Internal Risks Pose Significant Threat To US Economic Stability, Says JPMorgan CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Internal Risks Pose Significant Threat to US Economic Stability, Says JPMorgan CEO

JPMorgan Chase CEO Jamie Dimon's recent warning about significant internal risks threatening the US economy has sent shockwaves through financial markets. Dimon, known for his candid assessments of the economic landscape, highlighted several key areas of concern during a recent earnings call, emphasizing that these threats are arguably more pressing than external factors like the war in Ukraine or global inflation. This stark warning underscores the need for proactive policy adjustments and increased vigilance within the American economy.

Dimon's Key Concerns: A Deep Dive into Internal Economic Threats

Dimon didn't mince words, directly addressing several crucial internal factors contributing to his pessimistic outlook. These include:

1. Government Spending and the National Debt: The ballooning US national debt, fueled by years of increased government spending, is a major point of contention. Dimon expressed concern about the long-term sustainability of this trajectory, suggesting that it could lead to higher interest rates and ultimately stifle economic growth. He stressed the need for fiscal responsibility and strategic spending cuts to mitigate the potential fallout.

- Related: [Link to a reputable article discussing the US national debt]

2. Geopolitical Instability and Domestic Political Polarization: While acknowledging external factors like the war in Ukraine, Dimon emphasized that domestic political gridlock and increasing social divisions are creating significant uncertainty. This instability, he argued, makes it difficult for businesses to plan for the future and discourages investment, ultimately hindering economic progress.

- Learn More: [Link to an article discussing the impact of political polarization on the economy]

3. The Looming Threat of a Recession: Dimon reiterated his concerns about a potential recession, citing the persistent inflation and the Federal Reserve's aggressive interest rate hikes as contributing factors. He stressed that while a recession isn't guaranteed, the current economic climate significantly increases the likelihood of one.

- Expert Opinion: [Link to an analysis of recession probabilities from a respected economic institution]

4. The Labor Market's Uncertain Future: While the current unemployment rate is relatively low, Dimon highlighted potential challenges ahead. He warned that the ongoing skills gap, coupled with potential shifts in the labor market due to automation and changing demographics, could create significant headwinds for future economic growth.

5. The Ever-Present Risk of Unexpected Shocks: The JPMorgan CEO emphasized the inherent unpredictability of the economic landscape, highlighting the potential for unforeseen events (like a major cyberattack or a significant supply chain disruption) to exacerbate existing vulnerabilities.

What This Means for the Average American:

Dimon's warning isn't just a concern for Wall Street; it has implications for every American. Potential consequences include:

- Higher interest rates: Leading to increased borrowing costs for mortgages, auto loans, and credit cards.

- Increased inflation: Further eroding purchasing power and impacting the cost of living.

- Job losses: A potential recession could lead to significant job losses across various sectors.

- Reduced economic opportunity: Uncertainty and instability can hinder economic growth and limit opportunities for upward mobility.

Moving Forward: A Call for Proactive Measures

Dimon’s message is a clear call to action. It emphasizes the need for both government and private sector collaboration to address these internal risks. This includes responsible fiscal policy, promoting social cohesion, fostering innovation and workforce development, and preparing for potential economic shocks. The future stability of the US economy hinges on decisive action and a unified approach to addressing these challenges.

What are your thoughts on Dimon's assessment of the US economy? Share your opinion in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Internal Risks Pose Significant Threat To US Economic Stability, Says JPMorgan CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nio Q1 Earnings Looms Stock Price Drop A Buying Opportunity

Jun 03, 2025

Nio Q1 Earnings Looms Stock Price Drop A Buying Opportunity

Jun 03, 2025 -

Climate Change Preparedness Strategic Planning For A 2 C Future

Jun 03, 2025

Climate Change Preparedness Strategic Planning For A 2 C Future

Jun 03, 2025 -

Climate Change A New Economic Frontier For Brazil Says Finance Leader

Jun 03, 2025

Climate Change A New Economic Frontier For Brazil Says Finance Leader

Jun 03, 2025 -

Michigan Residents Fight Back Protests Erupt Over Dte Energys Price Increases

Jun 03, 2025

Michigan Residents Fight Back Protests Erupt Over Dte Energys Price Increases

Jun 03, 2025 -

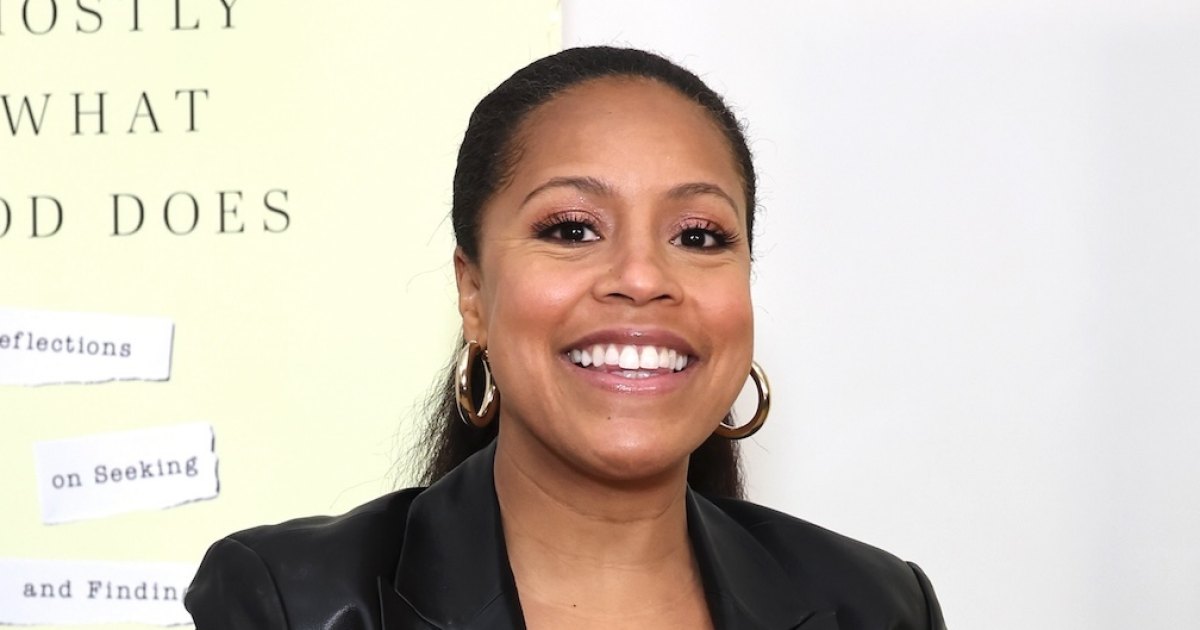

Sheinelle Jones Focuses On Family After Husbands Death A Source Reports

Jun 03, 2025

Sheinelle Jones Focuses On Family After Husbands Death A Source Reports

Jun 03, 2025