Investing In A Green Future: The Role Of Clean Energy Tax Policy In America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in a Green Future: The Role of Clean Energy Tax Policy in America

America's transition to a cleaner energy future hinges significantly on effective policy, and at the forefront is the crucial role of clean energy tax policy. For years, debate has raged about the best approach, balancing economic growth with environmental responsibility. But the current landscape reveals a growing consensus: strategic tax incentives are vital for driving investment and accelerating the adoption of renewable energy sources.

The Current State of Clean Energy Tax Incentives

The Inflation Reduction Act (IRA), signed into law in 2022, represents a landmark shift in American clean energy policy. This legislation offers a substantial array of tax credits and incentives designed to boost investment in renewable energy technologies, electric vehicles (EVs), and energy efficiency improvements. These incentives aren't just about tax breaks; they're designed to stimulate innovation, create jobs, and reduce America's carbon footprint.

Key Provisions of the IRA Affecting Clean Energy Investment:

- Production Tax Credits (PTCs) for Renewable Energy: These credits incentivize the production of renewable energy from sources like solar, wind, and geothermal. The IRA expanded and extended these credits, making them more attractive to investors.

- Investment Tax Credits (ITCs) for Renewable Energy: These credits encourage investment in renewable energy projects, offering a percentage reduction on the cost of building and deploying renewable energy infrastructure. Similar to PTCs, the IRA enhanced these incentives.

- Clean Vehicle Tax Credits: The IRA provides significant tax credits for the purchase of new and used electric vehicles, aiming to accelerate the transition to electric transportation. Eligibility requirements and credit amounts vary depending on factors such as vehicle type, manufacturer, and income.

- Energy Efficiency Tax Credits: Tax credits are also available for homeowners and businesses to improve energy efficiency, including upgrades to insulation, windows, and heating and cooling systems. This encourages energy conservation and reduces overall energy demand.

Impact and Challenges:

The IRA's impact is already being felt. We're seeing a surge in renewable energy project announcements and a significant increase in EV sales. However, challenges remain:

- Navigating the Complexity: The sheer volume and complexity of the tax credits can make it challenging for individuals and businesses to understand and take advantage of them. Clearer guidance and simplified application processes are crucial.

- Equity and Access: Ensuring that the benefits of these incentives reach all communities, particularly disadvantaged ones, is essential. This requires targeted outreach and programs to address disparities in access to clean energy technologies.

- Long-Term Stability: Policy consistency is crucial for long-term investment. The continued commitment to and potential future expansion of these incentives will be key to sustaining the momentum.

The Future of Clean Energy Tax Policy in America

The IRA represents a significant step forward, but it's not the end of the journey. Continued refinement of the tax code, coupled with ongoing research and development in clean energy technologies, will be vital for America to achieve its climate goals. Further consideration should be given to:

- Carbon Pricing Mechanisms: Exploring carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, could provide additional incentives for emissions reduction.

- Investing in Grid Modernization: Upgrading the nation's electricity grid is essential to accommodate the increased penetration of renewable energy sources. Tax incentives can play a crucial role in this process.

- Supporting Domestic Manufacturing: Policies that support domestic manufacturing of clean energy technologies can create jobs and reduce reliance on foreign suppliers.

Conclusion:

Clean energy tax policy is not just about reducing taxes; it's about investing in a sustainable future. The IRA represents a significant commitment, but ongoing refinement and expansion of these incentives, coupled with a broader policy framework, will be essential to ensure America leads the global transition to a cleaner, more sustainable energy system. The future of our planet depends on it. Learn more about available clean energy tax credits by visiting the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In A Green Future: The Role Of Clean Energy Tax Policy In America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tragedy Strikes My 600 Lb Life Star Latonya Pottains Death At 40

May 20, 2025

Tragedy Strikes My 600 Lb Life Star Latonya Pottains Death At 40

May 20, 2025 -

Accelerated Sale Possible Dtla Federal Courthouse On Gsa Disposition List

May 20, 2025

Accelerated Sale Possible Dtla Federal Courthouse On Gsa Disposition List

May 20, 2025 -

Stream The Intense Wwi Movie Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Stream The Intense Wwi Movie Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

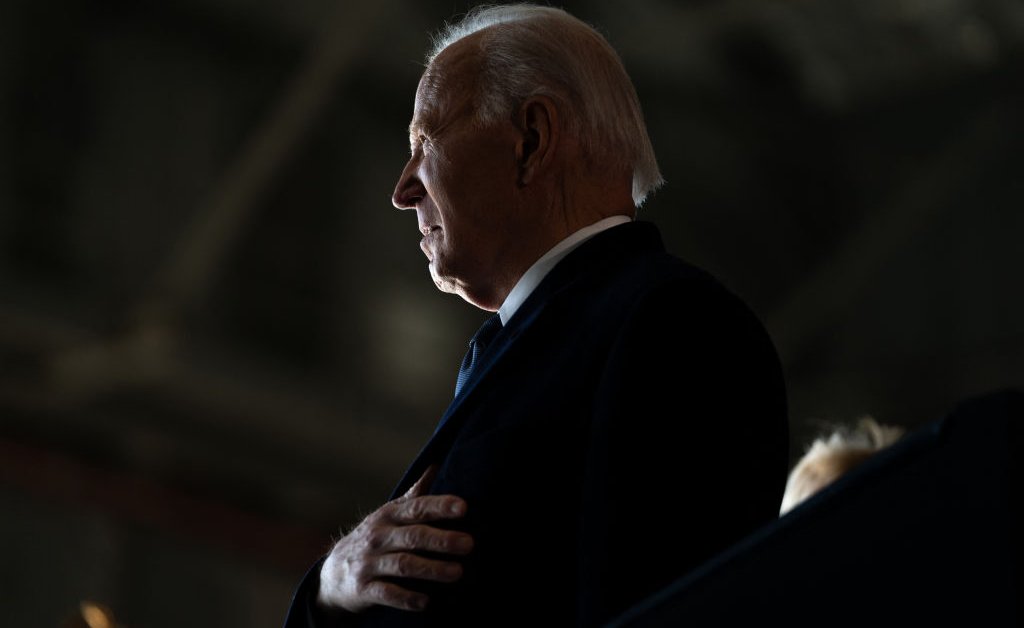

Support Floods In For President Biden After Cancer Diagnosis Announcement

May 20, 2025

Support Floods In For President Biden After Cancer Diagnosis Announcement

May 20, 2025 -

Supreme Court Upholds End To Venezuelan Migrant Protections Impacting Thousands

May 20, 2025

Supreme Court Upholds End To Venezuelan Migrant Protections Impacting Thousands

May 20, 2025