Is NIO Stock A Bargain After Its Recent Price Dip?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is NIO Stock a Bargain After its Recent Price Dip?

NIO, the Chinese electric vehicle (EV) maker, has experienced a rollercoaster ride in recent months. After a period of significant growth, the stock price has dipped, leaving many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? Let's delve into the factors influencing NIO's recent performance and explore whether this price dip presents a genuine bargain for savvy investors.

NIO's Recent Performance: A Mixed Bag

NIO's stock price has been impacted by a confluence of factors. While the company continues to deliver impressive vehicle sales figures, particularly in the premium EV segment, several headwinds have emerged. These include:

- Increased Competition: The Chinese EV market is becoming increasingly crowded, with both established players and new entrants vying for market share. This intense competition is putting pressure on pricing and profit margins.

- Global Economic Uncertainty: The global economic slowdown, particularly concerns about a potential recession, has dampened investor sentiment across the board, impacting even high-growth companies like NIO.

- Supply Chain Disruptions: Ongoing supply chain challenges, though easing, continue to pose a risk to NIO's production and delivery timelines.

- Geopolitical Risks: The evolving geopolitical landscape between China and the US also presents ongoing uncertainty for investors.

Analyzing the Price Dip: Is it a Bargain?

The recent price drop presents a complex scenario for investors. While the short-term outlook may seem uncertain, a deeper analysis reveals potential long-term opportunities. Here's a breakdown:

Arguments for NIO being a bargain:

- Strong Brand Recognition and Growing Market Share: Despite the competition, NIO maintains strong brand recognition in China and is steadily increasing its market share in the premium EV segment.

- Innovative Technology and Product Pipeline: NIO continues to invest heavily in research and development, with a promising pipeline of new models and technological advancements. Their battery swap technology, for example, remains a key differentiator.

- Potential for Long-Term Growth: The long-term outlook for the global EV market remains positive, and NIO is well-positioned to capitalize on this growth, particularly in the rapidly expanding Chinese market.

- Valuation: Compared to its peers, some analysts argue that NIO's current valuation might be undervalued, considering its future growth potential.

Arguments against NIO being a bargain:

- Profitability Concerns: NIO is not yet consistently profitable, and achieving profitability remains a key challenge.

- Dependence on the Chinese Market: A significant portion of NIO's sales are concentrated in China, making it vulnerable to economic and political developments within the country.

- High Debt Levels: NIO carries a relatively high level of debt, which could pose a risk in uncertain economic times.

What to Consider Before Investing:

Before making any investment decisions, it's crucial to conduct thorough due diligence. Consider the following:

- Your Risk Tolerance: Investing in NIO carries significant risk due to its volatility and the inherent uncertainties in the EV market.

- Long-Term Investment Horizon: NIO is a growth stock, and its value is likely to fluctuate significantly in the short term. A long-term investment horizon is generally recommended.

- Diversification: Never put all your eggs in one basket. Diversifying your investment portfolio is essential to mitigate risk.

Conclusion:

Whether NIO stock is a bargain after its recent price dip is a complex question with no easy answer. While the current price may present an attractive entry point for some long-term investors, significant risks remain. Careful consideration of the factors outlined above, coupled with thorough research and a well-defined investment strategy, is crucial before making any investment decisions. Consult with a qualified financial advisor before investing in any stock.

Related Articles:

- [Link to an article about the Chinese EV market]

- [Link to an article about investing in growth stocks]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is NIO Stock A Bargain After Its Recent Price Dip?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

England Womens Cricket Triumph Jones And Beaumonts Hundreds Fuel 108 Run Victory

Jun 04, 2025

England Womens Cricket Triumph Jones And Beaumonts Hundreds Fuel 108 Run Victory

Jun 04, 2025 -

Ukraines Underwater Offensive Damage Reported To Crimea Bridge

Jun 04, 2025

Ukraines Underwater Offensive Damage Reported To Crimea Bridge

Jun 04, 2025 -

Nio Stock Price Falls What To Expect From Q1 Results

Jun 04, 2025

Nio Stock Price Falls What To Expect From Q1 Results

Jun 04, 2025 -

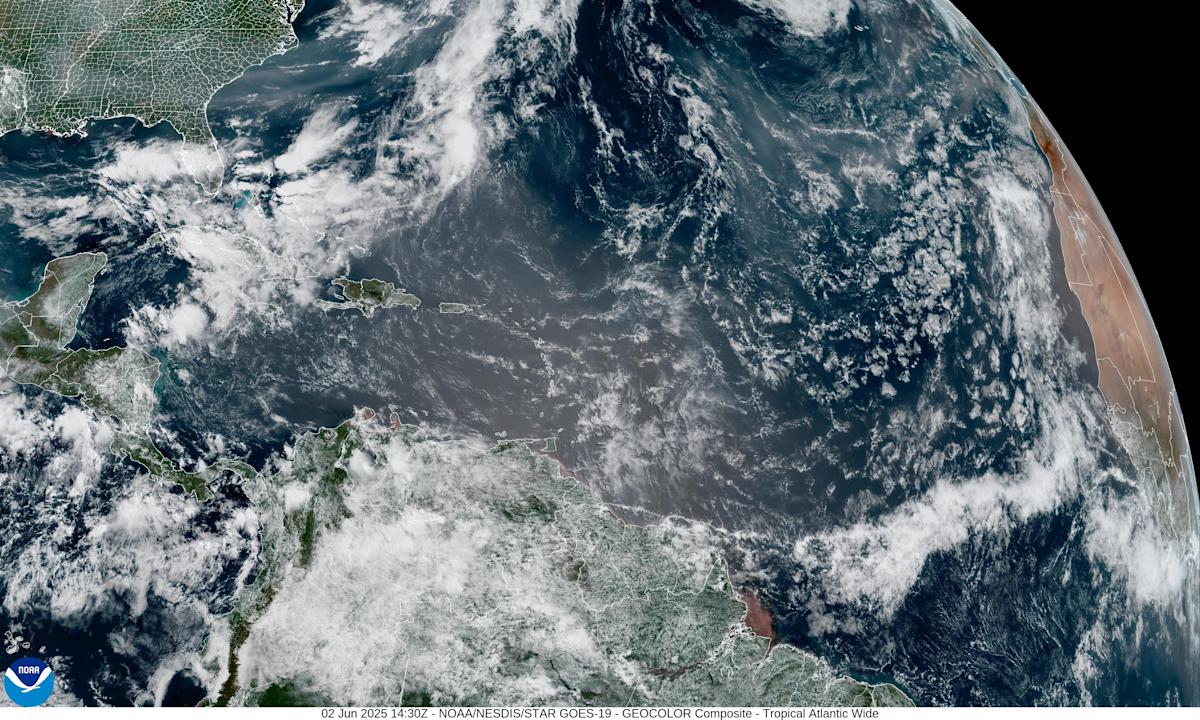

Saharan Dust And Canadian Wildfires A Double Blow To Floridas Air Quality

Jun 04, 2025

Saharan Dust And Canadian Wildfires A Double Blow To Floridas Air Quality

Jun 04, 2025 -

City Of St Louis Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025

City Of St Louis Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025