Economic Calendar: Tracking Asia's Markets On Monday, June 2, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Calendar: Asia's Markets on Monday, June 2nd, 2025 - Key Events and Their Impact

Monday, June 2nd, 2025, promises a busy start to the week for Asian markets, with several key economic indicators and events likely to shape the region's financial landscape. Traders and investors will be closely watching for data releases and announcements that could signal shifts in growth trajectories and policy decisions. This article provides a comprehensive overview of the key economic events impacting Asian markets on this date and explores their potential implications.

Key Economic Events and Data Releases:

This section will be updated as more information becomes available closer to the date. However, based on typical release schedules, we anticipate the following to be significant:

-

Chinese Manufacturing PMI (Preliminary): The preliminary Purchasing Managers' Index (PMI) for China's manufacturing sector is a crucial indicator of the country's economic health. A strong reading suggests robust factory activity and overall economic growth, while a weaker reading could signal slowing momentum and potentially impact global supply chains. This data point is usually highly influential on regional and global markets. [Link to relevant source - e.g., National Bureau of Statistics of China website]

-

Japanese Unemployment Rate: The unemployment rate for Japan provides insights into the health of its labor market. Changes in this figure can indicate shifts in consumer spending and overall economic confidence. A rising unemployment rate could signal a weakening economy, while a decline suggests positive momentum. [Link to relevant source - e.g., Statistics Bureau of Japan website]

-

South Korean Inflation Rate: South Korea's inflation rate is a key indicator of price stability and consumer spending. This data point is closely watched by the Bank of Korea, which uses it to inform monetary policy decisions. High inflation could lead to interest rate hikes, while low inflation might encourage more accommodative policies. [Link to relevant source - e.g., Bank of Korea website]

-

Potential Central Bank Announcements: Keep an eye out for any unscheduled announcements from major Asian central banks, such as the People's Bank of China or the Bank of Japan. Such announcements can significantly impact market sentiment and currency values.

Impact on Markets:

The interplay of these various data points will significantly influence market behavior. A positive confluence of economic indicators – strong PMI readings, low unemployment, and stable inflation – could lead to a positive opening for Asian stock markets and strengthen regional currencies. Conversely, negative data could trigger sell-offs and currency depreciation.

Strategies for Investors:

Investors should carefully consider the potential impacts of these economic events on their portfolios. Diversification across different asset classes and geographical regions is crucial to mitigate risk. Staying informed through reputable financial news sources and consulting with financial advisors is highly recommended.

Staying Updated:

The economic landscape is constantly evolving. For the most up-to-date information on market movements and economic data releases on June 2nd, 2025, and beyond, it's crucial to consult reliable sources like financial news websites and reputable economic data providers.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in financial markets involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Calendar: Tracking Asia's Markets On Monday, June 2, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

