Institutional Investors Fuel Bitcoin ETF Growth: A $5B+ Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Fuel Bitcoin ETF Growth: A $5 Billion+ Market Analysis

The race is on: The burgeoning Bitcoin ETF market is experiencing explosive growth, fueled by a significant influx of institutional investment. With assets under management (AUM) now exceeding $5 billion, this burgeoning sector is poised for even greater expansion, attracting both seasoned investors and newcomers alike. This in-depth analysis explores the key drivers behind this phenomenal growth and examines the future trajectory of Bitcoin exchange-traded funds (ETFs).

The Institutional Surge: A Paradigm Shift

For years, institutional investment in Bitcoin was largely limited to direct holdings or through less regulated channels. However, the approval of the first Bitcoin futures ETF in 2021 marked a pivotal moment. This opened the door for a more accessible and regulated entry point for institutional investors, who were previously hesitant due to regulatory uncertainty and operational complexities.

The subsequent approvals of spot Bitcoin ETFs in various jurisdictions have further accelerated this trend. This accessibility, coupled with the growing acceptance of Bitcoin as a legitimate asset class, has led to a significant influx of capital from pension funds, hedge funds, and other major financial institutions. This represents a significant shift in the perception of Bitcoin, transitioning from a niche asset to a mainstream investment option within diversified portfolios.

Market Size and Growth Projections:

The current AUM of over $5 billion is a testament to the growing confidence in Bitcoin ETFs. However, this is only the beginning. Industry analysts predict substantial growth in the coming years. Factors contributing to this projection include:

- Increased Regulatory Clarity: As more jurisdictions provide clearer regulatory frameworks for crypto assets, institutional investors will feel more comfortable allocating capital to Bitcoin ETFs.

- Growing Institutional Demand: The demand for exposure to Bitcoin within institutional portfolios continues to increase, driving further investment in ETFs.

- Product Innovation: The development of innovative Bitcoin ETF products, such as leveraged or inverse ETFs, could further expand the market.

Challenges and Considerations:

Despite the impressive growth, several challenges remain:

- Regulatory Uncertainty: The regulatory landscape for crypto assets remains volatile, creating uncertainty for investors. Changes in regulations could impact the performance and liquidity of Bitcoin ETFs.

- Market Volatility: Bitcoin's inherent price volatility poses a risk to investors, though diversification within a broader portfolio can mitigate this.

- Competition: The increasing number of Bitcoin ETFs competing for market share could impact individual fund performance.

Investing in Bitcoin ETFs: A Strategic Approach

Investing in Bitcoin ETFs offers several advantages for institutional investors:

- Regulatory Compliance: Investing through regulated ETFs simplifies compliance requirements.

- Diversification: Bitcoin ETFs allow for efficient diversification within broader portfolios.

- Liquidity: ETFs generally offer higher liquidity than direct Bitcoin holdings.

However, potential investors should carefully consider the risks associated with Bitcoin's price volatility and regulatory uncertainty. Conduct thorough due diligence, including reviewing fund prospectuses and understanding the underlying investment strategy, before making any investment decisions.

Conclusion: The Future is Bright (But Uncertain)

The rapid growth of the Bitcoin ETF market demonstrates the growing mainstream acceptance of Bitcoin as a legitimate asset class. The influx of institutional capital signals a significant shift in the industry, with further growth projected in the years to come. While challenges remain, particularly regarding regulatory uncertainty and market volatility, the long-term prospects for Bitcoin ETFs appear positive. This makes it a sector worth watching closely for investors and industry observers alike. For further insights into the cryptocurrency market, explore resources like [link to a reputable financial news source] and [link to a reputable crypto analysis website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Fuel Bitcoin ETF Growth: A $5B+ Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

