Institutional Money Fuels Bitcoin ETF Growth: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Money Fuels Bitcoin ETF Growth: $5 Billion and Counting

The cryptocurrency market is buzzing with excitement as institutional investment in Bitcoin exchange-traded funds (ETFs) continues its meteoric rise. With assets under management (AUM) surpassing the staggering $5 billion mark, the flood of institutional money pouring into Bitcoin ETFs signals a significant shift in the perception and adoption of the leading cryptocurrency. This surge represents a powerful endorsement of Bitcoin's potential as a legitimate asset class, attracting investors seeking diversification and exposure to the digital asset market.

The Rise of Bitcoin ETFs: A Game Changer for Institutional Investors

For years, institutional investors faced significant hurdles in accessing the Bitcoin market directly. Concerns about security, regulatory uncertainty, and the complexities of managing private keys hindered widespread adoption. The advent of Bitcoin ETFs, however, has dramatically altered this landscape. These funds offer a regulated and convenient way for institutional players to gain exposure to Bitcoin without the operational challenges of direct ownership.

This ease of access is a primary driver behind the recent surge in AUM. Large financial institutions, pension funds, and hedge funds are increasingly incorporating Bitcoin ETFs into their portfolios, diversifying their holdings and capitalizing on Bitcoin's potential for growth.

$5 Billion and Climbing: A Look at the Numbers

The $5 billion milestone represents a monumental achievement for the Bitcoin ETF market, demonstrating the growing confidence institutional investors have in the cryptocurrency. This figure is expected to climb even higher as more ETFs launch and regulatory approval becomes more widespread globally. Several factors contribute to this rapid growth:

- Increased Regulatory Clarity: Gradual regulatory clarity in key markets, such as the US, has boosted investor confidence and fueled institutional adoption. The approval of the first Bitcoin futures ETF in the US marked a watershed moment, paving the way for further growth.

- Growing Institutional Demand: Demand for exposure to Bitcoin from institutional investors is steadily increasing as they recognize its potential as a store of value and a hedge against inflation.

- Improved Infrastructure: The development of robust custodial solutions and trading platforms specifically designed for institutional investors has also played a crucial role in driving adoption.

What Does the Future Hold for Bitcoin ETFs?

The continued influx of institutional capital suggests a bright future for Bitcoin ETFs. As more jurisdictions embrace a regulatory framework for cryptocurrencies, we can anticipate further expansion of the ETF market, potentially leading to the approval of spot Bitcoin ETFs. This would represent another significant milestone, potentially unlocking even greater investment flows into the space.

The Impact on the Broader Cryptocurrency Market

The growth of Bitcoin ETFs is not only beneficial for Bitcoin itself but also for the broader cryptocurrency market. Increased institutional participation brings greater liquidity, price stability, and legitimacy to the sector, attracting a wider range of investors and fostering innovation.

Beyond Bitcoin: The Expanding World of Crypto ETFs

While Bitcoin currently dominates the ETF landscape, we are also witnessing the emergence of ETFs tracking other cryptocurrencies and broader crypto indices. This diversification within the crypto ETF space reflects the evolving maturity of the digital asset market.

Conclusion: A New Era for Bitcoin and Institutional Investment

The $5 billion milestone in Bitcoin ETF AUM is a testament to the growing acceptance and adoption of Bitcoin by institutional investors. This represents a significant turning point, signaling a shift towards mainstream acceptance of cryptocurrencies and paving the way for further growth and innovation in the digital asset market. The future of Bitcoin ETFs looks exceptionally promising, poised to shape the landscape of investment for years to come. Stay tuned for further updates as this exciting chapter unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Money Fuels Bitcoin ETF Growth: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

