Is Hims & Hers (HIMS) Stock A Buy Or A Sell? A Detailed Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Buy or a Sell? A Detailed Analysis

Hims & Hers Health, Inc. (HIMS), the telehealth company disrupting the men's and women's health market, has seen its stock price fluctuate significantly since its IPO. For prospective investors, the question remains: is HIMS stock a buy or a sell? This detailed analysis explores the company's performance, market position, and future prospects to help you make an informed decision.

Hims & Hers: A Disruptive Force in Telehealth

Hims & Hers offers convenient and affordable access to healthcare services, primarily focusing on dermatology, sexual health, and mental wellness. Their direct-to-consumer model, utilizing a subscription-based platform, bypasses traditional healthcare barriers, appealing to a tech-savvy demographic. This approach has fueled significant growth, but challenges remain.

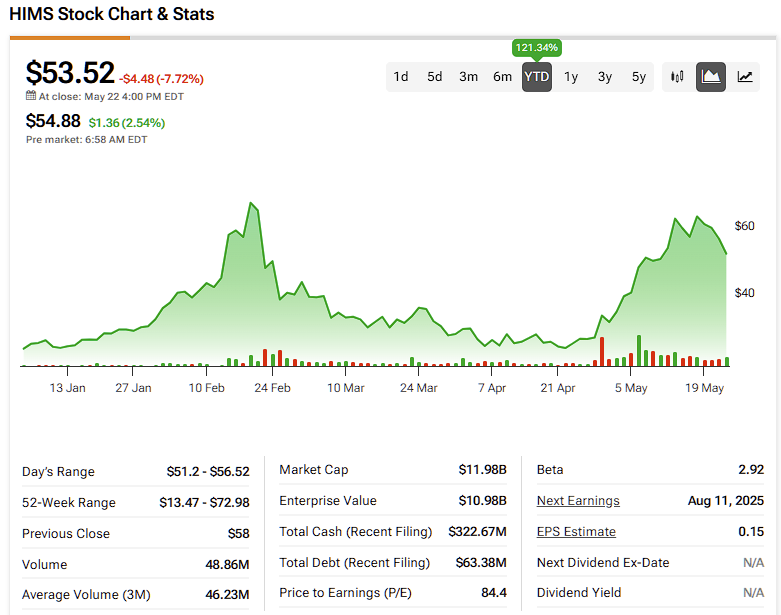

Analyzing HIMS Stock Performance:

The company's stock performance has been a rollercoaster ride. While initial enthusiasm surrounding its IPO led to price increases, subsequent market corrections and shifts in investor sentiment have resulted in volatility. Analyzing recent financial reports is crucial for understanding the current state of the company. Key factors to consider include:

- Revenue Growth: Examining the trajectory of HIMS' revenue growth is paramount. Sustained, strong revenue growth indicates a healthy and expanding market share. Look for trends and year-over-year comparisons to gauge the company's performance.

- Profitability: Is HIMS profitable, or is it still operating at a loss? Profitability is a key indicator of long-term sustainability. Investors need to analyze profit margins and operating expenses to assess the company's financial health.

- Customer Acquisition Costs (CAC): The cost of acquiring new customers is a critical metric for subscription-based businesses. High CAC can hinder profitability. Examining this metric provides insights into the efficiency of HIMS' marketing and sales strategies.

- Debt Levels: High debt levels can pose significant financial risks. Assessing the company's debt-to-equity ratio provides a crucial understanding of its financial stability.

Market Position and Competition:

HIMS operates in a rapidly expanding telehealth market, but faces fierce competition from established players and emerging startups. Analyzing the competitive landscape is vital. Consider:

- Market Share: How does HIMS' market share compare to its competitors? A dominant market share suggests a strong competitive advantage.

- Competitive Advantages: Does HIMS possess any unique advantages, such as a superior technology platform or a strong brand reputation? Identifying these advantages helps assess its long-term viability.

- Future Growth Potential: The telehealth market is expected to grow significantly in the coming years. HIMS' ability to capitalize on this growth is a critical factor in its long-term success.

Risks and Challenges:

Investing in HIMS stock involves several risks, including:

- Regulatory Changes: The healthcare industry is subject to frequent regulatory changes, which can significantly impact HIMS' operations.

