Fed Signals Single Rate Cut In 2025, Sending US Treasury Yields Lower

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals Single Rate Cut in 2025, Sending US Treasury Yields Lower

The Federal Reserve's (Fed) latest projections sent shockwaves through the financial markets, signaling a potential single interest rate cut in 2025. This announcement, delivered alongside the minutes from the July Federal Open Market Committee (FOMC) meeting, immediately impacted US Treasury yields, driving them lower. The shift in expectations marks a notable change from previous forecasts and underscores the evolving assessment of the US economy's trajectory.

This unexpected pivot has significant implications for investors, businesses, and consumers alike. Let's delve deeper into the details and explore the potential ramifications of this decision.

A Shift in Monetary Policy Expectations

The Fed's updated "dot plot," which illustrates individual policymakers' interest rate projections, now anticipates a single 25-basis-point rate cut by the end of 2025. This contrasts sharply with previous forecasts that largely anticipated rates remaining steady throughout the year. This change reflects a growing belief within the central bank that inflation is cooling more quickly than initially predicted, allowing for some easing of monetary policy in the future.

The minutes themselves highlighted a nuanced debate among committee members. While acknowledging the ongoing progress in lowering inflation, concerns remain about the persistence of price pressures and the potential for further tightening if necessary. This cautious optimism underscores the Fed's commitment to a data-driven approach to monetary policy.

Impact on US Treasury Yields

The announcement triggered an immediate reaction in the bond market. The anticipation of future rate cuts led to a decline in US Treasury yields. Investors, anticipating a less aggressive monetary policy stance, reduced their demand for higher-yielding bonds, pushing prices up and yields down. This decrease in yields represents a significant shift in market sentiment, reflecting the perceived lower risk associated with holding government bonds. The 10-year Treasury yield, a key benchmark for borrowing costs, experienced a notable drop, indicating a potential easing of borrowing conditions across the economy.

What Does This Mean for the Future?

The Fed's decision to signal a single rate cut in 2025 is a significant development that necessitates careful consideration. While it suggests a degree of confidence in the economy's ability to navigate the current inflationary pressures, several factors remain uncertain. The ongoing impact of geopolitical events, potential supply chain disruptions, and the strength of consumer demand all contribute to the complexity of economic forecasting.

Key Takeaways:

- Single Rate Cut Projected for 2025: The Fed's dot plot now projects a single 25-basis-point rate cut by the end of 2025.

- US Treasury Yields Decline: Anticipation of future rate cuts drove US Treasury yields lower.

- Data-Driven Approach: The Fed's decision highlights its ongoing commitment to a data-driven approach to monetary policy.

- Uncertainty Remains: Several economic factors continue to contribute to uncertainty surrounding future economic performance.

Looking Ahead: Investors and analysts will be closely monitoring economic data releases in the coming months for further insights into the trajectory of inflation and the overall health of the US economy. The Fed's next moves will depend heavily on these incoming data points, making future forecasts inherently subject to revision. The potential for further adjustments to monetary policy remains a crucial consideration for market participants. For the latest updates and in-depth analysis of the evolving economic landscape, be sure to stay tuned to reputable financial news sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals Single Rate Cut In 2025, Sending US Treasury Yields Lower. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Retirement Rumors Intensify Aspinall Negotiations And The I M Done Statement

May 20, 2025

Jon Jones Retirement Rumors Intensify Aspinall Negotiations And The I M Done Statement

May 20, 2025 -

Controversy Erupts Jon Jones Blasts Ufc For Concealing Aspinalls Condition

May 20, 2025

Controversy Erupts Jon Jones Blasts Ufc For Concealing Aspinalls Condition

May 20, 2025 -

65 000 Tourist Rentals Blocked In Spain Implications For The Holiday Sector

May 20, 2025

65 000 Tourist Rentals Blocked In Spain Implications For The Holiday Sector

May 20, 2025 -

Post Shanghai Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025

Post Shanghai Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025 -

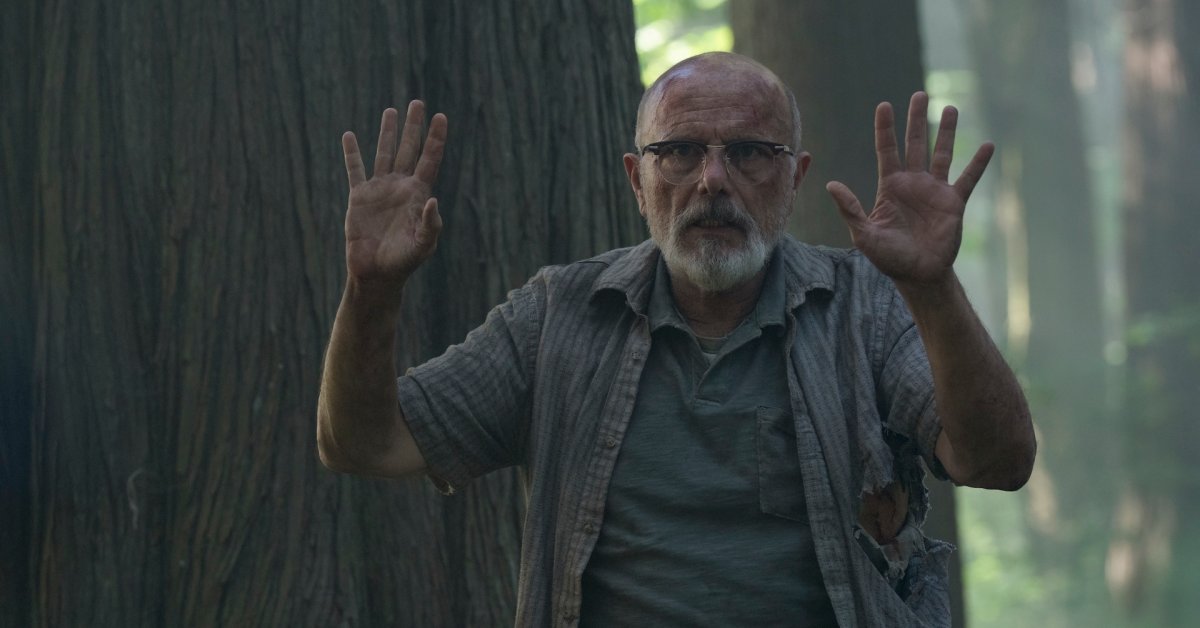

The Last Of Us Season 2 How Altered Gameplay Changes Joel And Ellies Dynamic

May 20, 2025

The Last Of Us Season 2 How Altered Gameplay Changes Joel And Ellies Dynamic

May 20, 2025