Institutional Investors Hold 83% Of Alliant Energy (LNT) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Hold 83% of Alliant Energy (LNT) Stock: What Does This Mean for Investors?

Alliant Energy Corporation (LNT), a prominent player in the energy sector, recently revealed a significant statistic: institutional investors control a whopping 83% of its outstanding stock. This substantial ownership stake raises important questions for both seasoned and novice investors considering adding LNT to their portfolios. What does this high institutional ownership signify, and what are the potential implications for future stock performance? Let's delve into the details.

Understanding Institutional Investors

Before we analyze the implications of this high ownership percentage, it's crucial to understand who institutional investors are. These are large-scale investors, including:

- Mutual funds: These funds pool money from multiple investors to invest in a diversified portfolio of assets, including stocks like LNT.

- Pension funds: These funds manage retirement savings for employees and often hold significant stakes in established companies.

- Hedge funds: These funds employ sophisticated investment strategies, often involving high risk and high reward.

- Insurance companies: Insurance companies invest a portion of their reserves in the stock market for long-term growth.

The presence of these large investors often indicates a degree of confidence in a company's long-term prospects. However, it's not a guaranteed indicator of future success.

Why the High Institutional Ownership in Alliant Energy (LNT)?

Several factors likely contribute to the high institutional ownership in Alliant Energy:

- Stable Dividend Growth: Alliant Energy has a history of consistent dividend payouts, making it attractive to investors seeking reliable income streams. [Link to Alliant Energy investor relations page for dividend history]

- Renewable Energy Focus: With a growing emphasis on sustainable energy, Alliant Energy's investments in renewable energy sources like wind and solar power may appeal to investors focused on Environmental, Social, and Governance (ESG) investing. [Link to Alliant Energy's sustainability report]

- Strong Regulatory Environment: The relatively stable and predictable regulatory environment in the utility sector provides a degree of security for long-term investors.

- Potential for Growth: Alliant Energy's ongoing investments in infrastructure upgrades and expansion could lead to future growth opportunities.

Implications for Individual Investors

While high institutional ownership can be viewed positively, individual investors should consider several points:

- Less Volatility (Potentially): Large institutional investors often provide a stabilizing influence on stock prices, potentially leading to less volatility compared to companies with a more dispersed ownership structure.

- Liquidity: The high trading volume associated with a company like Alliant Energy, where significant institutional activity is present, generally means greater liquidity for individual investors. This makes it easier to buy and sell shares without significantly impacting the price.

- Potential for Herd Mentality: It's important to remember that institutional investors are not infallible. If a significant number of these investors decide to sell, it could trigger a downward price movement. Independent research and analysis are crucial.

Conclusion: A Cautious Optimism

The high institutional ownership in Alliant Energy (LNT) suggests a degree of confidence in the company's long-term prospects. However, individual investors should conduct thorough due diligence before making any investment decisions. Consider the company's financial performance, future growth potential, and overall risk profile alongside the existing institutional interest. Remember, past performance is not indicative of future results. Consult with a qualified financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Hold 83% Of Alliant Energy (LNT) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assessing Trumps Foreign Policy Successes And Failures In Peacebuilding

Jun 24, 2025

Assessing Trumps Foreign Policy Successes And Failures In Peacebuilding

Jun 24, 2025 -

Orioles Latest Acquisition Catcher Chadwick Tromp

Jun 24, 2025

Orioles Latest Acquisition Catcher Chadwick Tromp

Jun 24, 2025 -

Illinois Jimmy Award Nominees Chicago And Frankfort Teens Shine

Jun 24, 2025

Illinois Jimmy Award Nominees Chicago And Frankfort Teens Shine

Jun 24, 2025 -

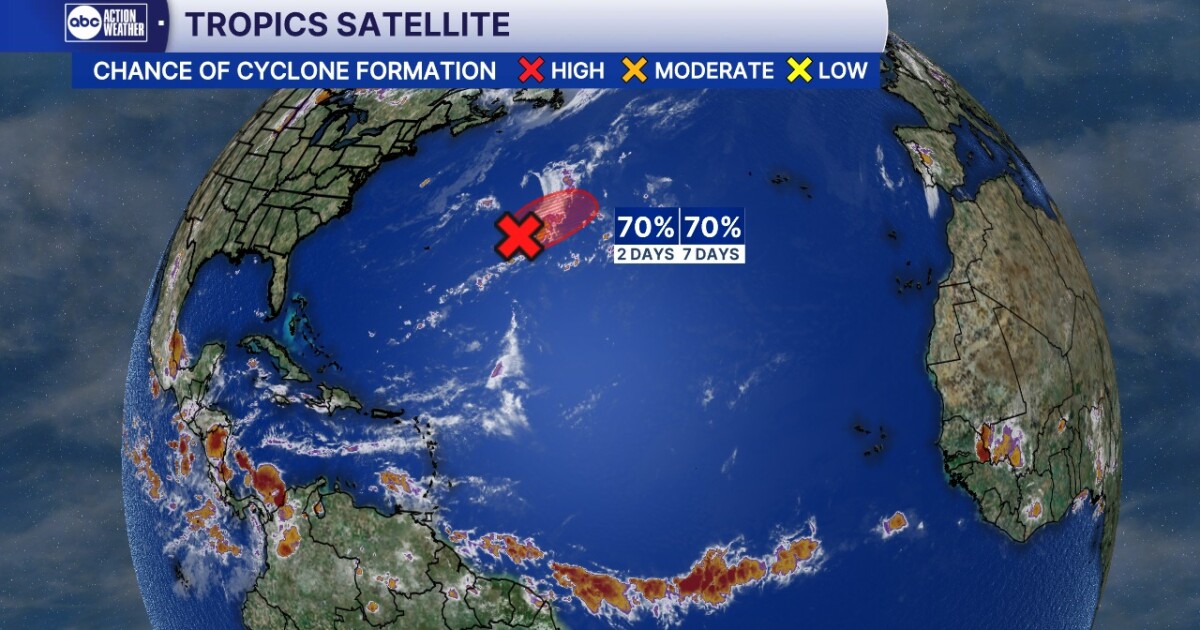

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025

Is Tropical Storm Andrea The First Hurricane Of 2025 Latest Updates

Jun 24, 2025 -

Stay Cool And Save Cash A Heatwave Budget Guide

Jun 24, 2025

Stay Cool And Save Cash A Heatwave Budget Guide

Jun 24, 2025