Find The Best Mortgage Refinance Rate: May 19, 2025 Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Find the Best Mortgage Refinance Rate: May 19, 2025 Market Analysis

Are you considering refinancing your mortgage? With interest rates constantly fluctuating, securing the best refinance rate can save you thousands of dollars over the life of your loan. This market analysis for May 19, 2025, provides insights into current rates and helps you navigate the refinancing process.

Current Mortgage Refinance Rate Landscape (May 19, 2025)

As of May 19, 2025, the mortgage refinance market presents a complex picture. While precise rates vary significantly depending on your credit score, loan type, down payment, and the lender, we're seeing a trend of [Insert General Trend Here: e.g., slightly higher rates compared to last month, a stabilization after recent increases, etc.]. It's crucial to remember that these are general observations and individual rates will differ.

Factors Influencing Your Refinance Rate:

Several factors influence the mortgage refinance rate you'll qualify for. Understanding these is critical to securing the best possible deal:

- Credit Score: A higher credit score (740+) typically qualifies you for the lowest interest rates. Improving your credit score before applying can significantly impact your savings. Learn more about [Link to a reputable credit score improvement article/resource].

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the home's value. A lower LTV (meaning a larger down payment) generally leads to better rates.

- Loan Type: Different loan types (e.g., 30-year fixed, 15-year fixed, ARM) carry varying interest rates. A 15-year fixed mortgage typically offers a lower rate but requires higher monthly payments.

- Interest Rate Environment: Broad economic conditions and Federal Reserve policies heavily influence prevailing mortgage rates. Staying updated on economic news is beneficial. [Link to a reputable financial news source]

- The Lender: Different lenders offer different rates and fees. Shopping around and comparing quotes from multiple lenders is essential to finding the best deal.

How to Find the Best Mortgage Refinance Rate:

Finding the best refinance rate requires proactive steps:

- Check Your Credit Report: Obtain a free credit report to identify any errors affecting your score.

- Shop Around: Get pre-approved from several lenders to compare rates and fees. Online lenders often offer competitive rates.

- Compare APRs, Not Just Interest Rates: The Annual Percentage Rate (APR) includes all loan costs, providing a more accurate comparison.

- Negotiate: Don't hesitate to negotiate with lenders for a better rate or lower closing costs.

- Consider Your Long-Term Goals: Factor in your financial situation and long-term goals when choosing a loan term and type.

Is Refinancing Right for You?

Refinancing isn't always the best option. Consider these factors:

- Current Interest Rate vs. Potential New Rate: Only refinance if the new rate offers significant savings.

- Closing Costs: Weigh the potential savings against the closing costs involved in refinancing.

- Loan Term: A shorter loan term means higher monthly payments but lower overall interest paid.

Conclusion:

Securing the best mortgage refinance rate on May 19, 2025, requires careful planning and research. By understanding the influencing factors and following the steps outlined above, you can increase your chances of saving significantly on your mortgage payments. Remember to always consult with a financial advisor for personalized guidance.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified professional before making any financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Find The Best Mortgage Refinance Rate: May 19, 2025 Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025 -

Market Rally Continues S And P 500s Six Day Winning Streak Market Analysis

May 20, 2025

Market Rally Continues S And P 500s Six Day Winning Streak Market Analysis

May 20, 2025 -

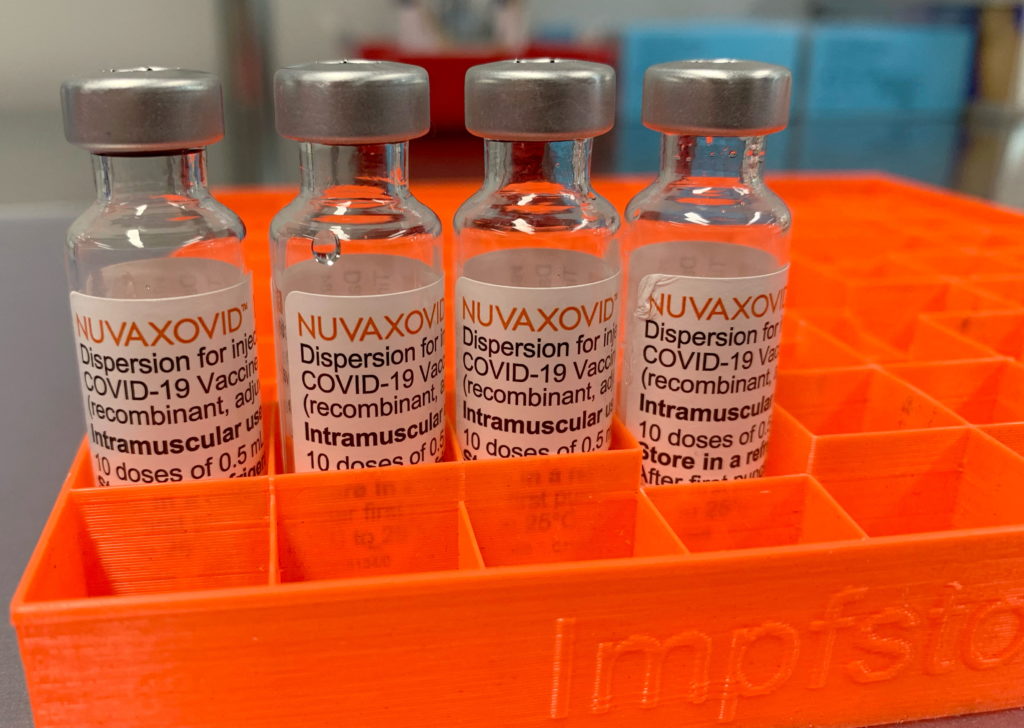

Fda Approval For Novavax Covid 19 Vaccine Key Restrictions Explained

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Key Restrictions Explained

May 20, 2025 -

Clean Energy Taxes Economic Impacts And Policy Implications For The Us

May 20, 2025

Clean Energy Taxes Economic Impacts And Policy Implications For The Us

May 20, 2025 -

The Impact Of Medical And Scientific Research On Americas Global Standing

May 20, 2025

The Impact Of Medical And Scientific Research On Americas Global Standing

May 20, 2025