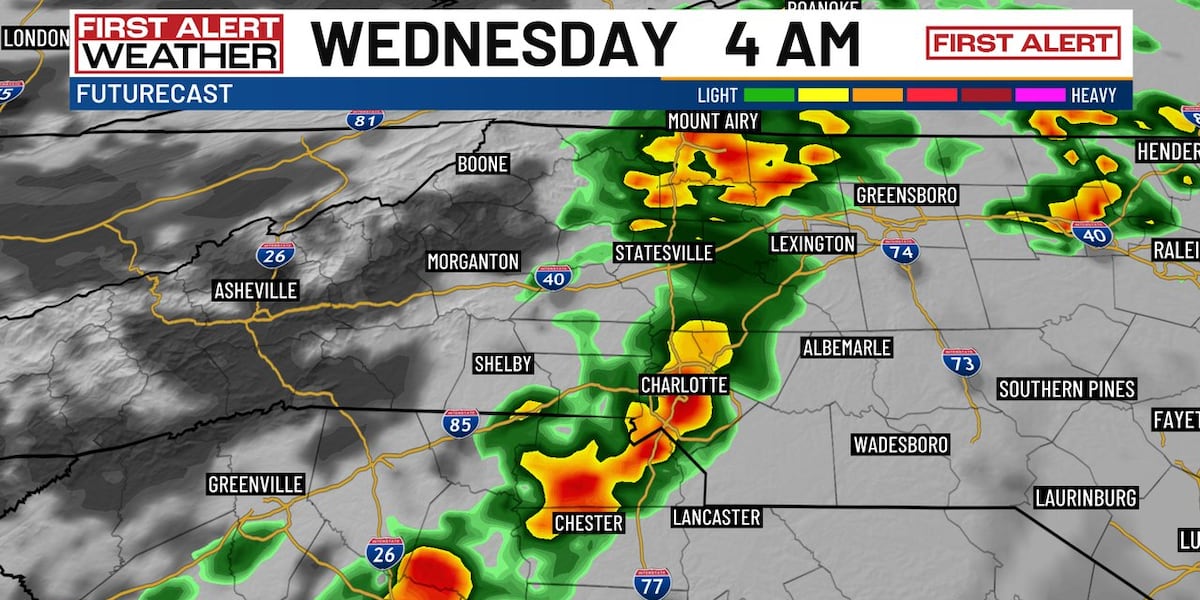

Get Ready Charlotte Overnight Storms And A Cold Front On The Way

May 21, 2025

Get Ready Charlotte Overnight Storms And A Cold Front On The Way

May 21, 2025 -

Ubisoft Milan Expands Hiring Spree For Upcoming Rayman Title

May 21, 2025

Ubisoft Milan Expands Hiring Spree For Upcoming Rayman Title

May 21, 2025 -

Fans Celebrate Ellen De Generes Social Media Reappearance After Recent Loss

May 21, 2025

Fans Celebrate Ellen De Generes Social Media Reappearance After Recent Loss

May 21, 2025 -

Improving Tourist Conduct In Bali A Call For International Assistance

May 21, 2025

Improving Tourist Conduct In Bali A Call For International Assistance

May 21, 2025 -

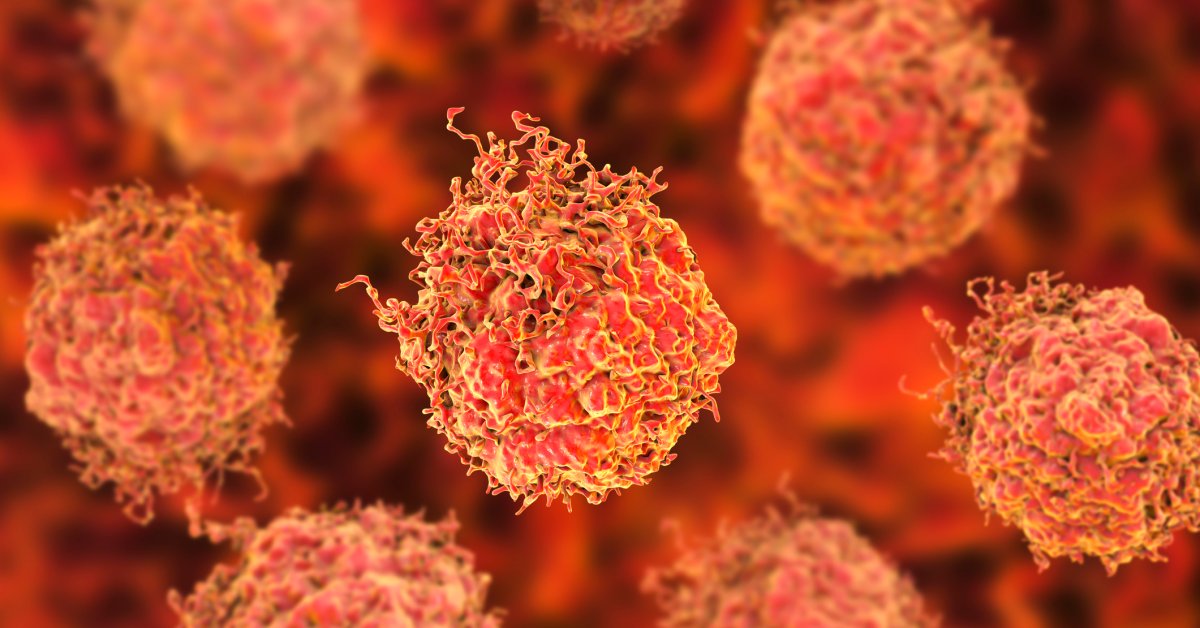

President Bidens Prostate Cancer What A Gleason Score Of 9 Indicates

May 21, 2025

President Bidens Prostate Cancer What A Gleason Score Of 9 Indicates

May 21, 2025