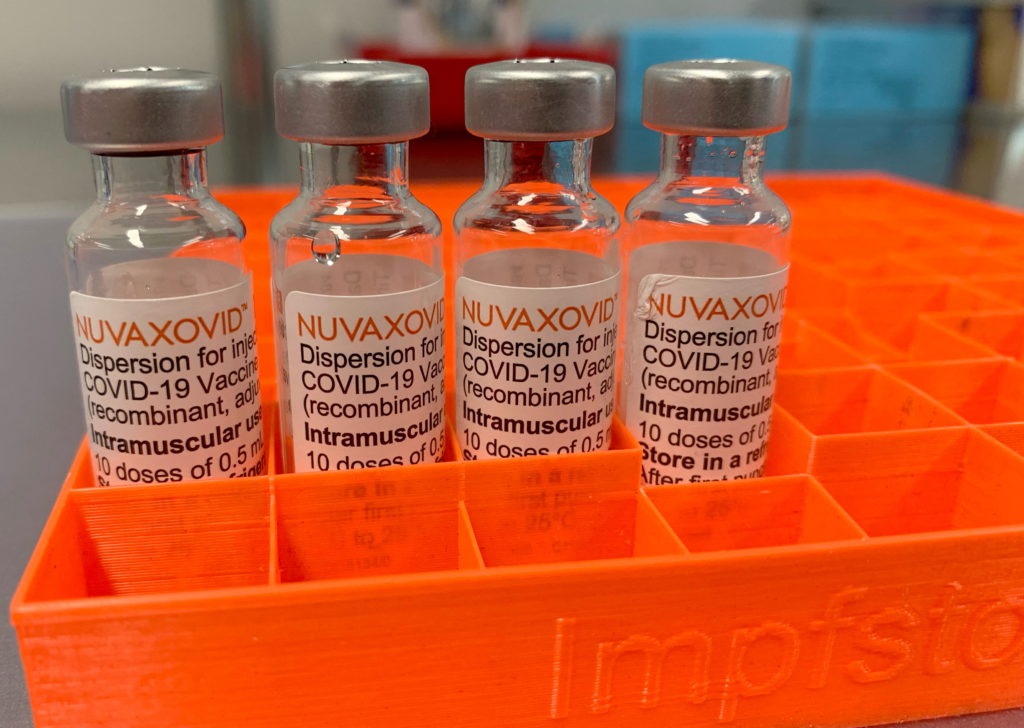

Novavax Covid 19 Vaccine Fda Approval Includes Unusual Usage Restrictions

May 20, 2025

Novavax Covid 19 Vaccine Fda Approval Includes Unusual Usage Restrictions

May 20, 2025 -

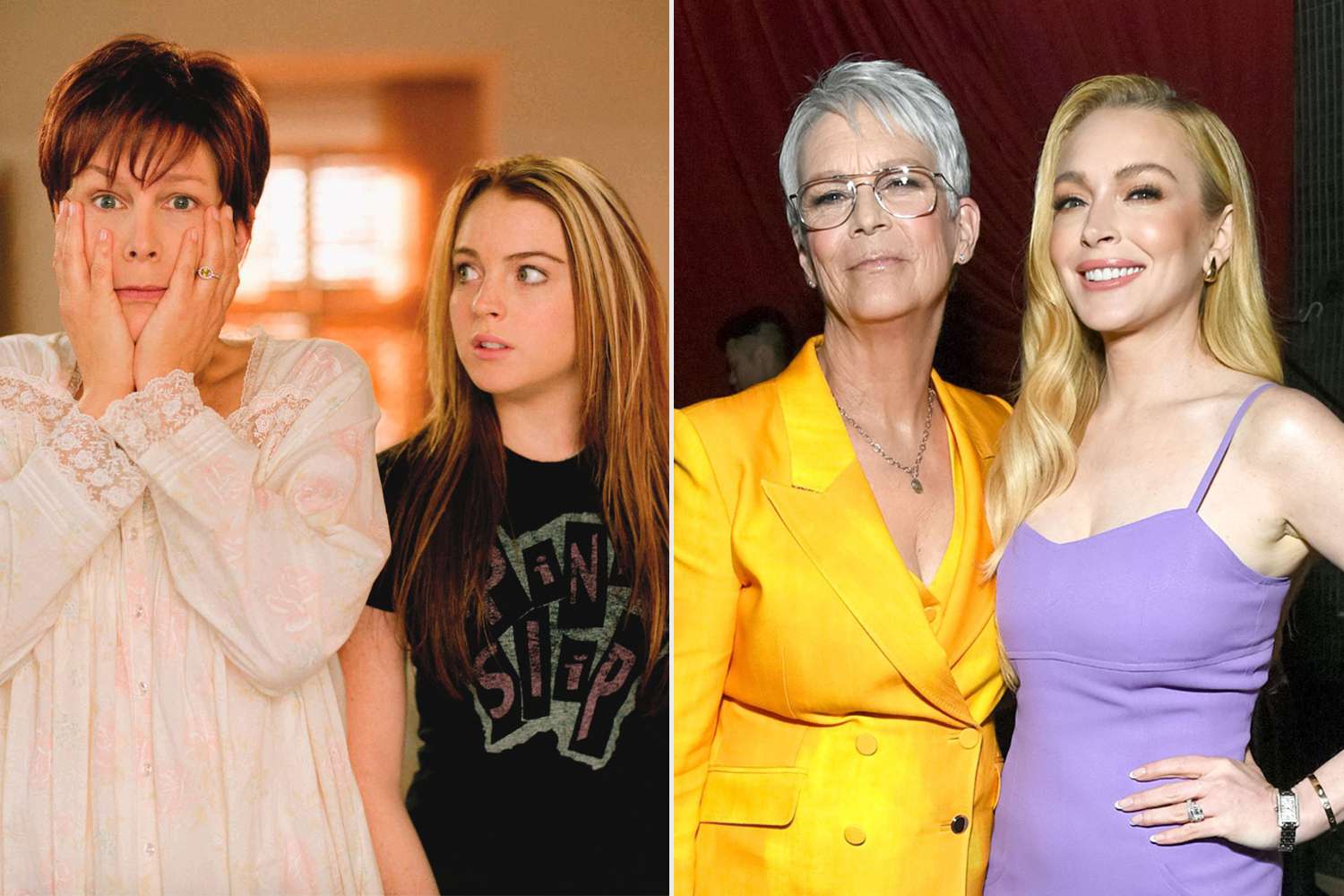

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Today

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Today

May 20, 2025 -

Jamie Lee Curtis Discusses Her Close Bond With Lindsay Lohan

