Impact Of Fed's 2025 Rate Cut Prediction On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's 2025 Rate Cut Prediction Sends Ripples Through U.S. Treasury Yields

The Federal Reserve's recent projection of interest rate cuts in 2025 has sent shockwaves through the financial markets, significantly impacting U.S. Treasury yields. This unexpected shift in the Fed's forward guidance has investors re-evaluating their strategies and raises important questions about the future trajectory of the U.S. economy.

Understanding the Impact

The Fed's prediction, revealed in its latest Summary of Economic Projections (SEP), suggests a belief that inflation will cool sufficiently by 2025 to allow for monetary policy easing. This expectation, however, contradicts the prevailing narrative of persistently high inflation and the need for sustained higher interest rates. The immediate consequence has been a decline in U.S. Treasury yields across the maturity spectrum. Longer-term yields, which are particularly sensitive to future interest rate expectations, have seen more pronounced drops.

This decline in yields reflects investor expectations of lower future interest rates. When the Fed cuts rates, existing bonds with higher yields become more attractive, driving up their prices and pushing yields down. This inverse relationship between bond prices and yields is a fundamental principle of fixed-income investing.

Market Reactions and Analysis

The market's reaction has been mixed. While some analysts see the rate cut prediction as a sign that the Fed is winning its battle against inflation, others remain skeptical. Concerns persist about the possibility of a prolonged period of high inflation, which could force the Fed to maintain higher rates for longer than anticipated.

- Concerns about Inflation: Many experts caution that the current inflation rate is still significantly above the Fed's target of 2%, and unforeseen economic shocks could easily reignite inflationary pressures. The persistence of elevated inflation could lead to a delay or even reversal of the projected rate cuts.

- Economic Growth Concerns: The projected rate cuts also raise concerns about potential economic slowdown. Lower interest rates, while stimulating borrowing and investment, can also fuel excessive inflation if not carefully managed. A delicate balance must be struck between controlling inflation and fostering economic growth.

- Impact on the Dollar: The prediction of future rate cuts has also led to a slight weakening of the U.S. dollar. Lower interest rates generally make a country's currency less attractive to foreign investors, leading to a decline in its value.

What Does This Mean for Investors?

The impact of the Fed's prediction on investors is multifaceted. For bondholders, declining yields represent both an opportunity and a risk. Lower yields mean lower returns on newly purchased bonds, but existing bonds with higher yields now offer a relative advantage. However, the uncertainty surrounding the Fed's future actions makes it crucial for investors to carefully assess their risk tolerance and investment horizon before making any major decisions.

Looking Ahead: Uncertainty Remains

The future direction of U.S. Treasury yields remains highly uncertain. The Fed's projections are subject to revision based on evolving economic data. Factors like inflation, economic growth, and geopolitical events will all play a crucial role in shaping the path of interest rates in the coming years. Investors should closely monitor these developments and stay informed about the Fed's ongoing policy decisions.

Further Reading:

- – Stay updated on the latest Fed announcements and economic data.

- – Get diverse perspectives on market analysis.

Call to Action: Consult with a qualified financial advisor to discuss how the Fed's rate cut prediction may impact your personal investment strategy. Don't rely solely on news articles; personalized financial advice is crucial for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's 2025 Rate Cut Prediction On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

