JPMorgan's Dimon Sounds Alarm: China Tariffs And The US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

JPMorgan's Dimon Sounds Alarm: China Tariffs and the US Economy

JPMorgan Chase CEO Jamie Dimon's stark warning about the potential economic fallout from escalating US-China tariffs has sent shockwaves through financial markets. Dimon, known for his frank assessments of the global economy, painted a grim picture, highlighting the significant risks posed by continued trade tensions between the world's two largest economies. His comments, made during a recent earnings call, underscore a growing concern among economists and business leaders about the long-term impact of this trade war.

The Impact of Tariffs: More Than Just Trade Disputes

Dimon didn't mince words. He explicitly linked the escalating tariffs to potential economic slowdown in the United States. He argued that the current trade dispute is far more than a simple disagreement over trade practices; it's a significant threat to global economic stability. The impact, he warned, could ripple through various sectors, impacting everything from consumer prices to corporate investment.

The implications are multifaceted:

- Inflationary Pressures: Increased tariffs translate directly to higher prices for consumers, impacting purchasing power and potentially slowing down consumer spending, a key driver of the US economy.

- Supply Chain Disruptions: The complex global supply chains, heavily reliant on trade between the US and China, are vulnerable to significant disruptions. Delays and increased costs could lead to production bottlenecks and shortages.

- Reduced Business Investment: Uncertainty surrounding the trade war discourages businesses from making long-term investments, hindering economic growth and potentially leading to job losses.

- Geopolitical Instability: The escalating trade tensions further exacerbate existing geopolitical uncertainties, making it more challenging for businesses to plan for the future and impacting investor confidence.

Dimon's Call for De-escalation and Dialogue

Dimon's message wasn't solely about highlighting the risks; he also stressed the urgent need for de-escalation and a return to constructive dialogue between the US and China. He emphasized the importance of finding a mutually beneficial solution that avoids a prolonged and damaging trade war. He suggested that both nations need to prioritize a long-term, stable relationship that benefits both economies. This sentiment echoes similar calls from other leading economists and business leaders who are increasingly concerned about the economic consequences of this trade conflict.

Looking Ahead: Uncertainty Remains

The future remains uncertain. While the immediate impact of the tariffs is already being felt, the long-term consequences are still unfolding. Experts are divided on the ultimate extent of the economic damage, with some predicting a mild recession while others forecast a more protracted slowdown. Regardless of the specific forecast, Dimon's warning serves as a potent reminder of the high stakes involved in the ongoing US-China trade dispute and the critical need for a swift and effective resolution.

Further Reading:

Call to Action: Stay informed about the evolving situation by following reputable news sources and economic analysis to understand the potential impact on your finances and investments. Consider diversifying your portfolio to mitigate potential risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on JPMorgan's Dimon Sounds Alarm: China Tariffs And The US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Scientists Baffled By Strange Stars Rhythmic Pulses

Jun 03, 2025

Scientists Baffled By Strange Stars Rhythmic Pulses

Jun 03, 2025 -

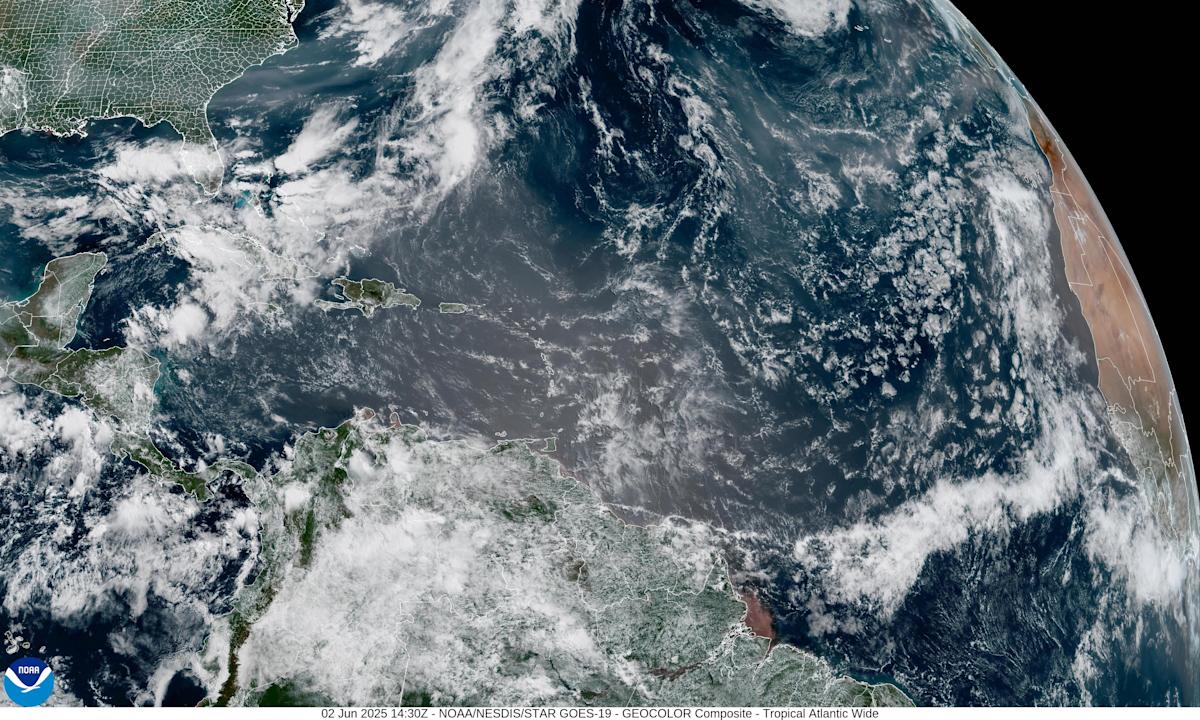

Florida Suffers Double Blow Saharan Dust And Canadian Wildfire Smoke

Jun 03, 2025

Florida Suffers Double Blow Saharan Dust And Canadian Wildfire Smoke

Jun 03, 2025 -

Dimons Blunt Assessment The Impact Of Us China Tariffs On The Economy

Jun 03, 2025

Dimons Blunt Assessment The Impact Of Us China Tariffs On The Economy

Jun 03, 2025 -

North Texas Police Capture Man Wanted For Capital Murder Following Extensive Search

Jun 03, 2025

North Texas Police Capture Man Wanted For Capital Murder Following Extensive Search

Jun 03, 2025 -

Exploring The True Stories Behind Successions Tech Driven Narrative Mountainhead

Jun 03, 2025

Exploring The True Stories Behind Successions Tech Driven Narrative Mountainhead

Jun 03, 2025