May 20, 2025

Jamie Lee Curtis Discusses Her Close Bond With Lindsay Lohan

May 20, 2025 -

Balis Tourism Safety A Collaborative Approach Needed

May 20, 2025

Balis Tourism Safety A Collaborative Approach Needed

May 20, 2025 -

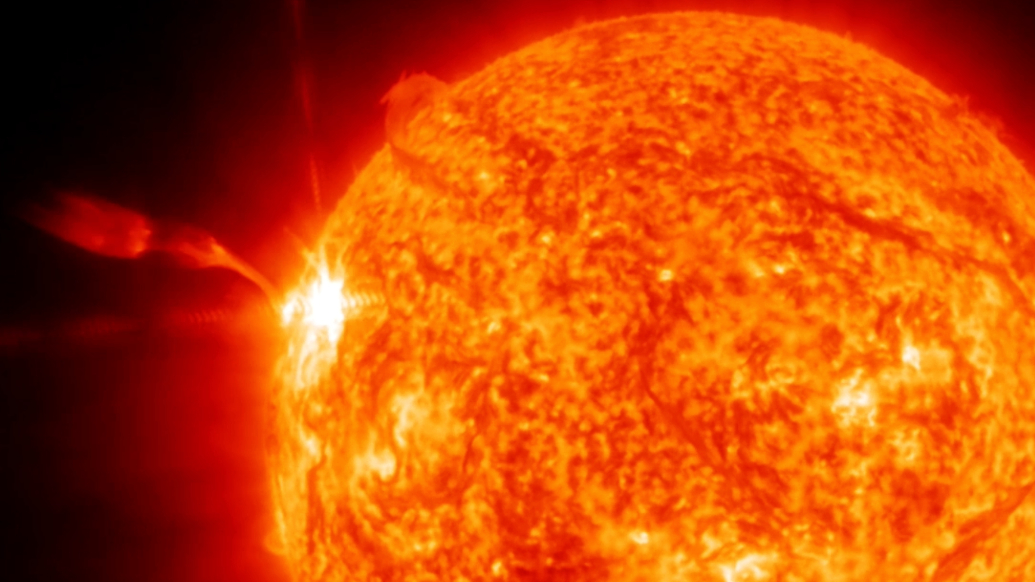

Powerful Solar Flare Causes Widespread Radio Blackouts Across Continents

May 20, 2025

Powerful Solar Flare Causes Widespread Radio Blackouts Across Continents

May 20, 2025