Federal Reserve's 2025 Rate Cut Forecast Leads To Decrease In U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Reserve's 2025 Rate Cut Forecast Triggers Dip in U.S. Treasury Yields

The U.S. Treasury market experienced a noticeable shift this week following the Federal Reserve's (Fed) projection of potential interest rate cuts in 2025. This forecast, unveiled during the latest Federal Open Market Committee (FOMC) meeting, immediately impacted investor sentiment and led to a decline in U.S. Treasury yields across the board. This development has significant implications for the broader economy and financial markets.

Understanding the Connection: Rates and Yields

Before delving into the specifics, it's crucial to understand the relationship between interest rates and Treasury yields. U.S. Treasury yields reflect the return an investor receives on government bonds. These yields move inversely to bond prices. When the Fed anticipates lowering interest rates, investors anticipate lower future yields on newly issued bonds, causing existing bonds to become more attractive. This increased demand drives up bond prices and subsequently pushes yields down.

The Fed's Projection and Market Reaction

The Fed's suggestion of potential rate cuts in 2025, while still relatively far off, signaled a potential easing of monetary policy. This expectation spurred a wave of selling in the U.S. Treasury market, leading to a decline in yields. The 2-year Treasury yield, a particularly sensitive indicator of short-term rate expectations, saw a more pronounced drop than longer-term yields. This reflects market confidence that the Fed's actions will successfully combat inflation without causing a prolonged economic downturn.

Implications for Investors and the Economy

This decrease in Treasury yields has several implications:

- Lower borrowing costs: Businesses and consumers may find it easier and cheaper to borrow money, potentially stimulating economic activity.

- Increased bond prices: This benefits existing bondholders, who see an increase in the value of their investments.

- Shifts in investment strategies: Investors may reassess their portfolios, potentially shifting allocations away from higher-yielding assets towards those with lower risk profiles.

- Impact on the dollar: Lower yields could potentially weaken the U.S. dollar relative to other currencies.

Concerns and Uncertainties Remain

While the market reacted positively to the Fed's forecast, uncertainties remain. The projected rate cuts hinge on several factors, including the trajectory of inflation and the overall health of the economy. Any unforeseen economic shocks could alter the Fed's plans, potentially reversing the current trend in Treasury yields. Furthermore, the timing of any rate cuts remains uncertain, leaving room for market volatility.

Looking Ahead: Monitoring Key Indicators

Going forward, investors and economists will closely monitor key economic indicators such as inflation data (CPI and PPI), employment figures (non-farm payroll), and consumer spending to assess the accuracy of the Fed's projections. These data points will play a crucial role in shaping future market movements and ultimately influencing the trajectory of U.S. Treasury yields. The coming months will be critical in determining whether the current downward trend continues or reverses course. Stay informed by following reputable financial news sources and consulting with financial advisors to make informed investment decisions.

Keywords: Federal Reserve, interest rates, rate cut, U.S. Treasury yields, bond prices, monetary policy, inflation, economic growth, FOMC, investment strategy, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Reserve's 2025 Rate Cut Forecast Leads To Decrease In U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investor Confidence Soars 200 Million Flows Into Ethereum Funds Following Pectra

May 21, 2025

Investor Confidence Soars 200 Million Flows Into Ethereum Funds Following Pectra

May 21, 2025 -

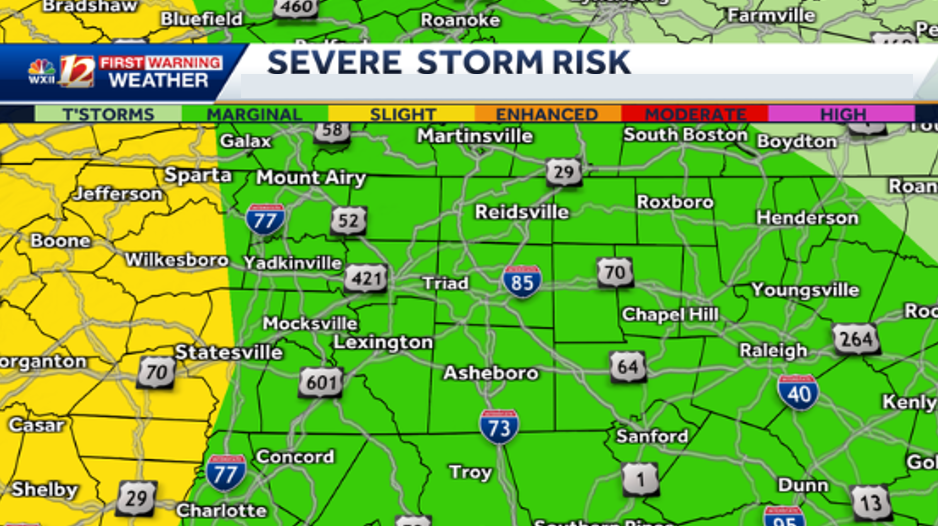

Rain And Severe Storms To Impact North Carolina Overnight What You Need To Know

May 21, 2025

Rain And Severe Storms To Impact North Carolina Overnight What You Need To Know

May 21, 2025 -

Nature Conservation Drives Corporate Value 160 Japanese Companies Adopt New Strategies Across 13 Sectors

May 21, 2025

Nature Conservation Drives Corporate Value 160 Japanese Companies Adopt New Strategies Across 13 Sectors

May 21, 2025 -

Overnight Storms And Heavy Rain To Impact North Carolina Severe Weather Warnings Issued

May 21, 2025

Overnight Storms And Heavy Rain To Impact North Carolina Severe Weather Warnings Issued

May 21, 2025 -

Popular Web Novel Solo Leveling Receives First Award

May 21, 2025

Popular Web Novel Solo Leveling Receives First Award

May 21, 2025