Economic Calendar: Tracking Asia's Markets On June 2nd, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Calendar: Navigating Asia's Markets on June 2nd, 2025

Introduction:

Asia's dynamic markets are constantly evolving, making it crucial for investors to stay informed. June 2nd, 2025, promises a flurry of economic data releases that will significantly impact trading decisions across the continent. This article serves as your essential guide, highlighting key economic indicators and events to watch, helping you navigate the complexities of Asian markets. Understanding these releases is key to making informed investment choices and mitigating potential risks.

Key Economic Releases to Watch on June 2nd, 2025 (Hypothetical):

While the specific releases for June 2nd, 2025, are not yet available (as it is a future date), we can anticipate the types of data that typically influence Asian markets. We'll use hypothetical data for illustrative purposes.

1. China's Manufacturing PMI (Purchasing Managers' Index):

This crucial indicator measures the activity in China's manufacturing sector. A reading above 50 indicates expansion, while a reading below suggests contraction. Hypothetically, let's assume a preliminary PMI reading of 51.5 is released at 08:00 GMT. This would generally be considered positive news, suggesting continued growth in the Chinese manufacturing sector, potentially boosting investor confidence. However, a significant deviation from analysts' expectations could cause market volatility.

2. Japan's Unemployment Rate:

Japan's unemployment rate is another key indicator reflecting the health of its economy. For our hypothetical example, a slight increase to 2.8% from 2.7% might be released at 23:00 GMT. This, while not necessarily alarming, could trigger some cautious reactions in the market, depending on the overall economic context. Understanding the context – are wages rising to compensate? – is vital.

3. India's Inflation Rate:

India's robust economy is constantly under scrutiny. The inflation rate provides valuable insights into price stability and consumer spending. A hypothetical release showing a slight decrease in inflation to 4.9% from 5.1% at 12:00 GMT could be viewed positively, signaling improved price stability and potentially encouraging further investment.

4. South Korea's Export Figures:

South Korea's reliance on exports makes its trade data incredibly important. A significant increase or decrease in export figures could drastically impact the Korean Won and related markets. Let's hypothetically assume an unexpected drop in exports is announced, leading to short-term market uncertainty.

Understanding the Impact:

The release of these economic indicators can trigger significant market fluctuations. Understanding the nuances of each indicator and its potential impact is crucial for investors. For instance, a higher-than-expected inflation rate could lead to increased interest rates, potentially impacting bond yields and stock valuations. Conversely, positive manufacturing PMI data could boost investor sentiment and lead to market gains.

How to Stay Informed:

Staying updated on real-time economic data is critical. Utilize reputable financial news sources like [link to a reputable financial news source] and [link to another reputable financial news source]. Consider subscribing to economic calendars provided by financial institutions or using dedicated financial data platforms.

Conclusion:

Navigating Asia's complex markets requires diligent monitoring of economic data releases. While the specifics for June 2nd, 2025, are yet to be determined, understanding the types of data released and their potential market impact is essential for informed decision-making. Remember to stay informed, analyze the data within its context, and consult with financial professionals before making significant investment decisions. Stay tuned for updates as we approach June 2nd, 2025, for the actual data releases and their impact.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Calendar: Tracking Asia's Markets On June 2nd, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anger Mounts As Dte Energy Rate Increases Burden Michigan Residents

Jun 03, 2025

Anger Mounts As Dte Energy Rate Increases Burden Michigan Residents

Jun 03, 2025 -

Market Closure Notice China And New Zealand Closed For Holiday June 2 2025

Jun 03, 2025

Market Closure Notice China And New Zealand Closed For Holiday June 2 2025

Jun 03, 2025 -

The 78 Development Home To Chicago Fires Planned 650 Million Stadium

Jun 03, 2025

The 78 Development Home To Chicago Fires Planned 650 Million Stadium

Jun 03, 2025 -

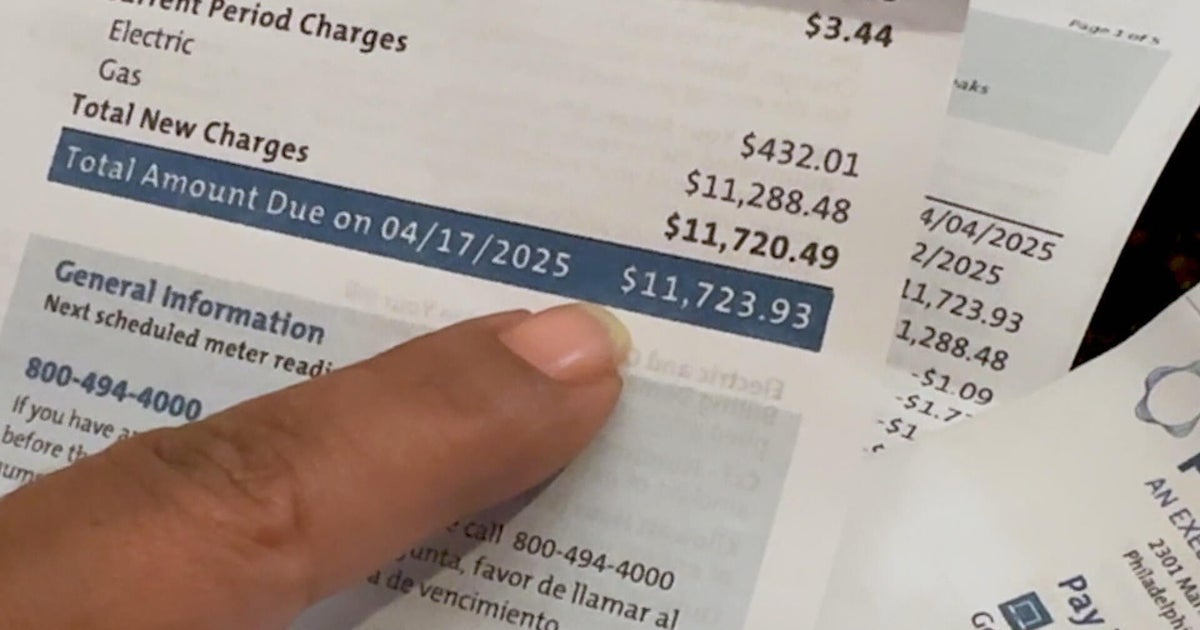

12 000 Peco Energy Bill Stuns Customer Are Others Facing Similar Issues

Jun 03, 2025

12 000 Peco Energy Bill Stuns Customer Are Others Facing Similar Issues

Jun 03, 2025 -

Is Hims And Hers Hims Stock A Risky Investment A Closer Look

Jun 03, 2025

Is Hims And Hers Hims Stock A Risky Investment A Closer Look

Jun 03, 2025