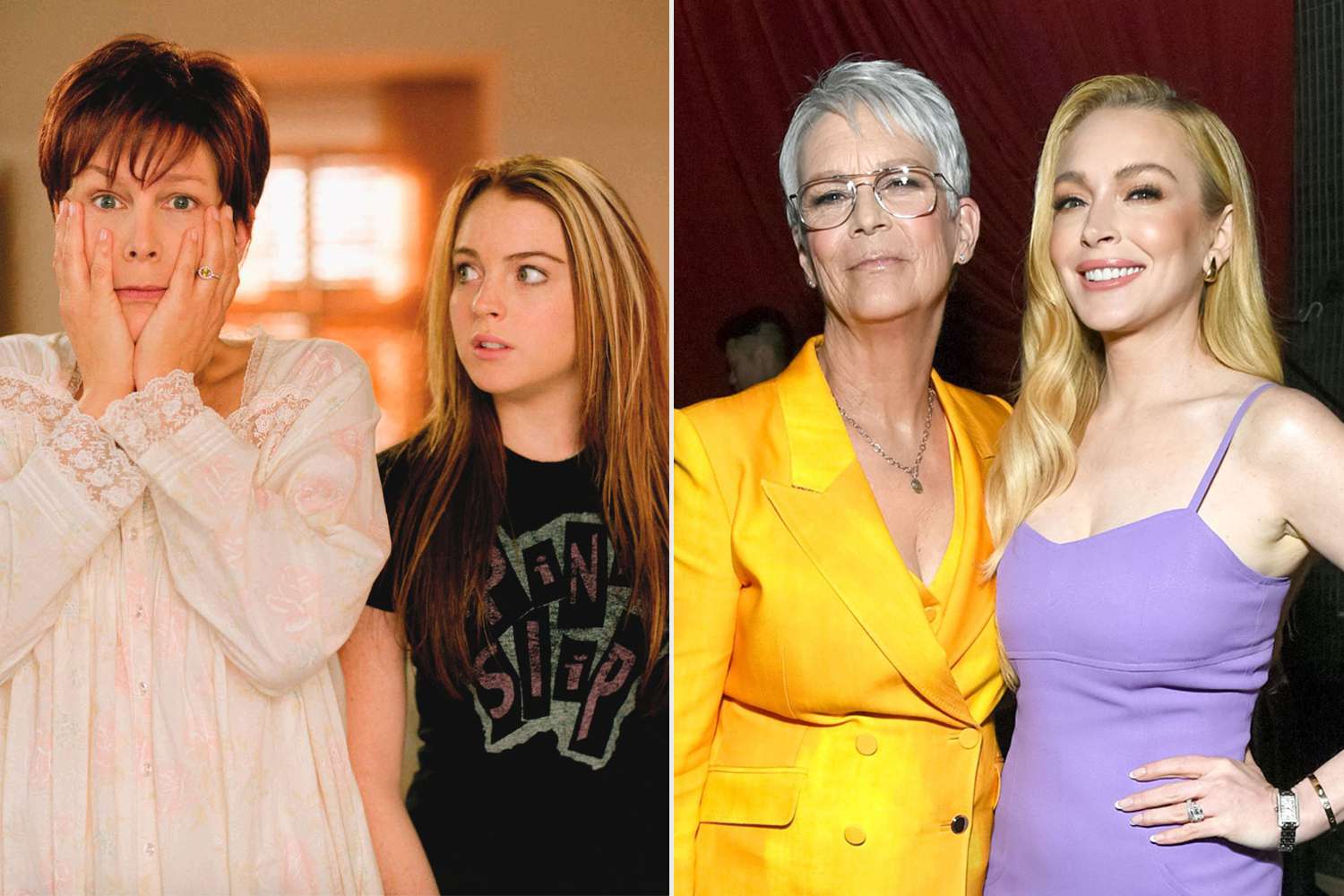

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Connection With Lindsay Lohan

May 20, 2025

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Connection With Lindsay Lohan

May 20, 2025 -

S And P 500 Dow Nasdaq Climb Stock Market Ignites Despite Moodys Negative Outlook

May 20, 2025

S And P 500 Dow Nasdaq Climb Stock Market Ignites Despite Moodys Negative Outlook

May 20, 2025 -

Over 65 000 Airbnb Listings Suspended In Spain Due To Regulatory Non Compliance

May 20, 2025

Over 65 000 Airbnb Listings Suspended In Spain Due To Regulatory Non Compliance

May 20, 2025 -

First Glimpse Of War 2 Hrithik Roshan Jr Ntr And Kiara Advani

May 20, 2025

First Glimpse Of War 2 Hrithik Roshan Jr Ntr And Kiara Advani

May 20, 2025 -

S And P 500s 6 Day Winning Streak Continues Market Defies Moodys Negative Outlook

May 20, 2025

S And P 500s 6 Day Winning Streak Continues Market Defies Moodys Negative Outlook

May 20, 2025