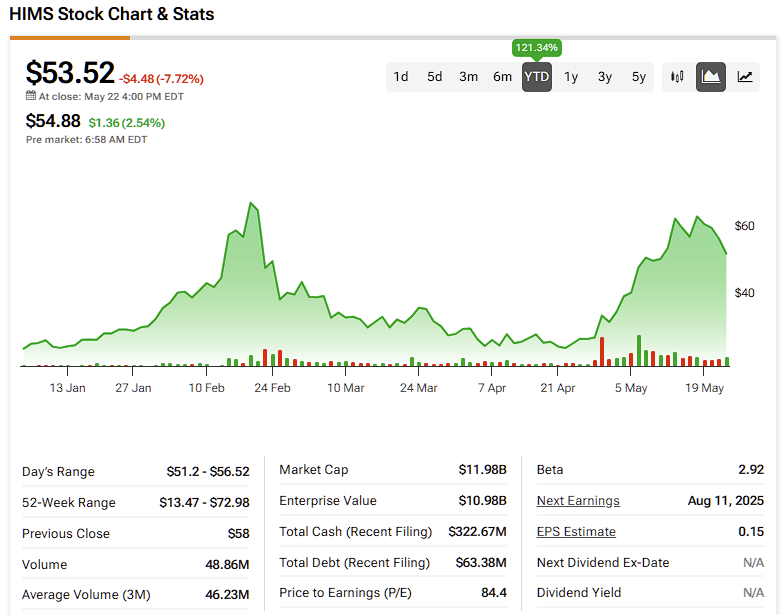

Is Hims And Hers Hims Stock A Buy Or A Sell A Detailed Analysis

Jun 03, 2025

Is Hims And Hers Hims Stock A Buy Or A Sell A Detailed Analysis

Jun 03, 2025 -

Hims And Hers Health Inc Hims Stock Up 3 02 May 30

Jun 03, 2025

Hims And Hers Health Inc Hims Stock Up 3 02 May 30

Jun 03, 2025 -

The Wire Star Speaks Out After Sons 300 Foot Toss In Tornado

Jun 03, 2025

The Wire Star Speaks Out After Sons 300 Foot Toss In Tornado

Jun 03, 2025 -

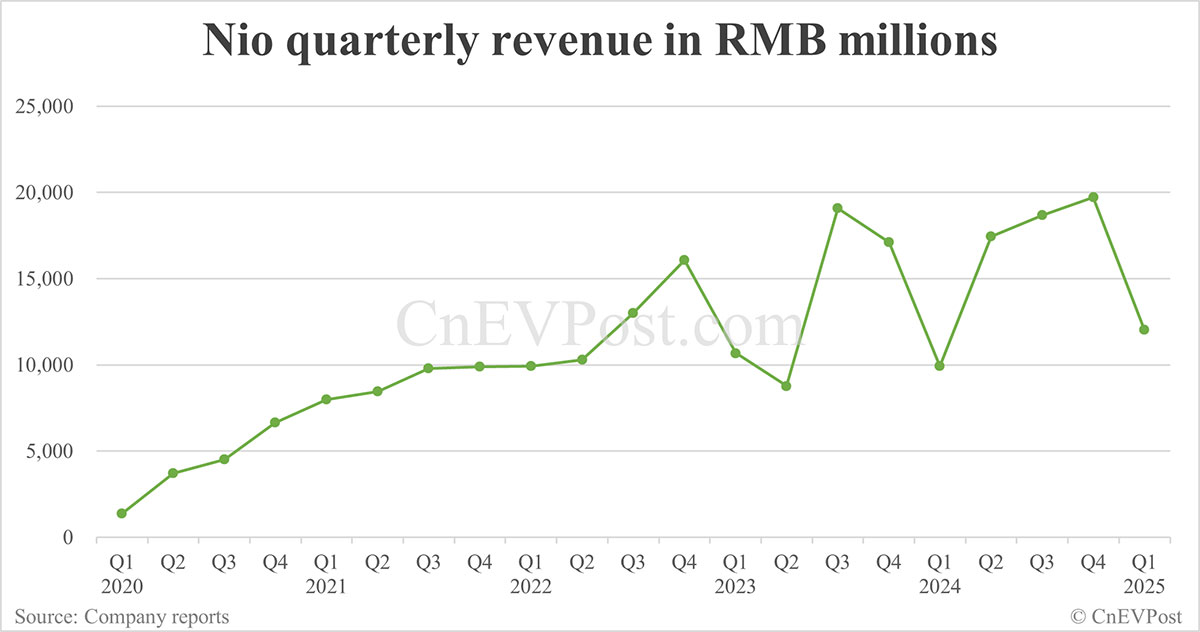

Nio Revenue Surges 21 Year Over Year In First Quarter 2024

Jun 03, 2025

Nio Revenue Surges 21 Year Over Year In First Quarter 2024

Jun 03, 2025 -

Can Nio Overcome Tariff Headwinds Q1 2024 Earnings Preview

Jun 03, 2025

Can Nio Overcome Tariff Headwinds Q1 2024 Earnings Preview

Jun 03, 2025