Economic Fallout Or Green Revolution? Analyzing The Clean Energy Tax Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Fallout or Green Revolution? Analyzing the Clean Energy Tax Plan

The recently proposed Clean Energy Tax Plan is sparking intense debate, pitting claims of economic revitalization against fears of significant financial repercussions. Will this ambitious initiative usher in a green revolution, or will it trigger an economic downturn? Let's delve into the details and analyze the potential impacts.

The plan, championed by [mention proponent/political party/organization], aims to accelerate the transition to clean energy through a series of tax incentives and credits. This includes substantial tax breaks for renewable energy projects like solar, wind, and geothermal, as well as investments in energy efficiency upgrades for homes and businesses. Proponents argue this will create jobs, stimulate innovation, and ultimately reduce reliance on fossil fuels.

Key Incentives Included in the Plan:

- Production Tax Credits for Renewable Energy: Significant tax credits are offered for the production of renewable energy, aiming to make clean energy sources more competitive with fossil fuels. This could drastically lower the cost of solar and wind power, driving wider adoption.

- Investment Tax Credits for Energy Efficiency: Tax credits are also proposed for businesses and homeowners who invest in energy efficiency improvements, such as installing energy-efficient windows or upgrading insulation. This incentivizes energy conservation and reduces overall energy consumption.

- Tax Breaks for Electric Vehicles (EVs): The plan likely includes provisions to further incentivize the purchase of electric vehicles, potentially through extended tax credits or rebates. This aims to boost EV adoption and reduce carbon emissions from the transportation sector.

Arguments for Economic Revitalization:

Supporters highlight the potential for job creation in the renewable energy sector. Manufacturing solar panels, wind turbines, and other clean energy technologies requires a skilled workforce, leading to new employment opportunities across various industries. Furthermore, investments in energy efficiency could lead to cost savings for consumers and businesses in the long run. The transition to a green economy, they argue, is not only environmentally beneficial but also economically advantageous. This could lead to the growth of entirely new sectors and industries surrounding green technologies.

Concerns Regarding Economic Fallout:

Critics express concerns about the potential economic costs associated with the plan. The significant tax breaks could lead to a substantial increase in the national debt, impacting long-term fiscal stability. There are also concerns about the potential for job losses in the fossil fuel industry, as the transition to clean energy could displace workers in traditional energy sectors. The economic impact of this job displacement warrants careful consideration and planning for worker retraining and transition programs. Furthermore, some argue that the tax incentives may disproportionately benefit large corporations, exacerbating existing inequalities.

Addressing the Opposition:

The success of this plan hinges on effectively addressing the concerns raised by its critics. This requires a comprehensive strategy that includes:

- Targeted Support for Displaced Workers: Investing in retraining and job placement programs for workers in the fossil fuel industry is crucial to mitigate potential job losses.

- Transparency and Accountability: Ensuring transparency in the allocation of tax incentives and robust mechanisms for accountability are essential to prevent abuse and ensure equitable distribution of benefits.

- Phased Implementation: A phased rollout of the plan, allowing for gradual adjustments based on economic impact assessments, could help minimize disruption and maximize effectiveness.

Conclusion:

The Clean Energy Tax Plan presents a complex challenge, balancing ambitious environmental goals with potential economic consequences. While it holds the promise of a green revolution and economic revitalization through job creation and technological innovation, addressing concerns about fiscal impact and potential job displacement is paramount. A carefully planned, transparent, and phased implementation is crucial to maximizing its benefits while mitigating potential risks. Only time will tell if this plan will truly deliver on its promise of a sustainable and prosperous future. Further research and ongoing analysis are necessary to fully assess its long-term effects. What are your thoughts? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Fallout Or Green Revolution? Analyzing The Clean Energy Tax Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigacao Da Operacao Cnn Comparacao Entre Alvalade E Alcochete

May 18, 2025

Investigacao Da Operacao Cnn Comparacao Entre Alvalade E Alcochete

May 18, 2025 -

Breanna Stewart Shares Thoughts On Sue Birds Retirement And New Role

May 18, 2025

Breanna Stewart Shares Thoughts On Sue Birds Retirement And New Role

May 18, 2025 -

Is It Allowed Rules And Regulations On Cleaning A Muddy Ball

May 18, 2025

Is It Allowed Rules And Regulations On Cleaning A Muddy Ball

May 18, 2025 -

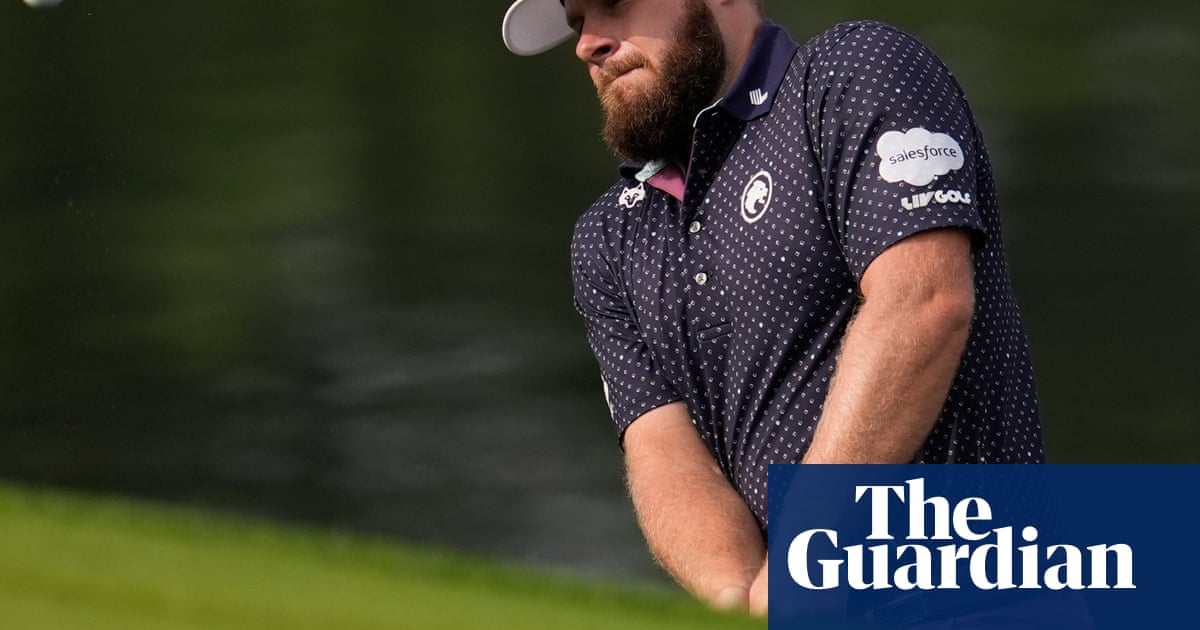

Tyrrell Hattons Outburst At Us Pga Potential Fine And Vegass Strong Lead

May 18, 2025

Tyrrell Hattons Outburst At Us Pga Potential Fine And Vegass Strong Lead

May 18, 2025 -

Climate Changes Devastating Effect On Healthy Pregnancies Understanding The Risks

May 18, 2025

Climate Changes Devastating Effect On Healthy Pregnancies Understanding The Risks

May 18, 2025