Despite Tariff Turmoil: Understanding The Continued Rise Of Stock Prices Under Trump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Despite Tariff Turmoil: Understanding the Continued Rise of Stock Prices Under Trump

The Trump presidency was a rollercoaster for the US economy, marked by significant trade disputes and the imposition of tariffs on various goods. Yet, despite this tariff turmoil, the stock market experienced a considerable bull run. This seemingly paradoxical situation begs the question: how did stock prices continue to rise under an administration known for its protectionist trade policies? This article delves into the factors contributing to this economic anomaly.

The Paradox of Tariffs and Stock Market Growth

The imposition of tariffs, intended to protect American industries and jobs, often leads to increased prices for consumers and potential disruptions to global supply chains. Economically, this should, in theory, negatively impact market confidence and lead to a downturn. However, under the Trump administration, this wasn't the case. Several factors contributed to this unexpected outcome:

1. Corporate Tax Cuts: The Tax Cuts and Jobs Act of 2017 significantly lowered the corporate tax rate from 35% to 21%. This substantial reduction boosted corporate profits, leading to increased shareholder returns and fueling stock market growth. Many analysts believe this was a primary driver behind the market's resilience in the face of trade tensions.

2. Deregulation Efforts: The Trump administration pursued a policy of deregulation across various sectors, aiming to reduce the regulatory burden on businesses. This, proponents argued, stimulated economic activity and increased investor confidence. While the long-term effects of deregulation are still being debated, its short-term impact was arguably positive for the stock market.

3. Monetary Policy: The Federal Reserve's monetary policy, including low interest rates and quantitative easing (QE) programs implemented before and during the Trump administration, played a significant role in supporting the economy and bolstering stock prices. This created a favorable environment for investment and borrowing, contributing to the sustained growth.

4. Positive Consumer Sentiment (Initially): At the beginning of the Trump presidency, consumer confidence was relatively high. This optimism, fueled by promises of economic growth and job creation, translated into increased spending and investment, positively impacting the stock market.

5. Market Speculation and Investor Behavior: Market sentiment and investor behavior are complex and often driven by factors beyond pure economic fundamentals. Speculation and anticipation of future policy changes, regardless of their actual impact, can influence stock prices significantly.

The Downside of Ignoring Economic Fundamentals

While the stock market thrived under Trump, it's crucial to acknowledge the potential downsides of ignoring fundamental economic principles. The tariff wars, while not immediately crippling the market, did create uncertainty and increased costs for businesses. This ultimately impacted some sectors more severely than others, highlighting the uneven distribution of economic benefits.

Conclusion: A Complex Economic Picture

The rise of stock prices under Trump, despite the tariff turmoil, was a multifaceted phenomenon. While corporate tax cuts and monetary policy played crucial roles, other factors, including deregulation and investor sentiment, also contributed to this complex economic picture. Understanding this intricate interplay is vital for analyzing the economic impact of future administrations and their policies. Further research into the long-term consequences of these policies is necessary for a complete understanding of their ultimate effects on the US and global economy.

Further Reading:

- [Link to a relevant article on corporate tax cuts and their impact on the stock market]

- [Link to a relevant article on the effects of deregulation on the economy]

- [Link to a relevant article on Federal Reserve monetary policy]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on thorough research and consultation with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Despite Tariff Turmoil: Understanding The Continued Rise Of Stock Prices Under Trump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Doge Price Chart Golden Cross Signals Potential Upswing

Aug 14, 2025

Doge Price Chart Golden Cross Signals Potential Upswing

Aug 14, 2025 -

180 Life Sciences Atnf Analyzing The Biotech Firms Unexpected Crypto Investment

Aug 14, 2025

180 Life Sciences Atnf Analyzing The Biotech Firms Unexpected Crypto Investment

Aug 14, 2025 -

Is Resident Evil 4 Remake Leon Kennedys Last Hurrah New Leak Hints

Aug 14, 2025

Is Resident Evil 4 Remake Leon Kennedys Last Hurrah New Leak Hints

Aug 14, 2025 -

K Drama Fans Rejoice Great Shows Not Available On Netflix

Aug 14, 2025

K Drama Fans Rejoice Great Shows Not Available On Netflix

Aug 14, 2025 -

League Of Legends Season 3 Halloween A Look At The Returning Game Mode

Aug 14, 2025

League Of Legends Season 3 Halloween A Look At The Returning Game Mode

Aug 14, 2025

Latest Posts

-

Brighter Lights Is This Increased Illumination Bad For Your Eyes

Aug 14, 2025

Brighter Lights Is This Increased Illumination Bad For Your Eyes

Aug 14, 2025 -

Why Are Stocks Climbing Amidst Trumps Trade Wars A Market Analysis

Aug 14, 2025

Why Are Stocks Climbing Amidst Trumps Trade Wars A Market Analysis

Aug 14, 2025 -

Ken Paxtons Legal Action O Rourke Faces Jail Over Dem Walkout Funds

Aug 14, 2025

Ken Paxtons Legal Action O Rourke Faces Jail Over Dem Walkout Funds

Aug 14, 2025 -

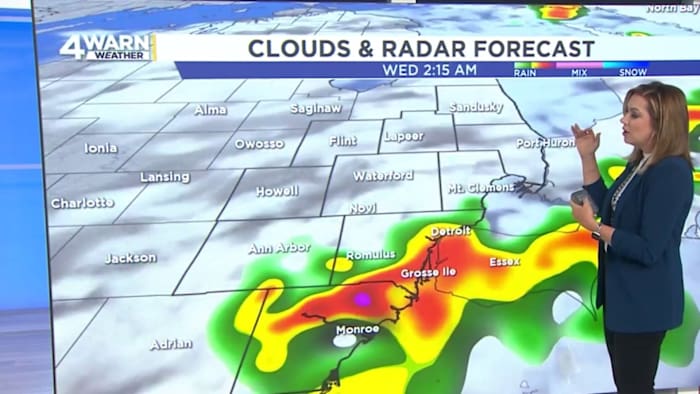

Severe Weather Outlook Southeast Michigan Thunderstorm Timing Tuesday

Aug 14, 2025

Severe Weather Outlook Southeast Michigan Thunderstorm Timing Tuesday

Aug 14, 2025 -

Stocks Rise Despite Trump Era Tariff Turmoil Understanding The Markets Resilience

Aug 14, 2025

Stocks Rise Despite Trump Era Tariff Turmoil Understanding The Markets Resilience

Aug 14, 2025