Institutional Investors Fuel Bitcoin ETF Boom: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Fuel Bitcoin ETF Boom: $5 Billion and Counting

The world of finance is buzzing. The launch of Bitcoin exchange-traded funds (ETFs) has ignited a firestorm of investment, with a staggering $5 billion already flowing into these new vehicles in just a few short weeks. This unprecedented surge is largely fueled by institutional investors, signifying a monumental shift in the perception and adoption of Bitcoin as a legitimate asset class.

This isn't just another fleeting crypto trend; this marks a significant turning point. For years, institutional participation in the cryptocurrency market was hesitant, hampered by regulatory uncertainty and concerns about volatility. Now, with the SEC approving several Bitcoin ETFs, the floodgates have opened, revealing a pent-up demand from large-scale investors eager to gain exposure to the world's largest cryptocurrency.

The Institutional Shift: Why Now?

Several factors have converged to create this perfect storm for Bitcoin ETF adoption:

- Regulatory Clarity: The SEC's approval, after years of deliberation, provided the much-needed regulatory certainty that institutional investors craved. This approval signaled a level of legitimacy previously absent in the crypto space.

- Increased Institutional Infrastructure: The rise of custodial services and other institutional-grade infrastructure has made it easier and safer for large funds to manage Bitcoin holdings.

- Diversification Strategies: Many institutional investors see Bitcoin as a compelling addition to their portfolios, offering potential diversification benefits and a hedge against inflation.

- Growing Adoption: The increasing mainstream adoption of cryptocurrencies, alongside a more mature understanding of blockchain technology, has boosted investor confidence.

This influx of capital has significant implications:

- Price Stability: While Bitcoin's price remains volatile, the substantial influx of institutional investment is likely to dampen extreme price swings in the long run.

- Market Maturity: The growing participation of institutional investors signals a maturing cryptocurrency market, attracting further investment and development.

- Increased Liquidity: The increased trading volume associated with Bitcoin ETFs will enhance liquidity within the market, making it easier for investors to buy and sell.

The Future of Bitcoin ETFs: What Lies Ahead?

The current momentum suggests that the $5 billion mark is just the beginning. Analysts predict further growth as more ETFs are approved and institutional investors continue to allocate capital to this asset class. We are likely to see:

- Increased Competition: Expect more firms to launch their own Bitcoin ETFs, further fueling competition and potentially lowering fees.

- Product Innovation: We could see the emergence of innovative Bitcoin ETF products, such as those offering leveraged exposure or specific investment strategies.

- Regulatory Scrutiny: The increased attention on Bitcoin ETFs will likely lead to heightened regulatory scrutiny, requiring the industry to maintain high standards of compliance.

The Bitcoin ETF boom is not simply about financial gains; it represents a fundamental shift in how the traditional financial world views cryptocurrencies. This significant milestone marks a pivotal moment for the crypto industry, and its ramifications will continue to unfold in the years to come. While risks remain, the potential for long-term growth is undeniably attractive for institutional investors, setting the stage for what could become a truly transformative period in financial markets.

Disclaimer: This article provides informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries inherent risks, and readers should conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Fuel Bitcoin ETF Boom: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

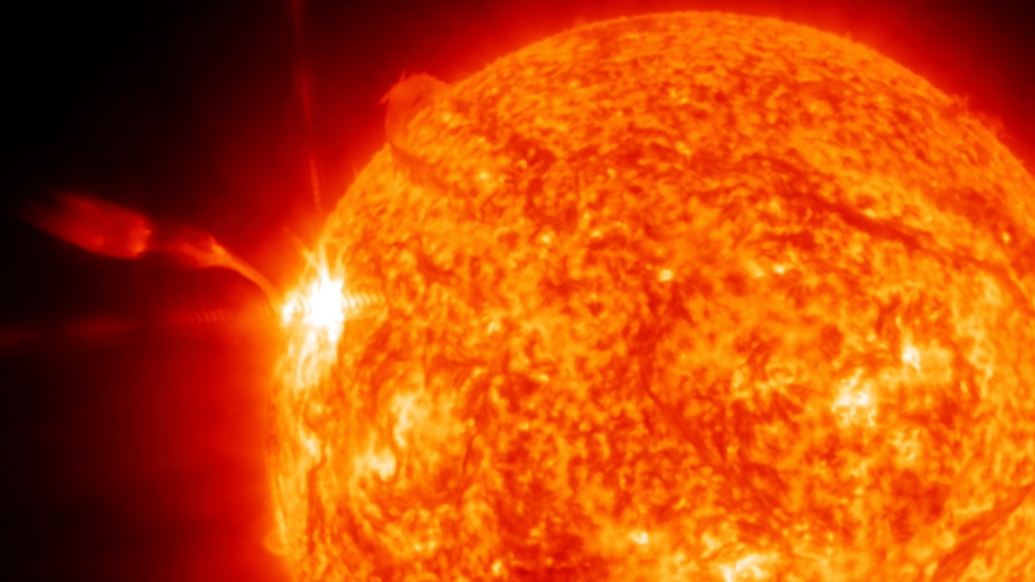

Major Solar Flare Of 2025 Radio Blackouts Hit Europe Asia And The Middle East

May 20, 2025

Major Solar Flare Of 2025 Radio Blackouts Hit Europe Asia And The Middle East

May 20, 2025 -

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Trend

May 20, 2025

Over 5 Billion Invested In Bitcoin Etfs Analyzing The Market Trend

May 20, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 20, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 20, 2025 -

The Putin Trump Dynamic Shifts A Power Play Analysis

May 20, 2025

The Putin Trump Dynamic Shifts A Power Play Analysis

May 20, 2025 -

Fans React To Jon Jones Cryptic Message Ufc Departure Imminent

May 20, 2025

Fans React To Jon Jones Cryptic Message Ufc Departure Imminent

May 20, 2025