How Clean Energy Tax Policy Will Reshape The American Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

How Clean Energy Tax Policy Will Reshape the American Economy

The American economy stands on the cusp of a significant transformation, driven by ambitious clean energy tax policies designed to combat climate change and foster economic growth. These policies, enshrined in legislation like the Inflation Reduction Act (IRA), represent a monumental shift away from fossil fuels and towards a sustainable future, impacting everything from job creation to international competitiveness. But how exactly will these changes reshape the American landscape?

The IRA's Impact: A Multi-Trillion Dollar Investment in Clean Energy

The IRA allocates hundreds of billions of dollars in tax credits and incentives to accelerate the adoption of renewable energy sources. This massive investment isn't just about environmental protection; it's a strategic economic play with far-reaching consequences. The Act offers substantial tax credits for:

- Solar and wind energy: Incentivizing the construction of new renewable energy facilities, creating thousands of jobs in manufacturing, installation, and maintenance.

- Electric vehicles (EVs): Boosting EV sales through tax credits, stimulating demand and driving innovation in battery technology and charging infrastructure. This, in turn, will support the growth of the automotive sector and related industries.

- Energy efficiency upgrades: Providing incentives for homeowners and businesses to improve energy efficiency, reducing energy consumption and lowering utility bills. This spurs investment in insulation, smart home technology, and energy-efficient appliances.

- Carbon capture and storage: Funding research and development into technologies that capture carbon dioxide emissions from power plants and industrial facilities, mitigating the environmental impact of existing infrastructure.

Job Creation and Economic Growth: A Green Revolution

The transition to a clean energy economy is expected to create millions of high-paying jobs across diverse sectors. From manufacturing solar panels and wind turbines to developing advanced battery technologies and installing smart grids, the opportunities are vast. These jobs aren't concentrated in a few specific locations; they are spread across the country, potentially revitalizing rural communities and reducing economic inequality. A report by the Brookings Institution estimates that the IRA could create as many as 1.5 million new jobs by 2030. [Link to Brookings Institution report].

Challenges and Considerations: A Smooth Transition

While the potential benefits are substantial, the transition to a clean energy economy also presents challenges. These include:

- Supply chain vulnerabilities: The reliance on critical minerals and materials for renewable energy technologies necessitates strengthening domestic supply chains to avoid dependence on foreign sources.

- Infrastructure development: Expanding the electric grid and building out charging infrastructure for EVs will require significant investment and careful planning.

- Equity and accessibility: Ensuring that the benefits of clean energy policies are distributed equitably across all communities is crucial to avoid exacerbating existing inequalities.

International Competitiveness: Leading the Global Green Race

The US is positioning itself as a global leader in clean energy technology and innovation through these policies. This could attract significant foreign investment and create new export opportunities, boosting the American economy on a global scale. However, maintaining this competitive edge will require continued investment in research and development, as well as addressing the challenges mentioned above.

Conclusion: A Future Powered by Clean Energy and Economic Growth

The clean energy tax policies enacted in the US represent a bold and ambitious plan to reshape the American economy. While challenges exist, the potential for job creation, economic growth, and environmental protection is immense. The success of this transition hinges on effective implementation, strategic planning, and a commitment to addressing the inequalities that could arise. The coming years will be crucial in determining how successfully the US navigates this transformative period and solidifies its position as a global leader in the clean energy revolution. Staying informed about these developments is key for businesses, investors, and individuals alike. Learn more about the specifics of the IRA and its implications [Link to relevant government website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on How Clean Energy Tax Policy Will Reshape The American Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

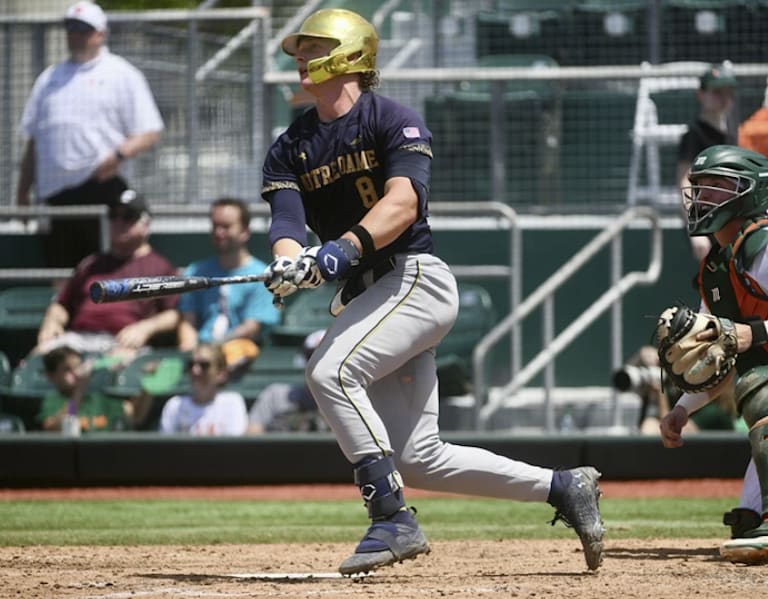

Notre Dame Baseballs Series Win Against Miami A Look At Tinneys Impact

May 18, 2025

Notre Dame Baseballs Series Win Against Miami A Look At Tinneys Impact

May 18, 2025 -

Rahm Eyes Pga Victory Making Music At Oak Hill Country Club

May 18, 2025

Rahm Eyes Pga Victory Making Music At Oak Hill Country Club

May 18, 2025 -

No 5 Syracuse Faces Quarterfinal Challenge On Long Island

May 18, 2025

No 5 Syracuse Faces Quarterfinal Challenge On Long Island

May 18, 2025 -

Baltimore Orioles O Neill Out 10 Day Il Stint Explained

May 18, 2025

Baltimore Orioles O Neill Out 10 Day Il Stint Explained

May 18, 2025 -

Review Of The Pga Championship Key Moments In Aptopix

May 18, 2025

Review Of The Pga Championship Key Moments In Aptopix

May 18, 2025