Economic Impact Of Clean Energy Tax Proposals In The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Economic Ripple Effect: Analyzing Clean Energy Tax Proposals in the US

The United States stands at a crossroads, grappling with the urgent need to address climate change while simultaneously navigating complex economic considerations. Proposed clean energy tax policies are at the heart of this debate, promising a path towards a greener future but raising questions about their potential economic impact. This article delves into the multifaceted effects of these proposals, examining both the potential benefits and drawbacks.

The Promise of Green Growth: Job Creation and Innovation

Many proponents argue that investing in clean energy through tax incentives will spark significant economic growth. The Clean Energy for America Act, for example, aims to incentivize renewable energy sources like solar and wind power through tax credits and direct investment. This, they contend, will lead to:

- Job creation: A surge in demand for renewable energy technologies will necessitate a large workforce in manufacturing, installation, and maintenance. Studies by organizations like the National Renewable Energy Laboratory (NREL) consistently point towards substantial job growth in the clean energy sector.

- Technological innovation: Tax credits and research funding can fuel innovation, leading to the development of more efficient and cost-effective renewable energy technologies. This fosters competition and drives down prices, making clean energy more accessible to consumers.

- Reduced energy dependence: A shift towards domestic renewable energy sources can reduce reliance on foreign fossil fuels, enhancing national energy security and potentially lowering energy prices in the long run.

Potential Economic Challenges and Mitigation Strategies

While the potential benefits are substantial, critics raise concerns about the economic implications of transitioning away from fossil fuels:

- Job displacement in fossil fuel industries: The transition to clean energy could lead to job losses in the coal, oil, and gas sectors. However, proponents argue that targeted retraining programs and investments in new industries can mitigate this impact, ensuring a just transition for affected workers.

- Increased energy costs in the short-term: Some argue that the initial investment in renewable energy infrastructure may lead to higher energy costs for consumers. However, long-term cost savings from reduced reliance on volatile fossil fuel markets and decreased environmental damage could offset these initial increases.

- Regional economic disparities: The economic benefits of clean energy development might not be evenly distributed across all regions of the US, potentially exacerbating existing economic inequalities. Strategic investment in infrastructure and workforce development in underserved communities is crucial to address this issue.

Analyzing Specific Tax Proposals: A Closer Look

Several key tax proposals are currently under consideration, each with its own unique economic implications. For instance, extensions of the Investment Tax Credit (ITC) for solar and wind energy are crucial for maintaining the momentum of the renewable energy sector. Similarly, tax credits for carbon capture and storage technologies are debated for their potential to decarbonize hard-to-abate industries. A thorough cost-benefit analysis of each proposal is essential to understand its potential impact on the economy.

Conclusion: A Balanced Approach to a Sustainable Future

The economic impact of clean energy tax proposals in the US is a complex issue with no easy answers. While transitioning to a clean energy economy presents both challenges and opportunities, a well-designed policy framework that incorporates job retraining initiatives, targeted investments in underserved communities, and a phased approach to decarbonization can maximize the benefits while minimizing the potential downsides. Further research and open public discourse are crucial to navigating this complex transition and ensuring a sustainable and prosperous future for all Americans. Stay informed on the latest developments in clean energy policy and advocate for responsible and equitable solutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Impact Of Clean Energy Tax Proposals In The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ubisoft Milan Recruiting For Major Rayman Project

May 21, 2025

Ubisoft Milan Recruiting For Major Rayman Project

May 21, 2025 -

No Animal Killing In Assassins Creed Mirage Ubisofts Explanation

May 21, 2025

No Animal Killing In Assassins Creed Mirage Ubisofts Explanation

May 21, 2025 -

Santa Rosa Church Vandalism Arrests Made In Urination And Defecation Case

May 21, 2025

Santa Rosa Church Vandalism Arrests Made In Urination And Defecation Case

May 21, 2025 -

Ellen De Generes Poignant Message Remembering A Cherished Family Member

May 21, 2025

Ellen De Generes Poignant Message Remembering A Cherished Family Member

May 21, 2025 -

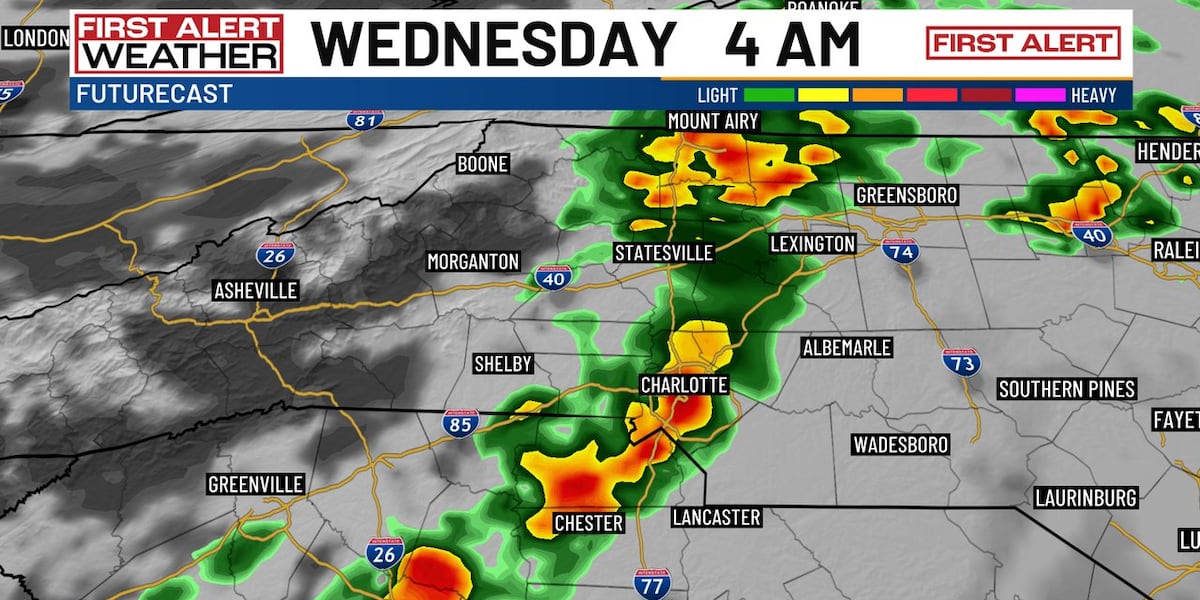

Charlotte Forecast Prepare For Overnight Storms And A Significant Temperature Drop

May 21, 2025

Charlotte Forecast Prepare For Overnight Storms And A Significant Temperature Drop

May 21, 2025