Dimon's Blunt Assessment: The Impact Of US China Tariffs On The Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Blunt Assessment: The Impact of US-China Tariffs on the Economy

Jamie Dimon, CEO of JPMorgan Chase, rarely minces words. His recent comments on the lingering effects of US-China tariffs have sent shockwaves through the financial world, highlighting the ongoing economic uncertainty stemming from the trade war. Dimon’s blunt assessment paints a picture of a complex situation with far-reaching consequences for both American and global economies. This article delves into the specifics of his statements and analyzes their broader implications.

The Tariffs: A Lingering Wound on the US Economy?

Dimon's concerns aren't about a hypothetical future; they're rooted in the tangible effects already felt. He argues that the tariffs, while intended to protect American industries, have ultimately hampered economic growth and increased costs for consumers. This isn't a new argument, but coming from a figure as influential as Dimon, it carries significant weight. He points to specific sectors, like agriculture and manufacturing, that have been disproportionately affected, leading to job losses and reduced competitiveness.

Beyond the Headlines: The Ripple Effect of Trade Tensions

The impact extends far beyond direct tariff impacts. The uncertainty created by ongoing trade tensions discourages investment, both domestically and internationally. Businesses hesitate to commit to long-term projects when the rules of engagement remain fluid. This hesitancy translates into slower economic growth and fewer job creation opportunities. Dimon's remarks underscore the crucial need for a stable and predictable trade environment to foster economic prosperity.

Dimon's Call for Resolution: A Path Forward?

While Dimon acknowledges the complexities of the US-China relationship, he advocates for a resolution to the tariff dispute. He suggests that a more collaborative approach, focused on mutual benefit and reduced trade barriers, would be far more beneficial for both countries in the long run. This isn't just about economic gain; it's about global stability and cooperation.

What's Next? Analyzing the Economic Outlook

The long-term consequences of the US-China trade war remain to be seen. Economists are divided on the ultimate impact, with some arguing that the effects have been minimal, while others share Dimon's concerns about substantial negative consequences. However, Dimon's stark warning serves as a crucial reminder of the potential for sustained economic damage if a lasting resolution isn't found. Further analysis is needed to fully understand the intricate web of economic consequences resulting from these trade policies.

Key Takeaways:

- Dimon's assessment highlights the ongoing negative impacts of US-China tariffs. His influential voice adds significant weight to existing concerns.

- The uncertainty caused by trade tensions discourages investment and slows economic growth. This ripple effect extends far beyond the initially targeted industries.

- Dimon advocates for a resolution to the tariff dispute, emphasizing the need for a more collaborative approach. This calls for a shift in strategy away from protectionist measures.

- The long-term economic consequences remain uncertain, but Dimon's warning necessitates careful consideration of the potential for sustained damage.

Further Reading: For more in-depth analysis on the economic impact of US-China trade relations, consider exploring resources from the Peterson Institute for International Economics [link to relevant resource] and the Congressional Research Service [link to relevant resource].

Call to Action: Stay informed about the evolving US-China trade relationship and its impact on the global economy. Engage in informed discussions and encourage policymakers to prioritize stable and predictable trade environments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Blunt Assessment: The Impact Of US China Tariffs On The Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

