Ethereum Sees $200M Investment Influx Post-Pectra (Shanghai) Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Sees $200M Investment Influx Post-Shanghai Upgrade: A Bullish Sign for the Future?

The Ethereum network is experiencing a significant surge in investment following the highly anticipated Shanghai upgrade, also known as the Pectra upgrade. Data indicates an influx of over $200 million in new capital, sparking renewed optimism within the cryptocurrency community. This significant investment follows months of anticipation and careful planning, solidifying Ethereum's position as a leading player in the decentralized finance (DeFi) space.

The Shanghai upgrade, finalized in April 2023, marked a pivotal moment for Ethereum. For the first time, it allowed users to withdraw staked Ether (ETH) from the Beacon Chain, a crucial step in unlocking liquidity and bolstering network participation. This long-awaited feature addressed a major concern among stakers, who previously faced a lock-up period for their ETH.

What Drove the $200M Investment Surge?

Several factors contributed to this substantial investment influx post-Shanghai upgrade:

- Increased Liquidity: The ability to withdraw staked ETH dramatically increased liquidity within the market. This reduced the risk associated with staking and opened up new opportunities for investors.

- Reduced Staking Risk: Prior to the upgrade, the risk of prolonged lock-up periods discouraged some potential stakers. The Shanghai upgrade effectively mitigated this risk, making staking a more appealing proposition.

- Positive Market Sentiment: The successful execution of the Shanghai upgrade boosted overall market sentiment towards Ethereum. This positive sentiment attracted both new and existing investors.

- Enhanced Network Security: The upgrade also included improvements to the network's security and scalability, further bolstering investor confidence.

The Significance for the Ethereum Ecosystem

This substantial investment injection is a powerful indicator of the continued growth and stability of the Ethereum ecosystem. It signals a renewed confidence in the long-term prospects of the network and its underlying technology. The increased liquidity and reduced risk associated with staking are likely to spur further adoption and participation within the DeFi space.

Furthermore, the influx of capital could fuel further development and innovation within the Ethereum ecosystem. This could lead to the emergence of new decentralized applications (dApps), improved user experiences, and a broader range of services built on the Ethereum blockchain.

Looking Ahead: Continued Growth or Temporary Boost?

While the $200 million investment is undoubtedly positive news, it's crucial to remain cautious. The long-term impact of the Shanghai upgrade remains to be seen. Factors such as broader market trends, regulatory developments, and technological advancements will continue to influence the price and adoption of Ethereum.

However, the successful implementation of the Shanghai upgrade, coupled with this significant investment, suggests a strong foundation for continued growth. The increased liquidity and reduced risk are likely to pave the way for broader adoption and further cement Ethereum's position as a dominant force in the blockchain space.

Keywords: Ethereum, Shanghai Upgrade, Pectra Upgrade, ETH withdrawal, Staking, DeFi, Decentralized Finance, Cryptocurrency, Blockchain, Investment, Liquidity, Market Sentiment, Network Security, Blockchain Technology.

Call to Action (Subtle): Stay tuned for further updates on the evolving Ethereum landscape and its impact on the cryptocurrency market. Follow our blog for in-depth analysis and insights.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Sees $200M Investment Influx Post-Pectra (Shanghai) Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

65 000 Airbnb Rentals Blocked In Spain Over Regulatory Issues

May 20, 2025

65 000 Airbnb Rentals Blocked In Spain Over Regulatory Issues

May 20, 2025 -

Over 65 000 Airbnb Listings Suspended In Spain Due To Regulatory Non Compliance

May 20, 2025

Over 65 000 Airbnb Listings Suspended In Spain Due To Regulatory Non Compliance

May 20, 2025 -

65 000 Holiday Rentals Blocked In Spain New Tourism Regulations Explained

May 20, 2025

65 000 Holiday Rentals Blocked In Spain New Tourism Regulations Explained

May 20, 2025 -

International Community Unites In Support Of President Bidens Cancer Fight

May 20, 2025

International Community Unites In Support Of President Bidens Cancer Fight

May 20, 2025 -

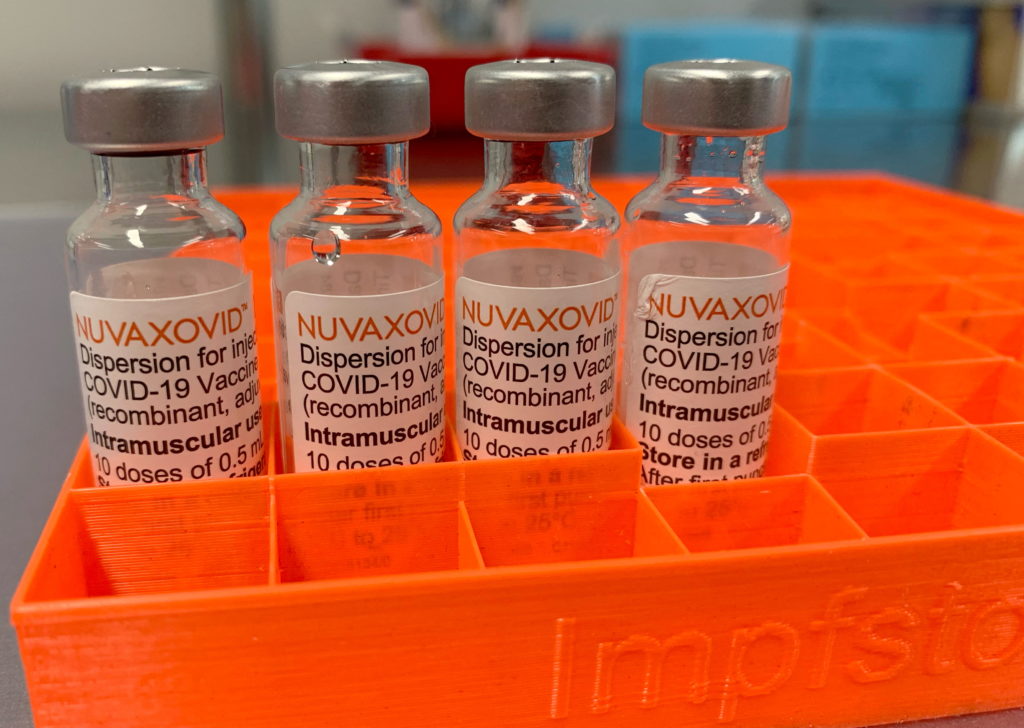

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025