Fed Signals Single 2025 Rate Cut, US Treasury Yields Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Signals Single 2025 Rate Cut, Sending US Treasury Yields Lower

The Federal Reserve's latest projections have sent ripples through the financial markets, with a signaled single interest rate cut in 2025 leading to a dip in US Treasury yields. This unexpected shift in the central bank's outlook marks a significant change from previous predictions of sustained higher rates and reflects a growing optimism, albeit cautious, about the trajectory of the US economy.

The move, revealed in the Federal Open Market Committee (FOMC) statement following their September meeting, surprised many analysts who had anticipated a more hawkish stance. The dot plot, which shows individual policymakers' projections for interest rates, now indicates a single 25-basis-point rate cut by the end of 2025. This contrasts sharply with previous forecasts that hinted at rates remaining elevated for a longer period.

What Drove the Shift?

Several factors likely contributed to the Fed's more dovish outlook. Inflation, while still above the Fed's 2% target, has shown signs of cooling. Recent economic data, including the latest Consumer Price Index (CPI) and Producer Price Index (PPI) reports, suggests that inflationary pressures may be easing more quickly than initially anticipated. However, it's crucial to note that this is not a definitive declaration of victory over inflation; the Fed continues to monitor economic indicators closely.

Furthermore, the recent resilience of the labor market, while positive in many respects, presents a potential challenge. A strong labor market can fuel wage growth, which in turn could reignite inflationary pressures. The Fed is likely carefully balancing the need to cool inflation with the risk of triggering a significant economic slowdown.

Impact on US Treasury Yields:

The announcement immediately impacted US Treasury yields, sending them lower. Investors, interpreting the single rate cut projection as a signal of easing monetary policy, reduced their demand for higher-yielding bonds. This decrease in demand directly translates to lower yields on US Treasuries, making them less attractive relative to other investments. The 10-year Treasury yield, a key benchmark for borrowing costs, experienced a notable decline following the FOMC announcement. This drop suggests a shift in market sentiment towards a less aggressive monetary policy stance in the near future.

What Does This Mean for Investors?

The Fed's shift in projections presents both opportunities and challenges for investors. Lower yields on US Treasuries might encourage some to seek higher returns elsewhere in the market. However, the uncertainty surrounding the future economic trajectory necessitates a cautious approach. Investors should carefully assess their risk tolerance and portfolio diversification strategies in light of this development.

Looking Ahead:

The coming months will be crucial in gauging the accuracy of the Fed's predictions. Further economic data releases and the Fed's ongoing assessment of the economic landscape will play a significant role in shaping future monetary policy decisions. While the single rate cut projection offers a glimpse of potential easing in 2025, the path forward remains subject to considerable uncertainty. Close monitoring of inflation, employment figures, and other key economic indicators will be vital for investors and economists alike.

Keywords: Fed, Federal Reserve, interest rates, rate cut, US Treasury yields, inflation, economic outlook, monetary policy, FOMC, dot plot, CPI, PPI, bond yields, investment strategy, economic data.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Signals Single 2025 Rate Cut, US Treasury Yields Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spains Regulatory Crackdown Airbnb Removes Thousands Of Holiday Listings

May 20, 2025

Spains Regulatory Crackdown Airbnb Removes Thousands Of Holiday Listings

May 20, 2025 -

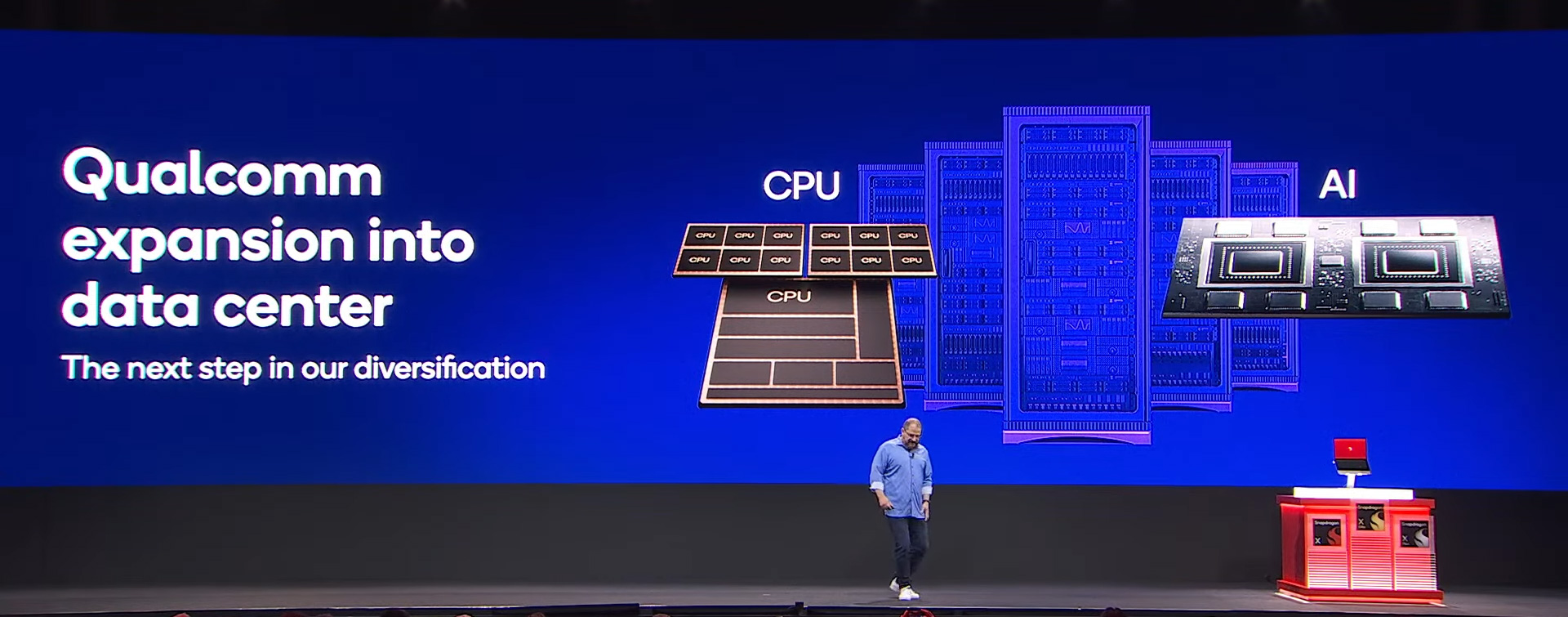

Ai And Data Center Processing Qualcomms Latest Innovations

May 20, 2025

Ai And Data Center Processing Qualcomms Latest Innovations

May 20, 2025 -

The Diminishing Trump Factor Putins Assertive Foreign Policy Shift

May 20, 2025

The Diminishing Trump Factor Putins Assertive Foreign Policy Shift

May 20, 2025 -

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025 -

Tensions Rise Lsg Stars War Of Words With Abhishek Sharma Dominates Ipl 2025

May 20, 2025

Tensions Rise Lsg Stars War Of Words With Abhishek Sharma Dominates Ipl 2025

May 20, 2025