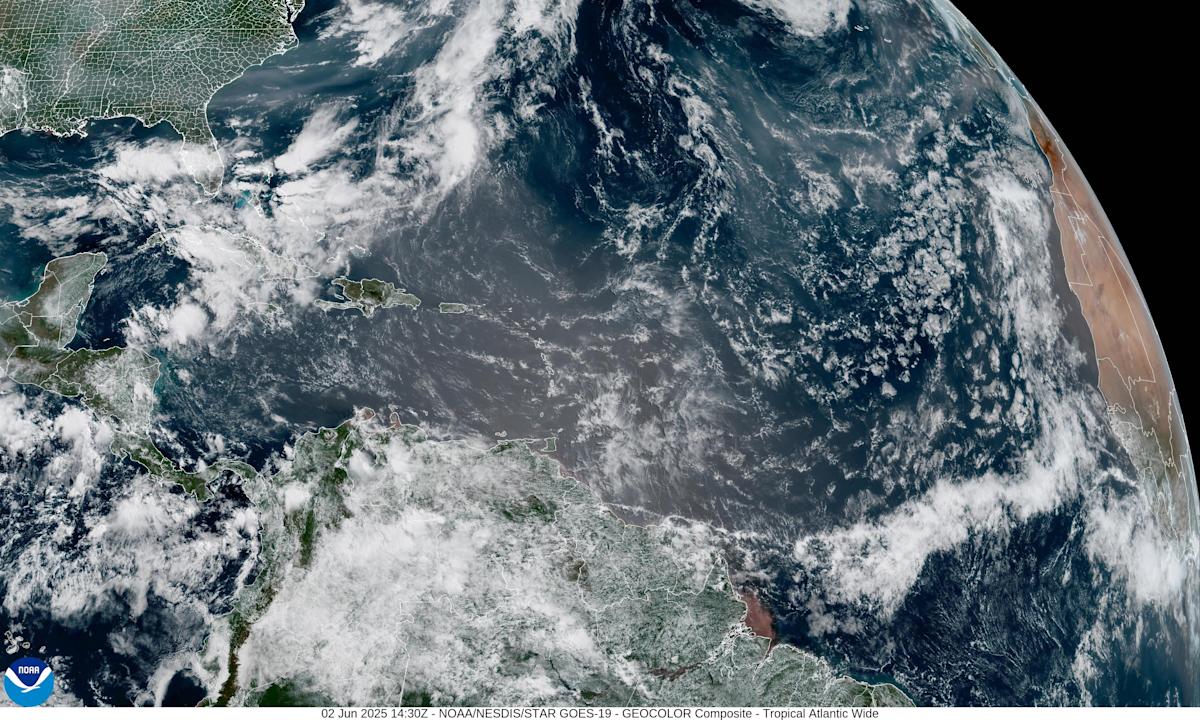

Impacts Of Saharan Dust And Canadian Wildfire Smoke On Floridas Environment And Health

Jun 03, 2025

Impacts Of Saharan Dust And Canadian Wildfire Smoke On Floridas Environment And Health

Jun 03, 2025 -

Top Asian Economic Events Monday June 2nd 2025 Calendar

Jun 03, 2025

Top Asian Economic Events Monday June 2nd 2025 Calendar

Jun 03, 2025 -

Jp Morgans Dimon Sounds Alarm On China Tariffs Challenges Us Strategy

Jun 03, 2025

Jp Morgans Dimon Sounds Alarm On China Tariffs Challenges Us Strategy

Jun 03, 2025 -

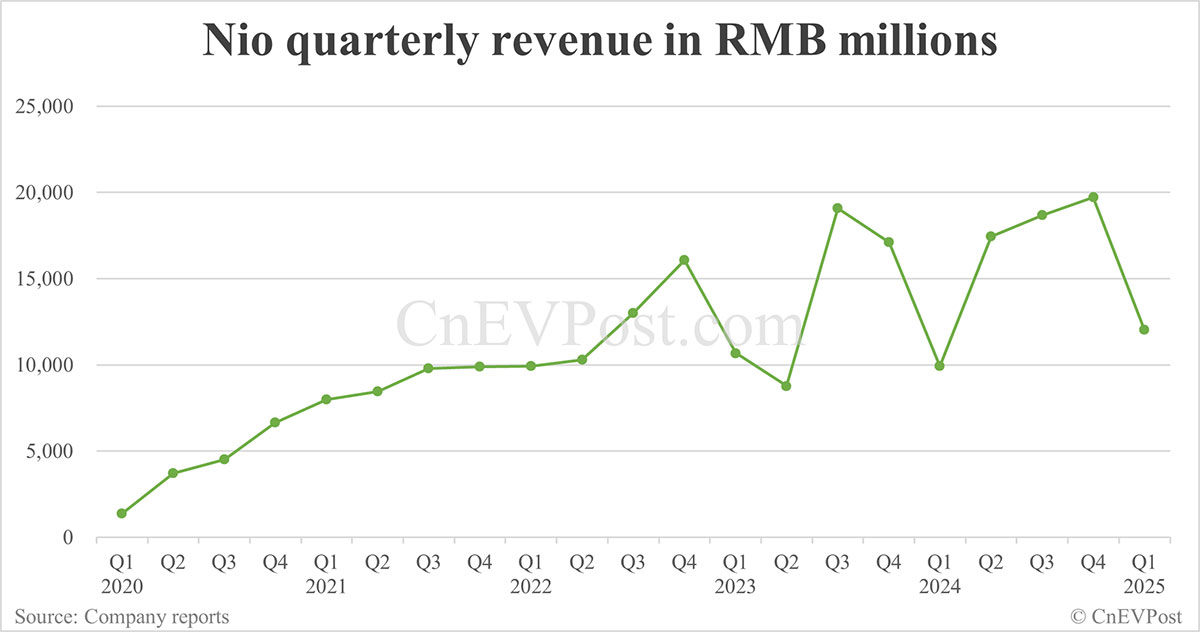

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025

Strong Q1 For Nio Revenue Up 21 Year On Year

Jun 03, 2025 -

Harry Brook Joe Roots Experience Improves With Age

Jun 03, 2025

Harry Brook Joe Roots Experience Improves With Age

Jun 03, 2025