NIO Q1 Earnings Looms: Stock Price Drop—A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looms: Stock Price Drop—A Buying Opportunity?

NIO, the Chinese electric vehicle (EV) maker, is gearing up to release its Q1 2024 earnings, and investors are on edge. Recent stock price drops have sparked a crucial question: is this a temporary dip, or a sign of deeper trouble? For savvy investors, this presents a compelling question: is now the time to buy NIO stock?

The recent decline in NIO's stock price has been attributed to several factors, including intensified competition in the burgeoning Chinese EV market, concerns about slowing overall EV sales growth in China, and broader macroeconomic anxieties impacting the global market. However, a closer look reveals a more nuanced picture, and potential opportunities for those willing to take a calculated risk.

Understanding the Price Drop: More Than Meets the Eye

While the recent downturn is undeniably concerning, it's important to analyze the contributing factors carefully. The increased competition is undeniable; players like BYD and Tesla are aggressively vying for market share. However, NIO's unique selling proposition – its battery-as-a-service (BaaS) model and commitment to innovative technology – continues to set it apart. The BaaS model, in particular, is proving to be a differentiator, addressing range anxiety and reducing the overall cost of ownership for consumers. [Link to article about NIO's BaaS model]

NIO's Strengths and Potential for Growth:

Despite the challenges, NIO retains significant strengths:

- Innovative Technology: NIO consistently pushes the boundaries of EV technology, offering advanced features and performance. Their commitment to R&D suggests a strong future product pipeline.

- Expanding Infrastructure: NIO's growing network of battery swap stations provides a significant advantage, addressing a critical pain point for EV adoption. This infrastructure advantage is a key differentiator in the competitive Chinese market.

- Strong Brand Loyalty: NIO has cultivated a loyal customer base through exceptional customer service and a strong brand identity.

Q1 Earnings: A Crucial Turning Point?

The upcoming Q1 2024 earnings release will be pivotal in determining the future trajectory of NIO's stock price. Analysts are eagerly awaiting the figures to gauge the impact of recent market headwinds. Positive surprises, particularly regarding sales figures and the uptake of the BaaS model, could trigger a significant rebound. Conversely, disappointing results might exacerbate the current downward trend.

Is it a Buying Opportunity? A Cautious Assessment

The current stock price drop presents a potential buying opportunity for long-term investors with a high-risk tolerance. However, it's crucial to proceed with caution. Thoroughly research the company's financial performance, upcoming product launches, and competitive landscape before making any investment decisions. Consider diversifying your portfolio to mitigate risk.

What to Watch for in the Q1 Earnings Report:

- Vehicle deliveries: A strong increase in deliveries would signal resilience against market headwinds.

- BaaS adoption rate: High adoption rates would confirm the viability of this key differentiator.

- Gross margin: Improved gross margins would indicate progress in cost efficiency.

- Guidance for the remainder of 2024: Positive guidance would bolster investor confidence.

Conclusion: Proceed with Informed Caution

The recent drop in NIO's stock price presents a complex situation. While the challenges are real, NIO's innovative technology, strong brand loyalty, and strategic initiatives offer a compelling counterpoint. The upcoming Q1 earnings report will be a crucial determinant. For those with a long-term investment horizon and a thorough understanding of the risks involved, this could indeed prove to be a strategic buying opportunity. However, always conduct thorough due diligence and consider seeking advice from a qualified financial advisor before making any investment decisions. [Link to a reputable financial news source]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looms: Stock Price Drop—A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harry Brook Praises Joe Roots Enhanced Skills And Experience

Jun 03, 2025

Harry Brook Praises Joe Roots Enhanced Skills And Experience

Jun 03, 2025 -

Jamie Dimon Identifies Trumps Most Important Focus In A Changing World

Jun 03, 2025

Jamie Dimon Identifies Trumps Most Important Focus In A Changing World

Jun 03, 2025 -

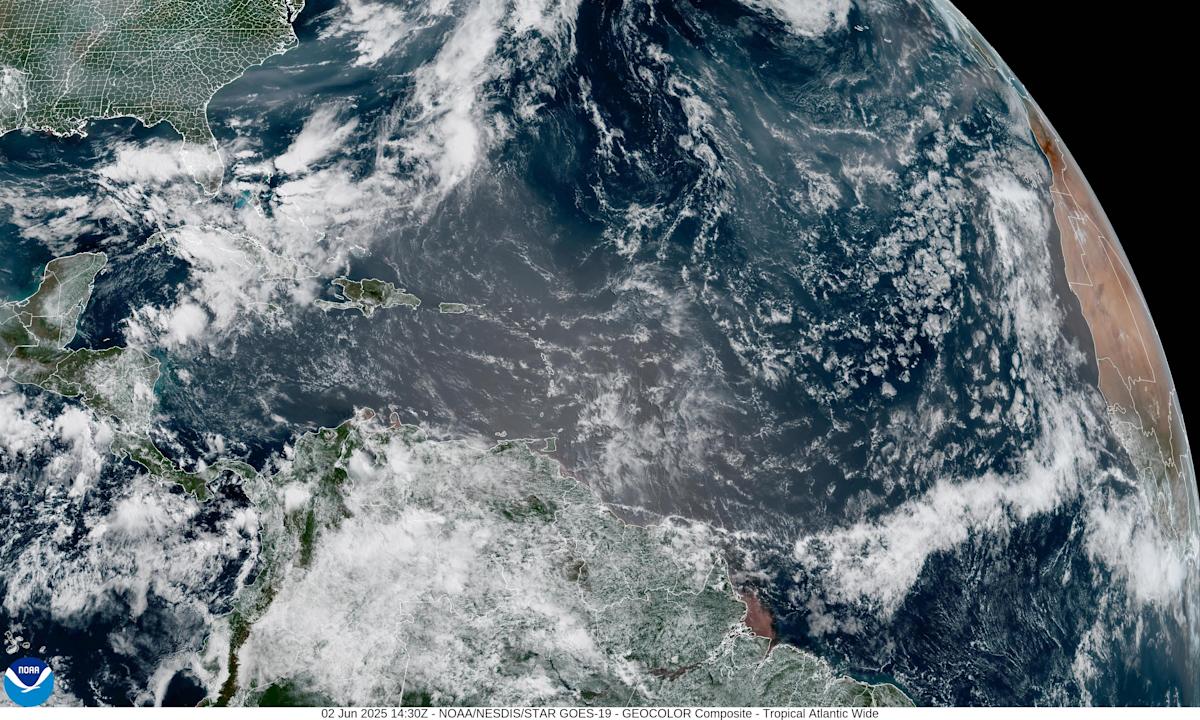

Saharan Dust And Canadian Wildfires A Perfect Storm Over Florida

Jun 03, 2025

Saharan Dust And Canadian Wildfires A Perfect Storm Over Florida

Jun 03, 2025 -

Urgent Action Needed How Quickly Should Companies Adapt To A 2 C Rise

Jun 03, 2025

Urgent Action Needed How Quickly Should Companies Adapt To A 2 C Rise

Jun 03, 2025 -

Roseanne Barr Overcoming Adversity On Her Texas Ranch

Jun 03, 2025

Roseanne Barr Overcoming Adversity On Her Texas Ranch

Jun 03, 2025