Post-Shanghai Upgrade: Investors Pour $200 Million Into Ethereum Funds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Post-Shanghai Upgrade: Investors Flood Ethereum Funds with $200 Million

Ethereum's Shanghai upgrade has unlocked a wave of investor confidence, resulting in a significant surge of capital into Ethereum-focused investment funds. The upgrade, which allowed for the withdrawal of staked ETH, marked a pivotal moment for the second-largest cryptocurrency, removing a key uncertainty for many potential investors. This unprecedented influx of capital, totaling an estimated $200 million, signals a bullish outlook for the future of Ethereum and its ecosystem.

<h3>A Vote of Confidence in Ethereum 2.0</h3>

The Shanghai upgrade, finalized in April 2023, was more than just a technical update; it was a critical step in the evolution of Ethereum. For months, billions of dollars worth of ETH were locked in the staking contract, unable to be withdrawn. This "locked" ETH represented a significant risk for some investors. The successful implementation of the upgrade, however, alleviated these concerns, opening the floodgates for new investments.

This significant investment represents a powerful vote of confidence in Ethereum's long-term potential. It signals that institutional and individual investors alike are increasingly comfortable with the network's stability and its continued development. The ability to now unstake ETH and access liquidity has drastically reduced the perceived risk associated with staking, attracting a new wave of participants to the Ethereum ecosystem.

<h3>Where is the Money Going?</h3>

The $200 million influx hasn't been evenly distributed. Several prominent Ethereum-focused investment funds have reported significant increases in assets under management (AUM). These funds often employ sophisticated strategies to maximize returns within the Ethereum ecosystem, focusing on areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies. While specific fund allocation details remain largely undisclosed for competitive reasons, reports indicate substantial growth across the board. This capital injection will undoubtedly fuel further innovation and development within the Ethereum ecosystem.

<h3>The Impact on ETH Price</h3>

While the direct correlation between the investment influx and ETH price is complex and influenced by various market factors, the significant investment is undoubtedly a positive sign. The increased demand for ETH, coupled with the successful Shanghai upgrade, contributes to a more bullish sentiment around the cryptocurrency. This boost in confidence could lead to further price appreciation in the coming months, although it's important to remember that cryptocurrency markets remain highly volatile.

<h3>Looking Ahead: Continued Growth Potential</h3>

The post-Shanghai upgrade investment surge is a clear indication of growing institutional interest in Ethereum. As the network continues to evolve and mature, we can expect to see further capital inflows, driving innovation and solidifying Ethereum's position as a leading blockchain platform. The successful withdrawal of staked ETH marks a significant milestone, paving the way for broader adoption and potentially accelerating the growth of the entire decentralized finance landscape. This event should be seen as a pivotal moment in the history of Ethereum, highlighting its resilience and the enduring faith investors have in its future.

Learn more:

- (This will need to be replaced with a relevant and specific link once available).

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose money. Always conduct thorough research and consider your own risk tolerance before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Post-Shanghai Upgrade: Investors Pour $200 Million Into Ethereum Funds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

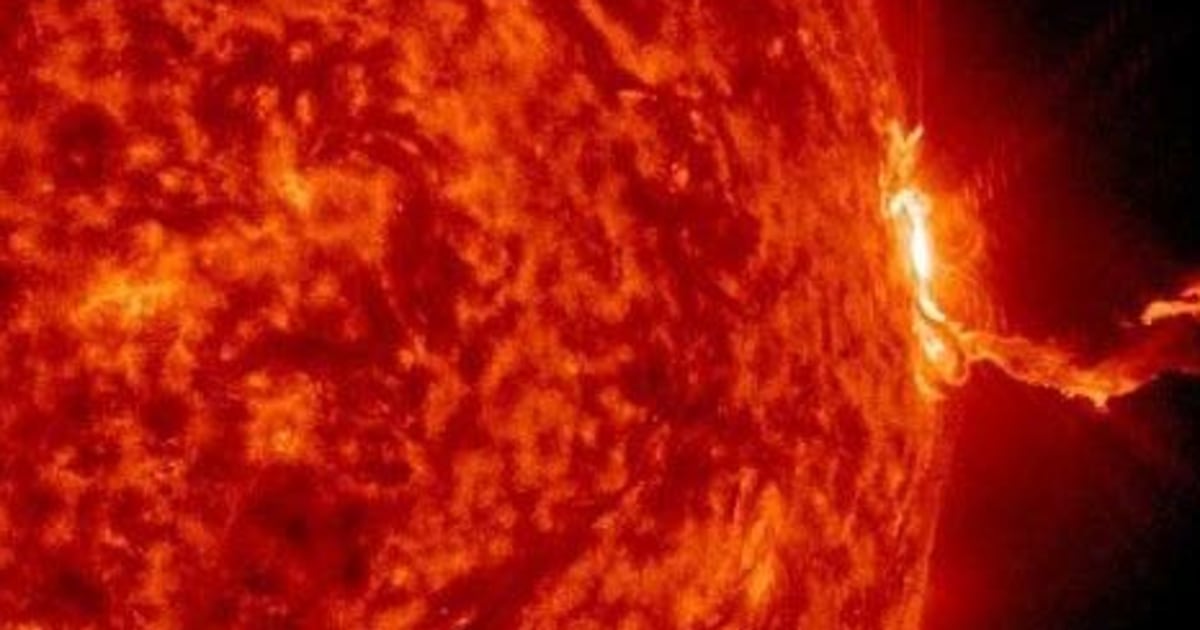

Widespread Communications Failure A Massive Solar Storms Impact

May 20, 2025

Widespread Communications Failure A Massive Solar Storms Impact

May 20, 2025 -

Jon Jones Ufcs Secrecy Around Tom Aspinall Injury Is Unacceptable

May 20, 2025

Jon Jones Ufcs Secrecy Around Tom Aspinall Injury Is Unacceptable

May 20, 2025 -

Jenn Sterger Details Devastating Impact Of Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Details Devastating Impact Of Brett Favre Sexting Scandal

May 20, 2025 -

Bali Tourism Prioritizing Safety And Responsible Traveler Conduct Through International Partnerships

May 20, 2025

Bali Tourism Prioritizing Safety And Responsible Traveler Conduct Through International Partnerships

May 20, 2025 -

Helldivers 2 May 15th Update New Master Of Ceremony Warbond Rewards

May 20, 2025

Helldivers 2 May 15th Update New Master Of Ceremony Warbond Rewards

May 20, 2025