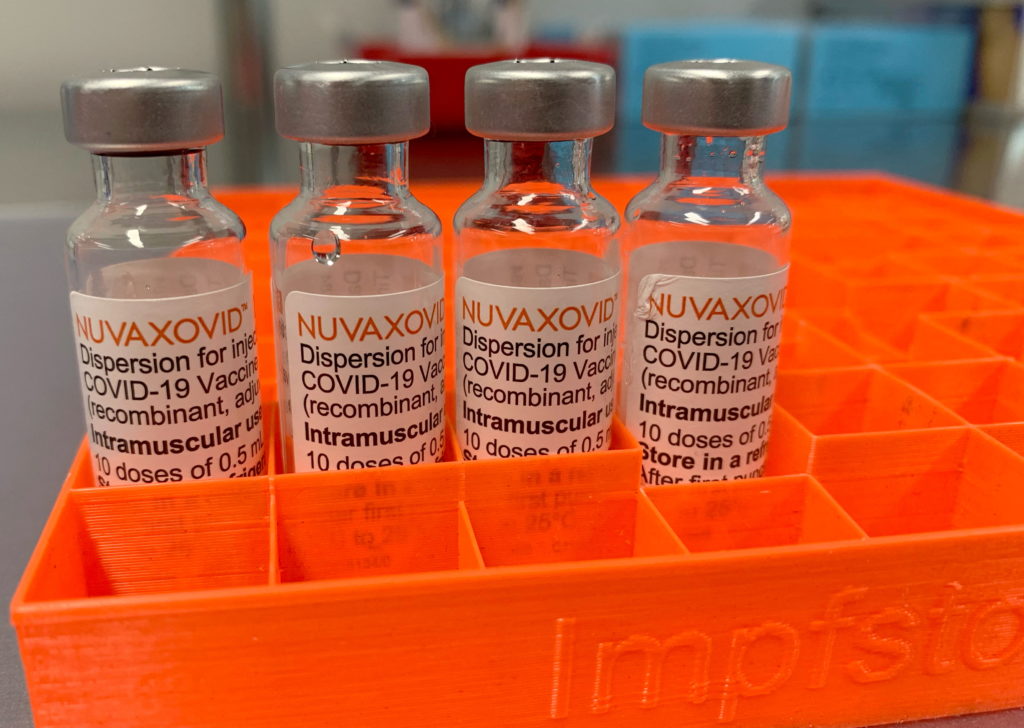

Limited Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025

Limited Fda Approval For Novavax Covid 19 Vaccine Understanding The Restrictions

May 20, 2025 -

Jamie Lee Curtis On Lindsay Lohan Shes Always Been Real With Me

May 20, 2025

Jamie Lee Curtis On Lindsay Lohan Shes Always Been Real With Me

May 20, 2025 -

Positive Economic Indicators Push Mortgage Rates Higher

May 20, 2025

Positive Economic Indicators Push Mortgage Rates Higher

May 20, 2025 -

The Vital Role Of Research Strengthening America Through Medical And Scientific Discoveries

May 20, 2025

The Vital Role Of Research Strengthening America Through Medical And Scientific Discoveries

May 20, 2025