Impact Of Fed's 2025 Rate Cut Projection On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's 2025 Rate Cut Projection Sends Ripples Through US Treasury Yields

The Federal Reserve's recent projection of interest rate cuts in 2025 has sent shockwaves through the US Treasury market, sparking significant debate among economists and investors about the future trajectory of yields. This unexpected shift in the Fed's outlook has created considerable uncertainty, impacting everything from long-term investment strategies to the cost of borrowing for businesses and consumers.

Understanding the Fed's Decision:

The Fed's decision to project rate cuts for 2025 signals a belief that inflation will be successfully tamed by the end of 2024. This projection, however, directly contradicts recent market expectations which anticipated interest rates remaining higher for a longer duration. This divergence of opinion has led to a noticeable drop in US Treasury yields, particularly in the longer-dated maturities.

Impact on US Treasury Yields:

The immediate impact on US Treasury yields has been a decline. Investors, anticipating lower future interest rates, are buying longer-term Treasury bonds, driving up their prices and consequently pushing yields down. This inverse relationship between bond prices and yields is a fundamental principle of fixed-income investing.

- Short-term yields: Have remained relatively stable, reflecting the Fed's commitment to keeping rates higher in the near term to combat inflation.

- Long-term yields: Have experienced a more pronounced decline, reflecting the market's reaction to the projected rate cuts in 2025. This spread between short-term and long-term yields, known as the yield curve, has flattened, potentially signaling concerns about future economic growth.

Potential Implications:

This shift in the Treasury market has several potential implications:

- Mortgage rates: A decline in long-term Treasury yields could translate into lower mortgage rates, potentially boosting the housing market. However, this effect depends on other factors like overall economic conditions and lending standards.

- Corporate borrowing costs: Lower yields could reduce the cost of borrowing for corporations, potentially stimulating investment and economic growth.

- Inflation expectations: The market's reaction suggests a belief that inflation will be under control by 2025. However, unexpected inflationary pressures could reverse this trend.

- Investment strategies: Investors are reassessing their portfolios in light of the changed outlook. This could lead to portfolio adjustments, shifting allocations between bonds and other asset classes.

Expert Opinions and Market Analysis:

Economists are divided on the accuracy of the Fed's projection. Some believe it reflects an optimistic view of the economy's ability to withstand higher interest rates, while others express concern about the potential for unforeseen economic shocks. The ongoing debate underscores the inherent uncertainty in economic forecasting and the volatility of the Treasury market. Many analysts are closely monitoring economic data like inflation figures and employment reports to gauge the accuracy of the Fed's projection. [Link to relevant economic data source].

Conclusion:

The Fed's projection of rate cuts in 2025 has created significant uncertainty in the US Treasury market, leading to a decline in yields, particularly in the long-term segment. The impact on various sectors, from housing to corporate borrowing, remains to be seen. Close monitoring of economic indicators and market reactions will be crucial in understanding the long-term implications of this pivotal decision. Staying informed on economic news and market trends is essential for investors and businesses alike. For more in-depth analysis, consider consulting a financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's 2025 Rate Cut Projection On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Helldivers 2 May 15th Master Of Ceremony Warbond Drop Incoming

May 21, 2025

Helldivers 2 May 15th Master Of Ceremony Warbond Drop Incoming

May 21, 2025 -

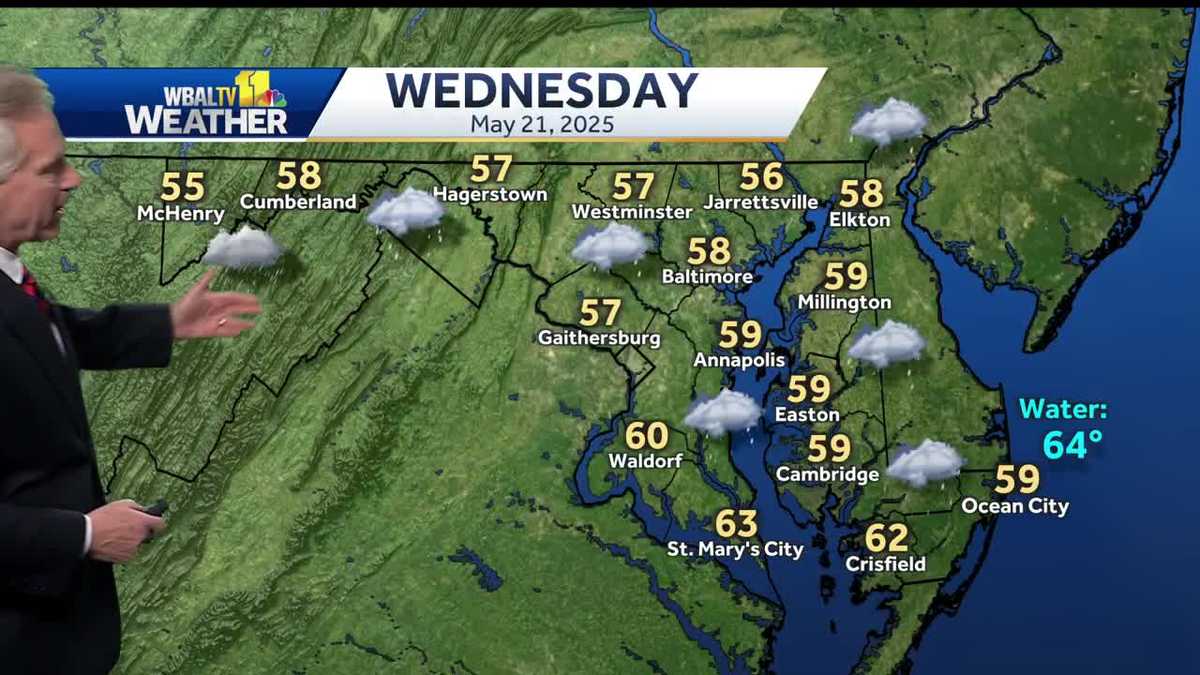

Chilly Rain To Blanket The Region Wednesday Weather Forecast

May 21, 2025

Chilly Rain To Blanket The Region Wednesday Weather Forecast

May 21, 2025 -

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025 -

I M Done Jon Jones Retirement Speculation Intensifies After Aspinall Delay

May 21, 2025

I M Done Jon Jones Retirement Speculation Intensifies After Aspinall Delay

May 21, 2025 -

Tom Aspinall Contract Talks And Jon Jones Cryptic Message Ufcs Future In Question

May 21, 2025

Tom Aspinall Contract Talks And Jon Jones Cryptic Message Ufcs Future In Question

May 21, 2025