$200 Million Rushes Into Ethereum Funds Post-Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Floods into Ethereum Funds Following Successful Shanghai Upgrade

Ethereum experienced a significant surge in institutional investment following the highly anticipated Shanghai upgrade, with approximately $200 million pouring into Ethereum-focused funds in the weeks immediately following the completion of the upgrade. This influx of capital signifies a renewed confidence in the second-largest cryptocurrency and its underlying blockchain technology.

The successful implementation of the Shanghai upgrade, also known as the EIP-4895 upgrade, marked a pivotal moment for Ethereum. This upgrade enabled the withdrawal of staked ETH, a feature eagerly awaited by many investors who had previously been locked into staking contracts. This unlocked liquidity is widely considered a primary driver behind the recent investment boom.

Unlocking Staked ETH: A Catalyst for Growth?

For months, billions of dollars worth of ETH were locked in staking contracts, unable to be withdrawn. This limitation, while necessary for network security, created a degree of uncertainty for some investors. The Shanghai upgrade removed this hurdle, allowing users to access their staked ETH, thereby significantly increasing the asset's liquidity.

This newfound liquidity is seen as particularly attractive to institutional investors, who often require easier access to their assets for portfolio management and rebalancing. The ability to withdraw staked ETH without impacting network security has demonstrably boosted investor confidence and fueled the significant capital inflow into Ethereum funds.

Institutional Investors Embrace Ethereum's Enhanced Utility

The $200 million surge is not merely a short-term reaction. Industry analysts believe this represents a longer-term shift in institutional sentiment towards Ethereum. The successful upgrade solidified Ethereum's position as a robust and adaptable blockchain platform. This is further reinforced by Ethereum's growing ecosystem of decentralized applications (dApps) and its expanding role in the burgeoning decentralized finance (DeFi) sector.

Several leading institutional investment firms have confirmed increased allocations to Ethereum in their portfolios, citing the upgrade's success as a key factor in their decision-making process. This growing institutional adoption is a powerful indicator of Ethereum's maturation as a leading digital asset.

What Does This Mean for the Future of Ethereum?

The post-Shanghai upgrade influx of capital suggests a positive outlook for Ethereum's price and overall market position. However, it's crucial to remember that the cryptocurrency market remains volatile. While this substantial investment is encouraging, it's essential to maintain a balanced perspective and consider broader market trends.

Key Takeaways:

- Significant Capital Inflow: Approximately $200 million flowed into Ethereum funds post-Shanghai upgrade.

- EIP-4895's Impact: The ability to withdraw staked ETH was a major catalyst for this investment surge.

- Increased Institutional Confidence: The successful upgrade solidified institutional belief in Ethereum's long-term viability.

- Future Outlook: While positive, the cryptocurrency market remains volatile, requiring careful consideration of broader market forces.

This substantial investment highlights Ethereum's ongoing evolution and its potential for continued growth. The successful execution of the Shanghai upgrade has clearly demonstrated the project's capacity for innovation and adaptation, attracting significant institutional interest and capital. Only time will tell the full extent of the upgrade's impact, but the initial signs are undeniably positive. Stay tuned for further updates as the Ethereum ecosystem continues to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Rushes Into Ethereum Funds Post-Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Intervention Russia And Ukraine To Engage In Immediate Truce Talks

May 21, 2025

Trumps Intervention Russia And Ukraine To Engage In Immediate Truce Talks

May 21, 2025 -

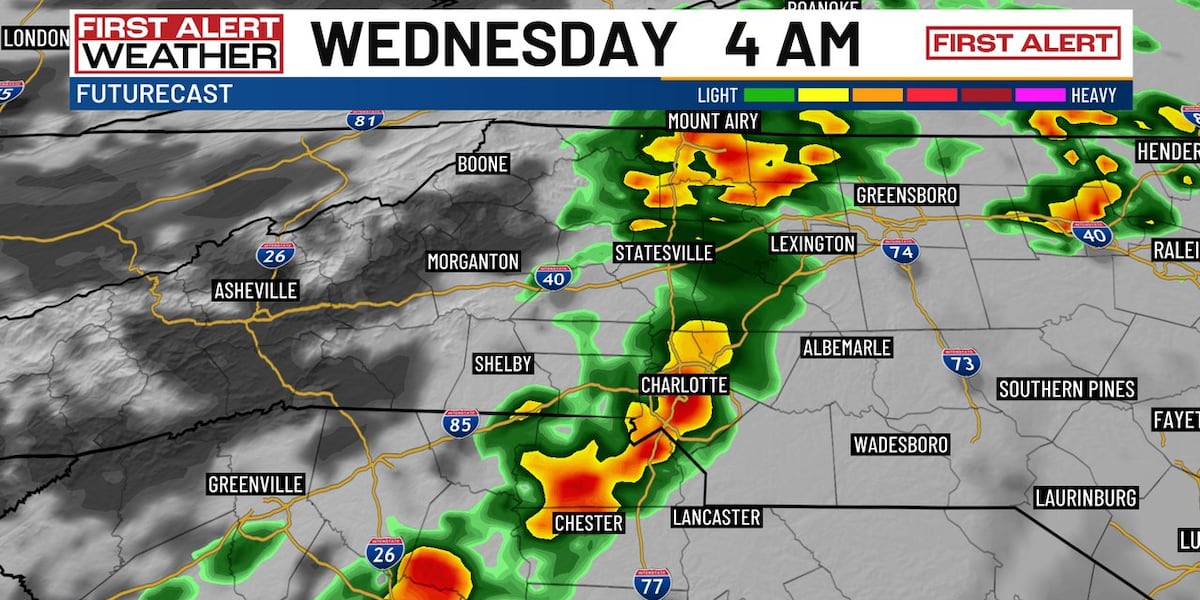

Overnight Storm Threat For Charlotte Prepare For Strong Winds And Heavy Rain

May 21, 2025

Overnight Storm Threat For Charlotte Prepare For Strong Winds And Heavy Rain

May 21, 2025 -

Fan Fury Jon Jones Faces Backlash Over Comments Targeting Tom Aspinall

May 21, 2025

Fan Fury Jon Jones Faces Backlash Over Comments Targeting Tom Aspinall

May 21, 2025 -

Jon Jones Blasts Ufc For Keeping Aspinall Injury Information From Public

May 21, 2025

Jon Jones Blasts Ufc For Keeping Aspinall Injury Information From Public

May 21, 2025 -

Peaky Blinders Creator Announces New Series Reveals Major Plot Twist

May 21, 2025

Peaky Blinders Creator Announces New Series Reveals Major Plot Twist

May 21, 2025