- Competition: Intense competition from established players and new entrants can erode HIMS' market share.

- Dependence on Technology: HIMS' business model relies heavily on technology. Technical glitches or cybersecurity breaches can disrupt its operations and damage its reputation.

Should You Buy or Sell HIMS Stock?

Ultimately, the decision of whether to buy or sell HIMS stock depends on your individual risk tolerance, investment goals, and a thorough analysis of the factors outlined above. Considering the company's growth potential, competitive landscape, and inherent risks is crucial. Consulting with a financial advisor before making any investment decisions is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Buy Or A Sell? A Detailed Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anger Mounts As Rep Khanna And Labor Unions Fight Federal Layoffs

Jun 03, 2025

Anger Mounts As Rep Khanna And Labor Unions Fight Federal Layoffs

Jun 03, 2025 -

Miley Cyruss Honest Take How Adulthood Altered Her Parent Child Dynamic

Jun 03, 2025

Miley Cyruss Honest Take How Adulthood Altered Her Parent Child Dynamic

Jun 03, 2025 -

2 C Climate Scenario Strategic Planning For Businesses Today

Jun 03, 2025

2 C Climate Scenario Strategic Planning For Businesses Today

Jun 03, 2025 -

Anger Over Dte Energy Price Increases Residents Take To The Streets In Protest

Jun 03, 2025

Anger Over Dte Energy Price Increases Residents Take To The Streets In Protest

Jun 03, 2025 -

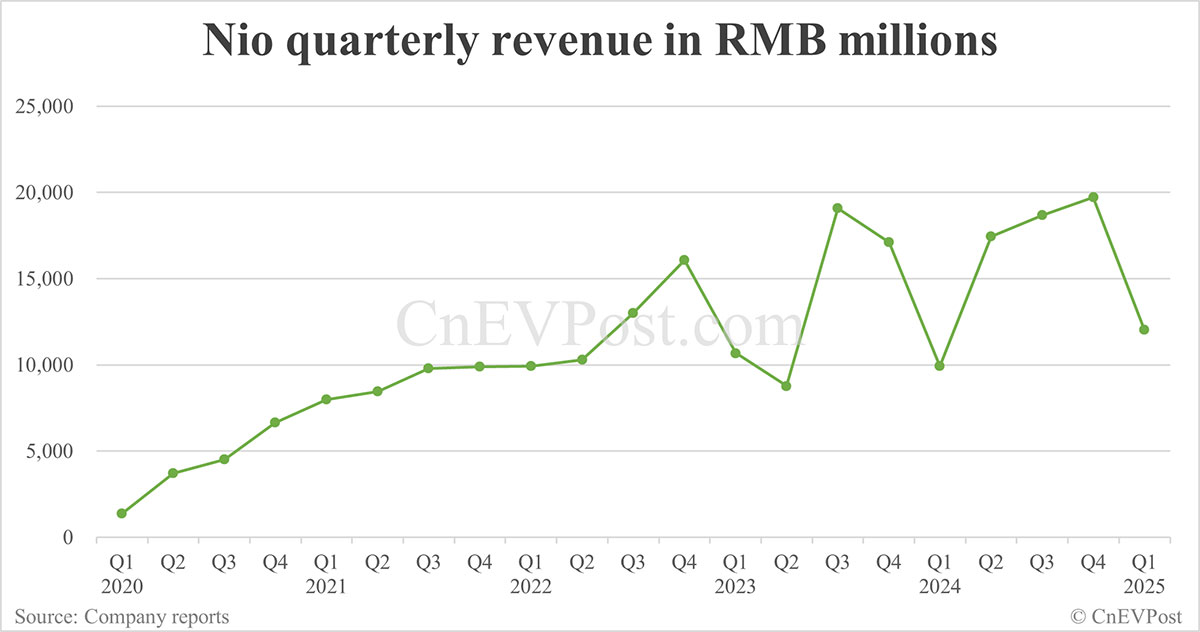

Nios Q1 2024 Financial Results A 21 Year On Year Revenue Increase

Jun 03, 2025

Nios Q1 2024 Financial Results A 21 Year On Year Revenue Increase

Jun 03, 2025