Is Hims & Hers (HIMS) Stock A Risky Investment? A Closer Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Hims & Hers (HIMS) Stock a Risky Investment? A Closer Look

Hims & Hers Health (HIMS), the telehealth company disrupting the healthcare industry with its convenient approach to men's and women's health, has attracted significant attention from investors. But is HIMS stock a wise investment, or is it a gamble too risky for your portfolio? This in-depth analysis will explore the potential upsides and downsides, helping you make an informed decision.

The Allure of Hims & Hers:

Hims & Hers' business model is undeniably appealing. Their direct-to-consumer telehealth platform offers a seamless experience for obtaining medications and treatments for a range of conditions, from hair loss and skincare to sexual health and mental wellness. This convenience, coupled with a strong digital marketing strategy, has fueled impressive user growth. This convenience factor is a key driver of their success, especially amongst younger demographics who are increasingly comfortable with online healthcare solutions.

Reasons for Optimism:

- Expanding Market: The telehealth market is booming, presenting a massive opportunity for growth. As more people embrace remote healthcare options, Hims & Hers is well-positioned to capitalize on this trend. [Link to a relevant market research report].

- Diversified Product Offering: The company's diverse range of products and services reduces reliance on any single offering, mitigating risk. Their expansion beyond hair loss treatments demonstrates a commitment to long-term growth and market diversification.

- Strong Brand Recognition: Hims & Hers has built a recognizable and trusted brand, essential for attracting new customers in a competitive market. Their marketing campaigns are often clever and memorable.

Reasons for Caution:

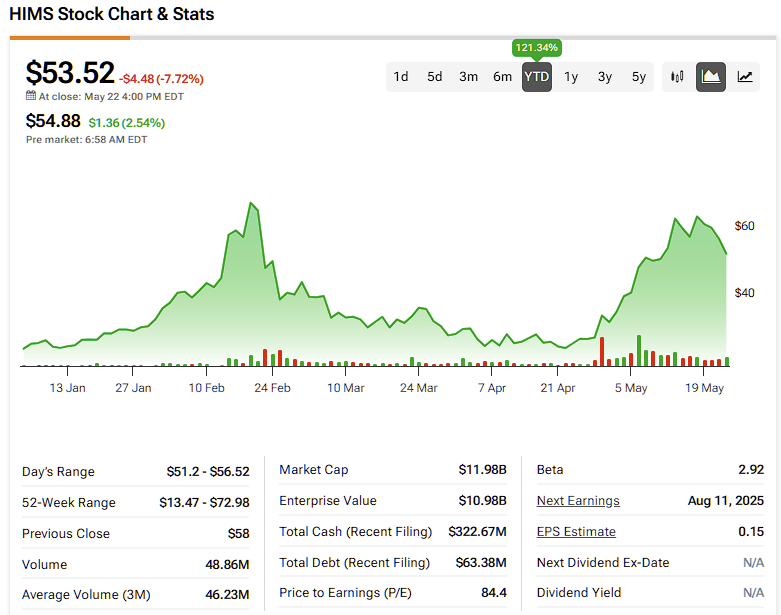

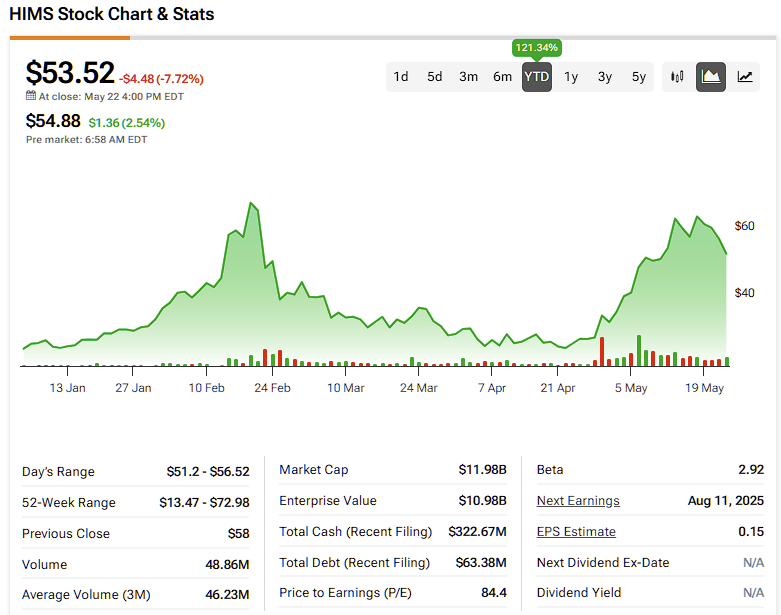

- High Valuation: HIMS stock's valuation has fluctuated significantly, leading some analysts to believe it's currently overvalued. Investors should carefully consider the price-to-earnings ratio and other key financial metrics before investing.

- Competition: The telehealth industry is increasingly competitive, with established players and new entrants vying for market share. Hims & Hers faces stiff competition from both large pharmaceutical companies and smaller telehealth startups.

- Regulatory Risks: The healthcare industry is heavily regulated, and changes in regulations could significantly impact Hims & Hers' business model. Navigating these complexities successfully is crucial for their continued success.

- Profitability Concerns: While the company has seen significant revenue growth, profitability remains a challenge. Investors should examine their financial statements closely to assess their long-term financial viability.

H2: Is it Right for You?

Ultimately, whether HIMS stock is a risky investment depends on your individual risk tolerance and investment goals. It's crucial to conduct thorough due diligence before making any investment decisions. This includes:

- Reviewing financial statements: Analyze revenue growth, profitability, and debt levels.

- Understanding the competitive landscape: Assess the strengths and weaknesses of competitors.

- Considering regulatory risks: Evaluate potential impacts of changes in healthcare regulations.

- Diversifying your portfolio: Don't put all your eggs in one basket. HIMS should be a part of a well-diversified investment strategy.

H3: The Bottom Line:

Hims & Hers presents an intriguing investment opportunity, riding the wave of the burgeoning telehealth market. However, its high valuation and the competitive landscape introduce significant risks. Investors should carefully weigh these factors against their personal risk appetite and investment horizon before making a decision. Consider consulting with a qualified financial advisor to help you assess the suitability of HIMS stock for your portfolio. Remember, this is not financial advice; this analysis is for informational purposes only.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Hims & Hers (HIMS) Stock A Risky Investment? A Closer Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Real Life Influences How Tech Leaders Shaped Successions Mountainhead

Jun 03, 2025

Real Life Influences How Tech Leaders Shaped Successions Mountainhead

Jun 03, 2025 -

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025 -

Doubling Down On Tariffs Trumps Rationale And The Risks Ahead

Jun 03, 2025

Doubling Down On Tariffs Trumps Rationale And The Risks Ahead

Jun 03, 2025 -

The Tech Titans Who Shaped Jesse Armstrongs Mountainhead In Succession

Jun 03, 2025

The Tech Titans Who Shaped Jesse Armstrongs Mountainhead In Succession

Jun 03, 2025 -

Breaking Murder Suspect Arrested In State Name

Jun 03, 2025

Breaking Murder Suspect Arrested In State Name

Jun 03, 2025