Inflation Slowdown Prompts Australia To Slash Interest Rates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Slowdown Prompts Australia to Slash Interest Rates: Relief for Homeowners?

Australia's central bank, the Reserve Bank of Australia (RBA), has surprised markets by slashing interest rates by 0.25%, bringing the official cash rate down to 3.75%. This bold move follows a significant slowdown in inflation, offering a glimmer of hope for homeowners grappling with rising mortgage repayments and a cooling property market. The decision, announced earlier today, marks a significant shift in monetary policy after a year of aggressive rate hikes aimed at curbing runaway inflation.

Inflation Eases, but Challenges Remain

The RBA cited cooling inflation figures as the primary driver behind the rate cut. Recent data revealed that inflation, while still above the target range of 2-3%, has slowed considerably from its peak earlier this year. This deceleration, coupled with weakening consumer spending and a softening labour market, persuaded the RBA to ease its monetary tightening stance. However, the bank cautioned that inflation remains a concern, and further adjustments to interest rates may be necessary depending on future economic data.

Impact on Australian Households and the Economy

This rate cut is expected to provide significant relief to many Australian households. Lower interest rates will translate to lower mortgage repayments, potentially freeing up disposable income for consumers. This, in turn, could stimulate economic activity and boost consumer confidence, which has been subdued in recent months due to economic uncertainty.

However, the impact won't be uniform. While borrowers will benefit, savers might see lower returns on their deposits. The impact on the property market remains uncertain; while lower interest rates could stimulate demand, other factors, such as tighter lending standards and reduced investor activity, continue to play a role.

Experts Weigh In: A Cautious Optimism

Economists have offered mixed reactions to the RBA's decision. Some analysts applaud the move as a necessary adjustment to the changing economic landscape, highlighting the importance of avoiding a sharp economic downturn. Others remain cautious, warning that the inflation battle is far from over and that further rate cuts might be premature.

“The RBA's decision reflects a delicate balancing act,” says Dr. Sarah Chen, chief economist at the Australian Institute of Economic Research. "While inflation is cooling, it remains above target, and the risks of prematurely easing monetary policy are substantial."

What This Means for You:

- Homeowners: Expect lower mortgage repayments, potentially providing some financial breathing room.

- Savers: Prepare for potentially lower returns on your savings accounts.

- Businesses: The rate cut might boost investment and economic activity.

- Property Market: The impact is uncertain, with several factors influencing future market trends.

Looking Ahead: Continued Monitoring Essential

The RBA has emphasized its commitment to monitoring economic data closely. Future interest rate decisions will depend heavily on inflation trends, employment figures, and overall economic growth. This suggests that the current rate cut may not be the last, and further adjustments could occur in the coming months. The RBA’s next meeting will be crucial in providing further clarity on the direction of monetary policy. Stay tuned for further updates and analysis as the situation unfolds.

Keywords: Australia, RBA, Reserve Bank of Australia, interest rates, interest rate cut, inflation, monetary policy, economic growth, mortgage rates, property market, Australian economy, consumer spending, economic slowdown.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Slowdown Prompts Australia To Slash Interest Rates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

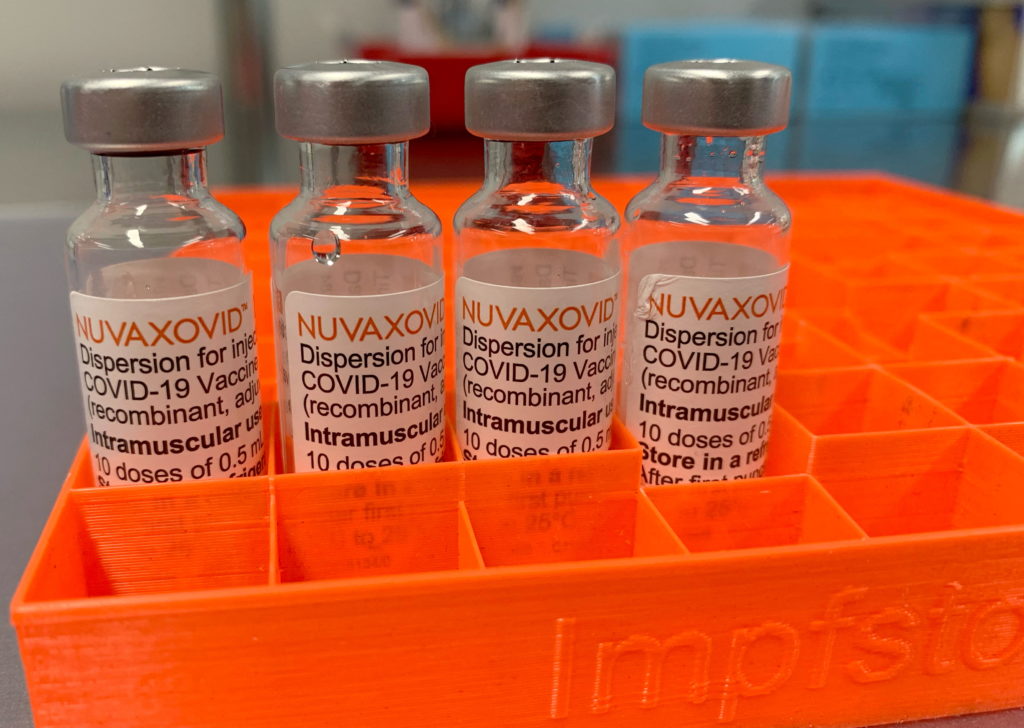

Novavax Covid 19 Vaccine Gets Fda Nod But With Unconventional Usage Rules

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Unconventional Usage Rules

May 20, 2025 -

Claim Exclusive Rewards Helldivers 2 Masters Of Ceremony Warbond Drop May 15th

May 20, 2025

Claim Exclusive Rewards Helldivers 2 Masters Of Ceremony Warbond Drop May 15th

May 20, 2025 -

Tom Aspinall Contract Talks Impact Jon Jones Ufc Decision Is He Retiring

May 20, 2025

Tom Aspinall Contract Talks Impact Jon Jones Ufc Decision Is He Retiring

May 20, 2025 -

Institutional Money Fuels Bitcoin Etf Growth 5 Billion And Counting

May 20, 2025

Institutional Money Fuels Bitcoin Etf Growth 5 Billion And Counting

May 20, 2025 -

The Last Of Us Season 2 How Altered Video Game Events Reshape Joel And Ellies Bond

May 20, 2025

The Last Of Us Season 2 How Altered Video Game Events Reshape Joel And Ellies Bond

May 20, 2025