Decoding The Divergence: CNBC's Daily Open On The Latest US Jobs Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding the Divergence: CNBC's Daily Open on the Latest US Jobs Data

The US jobs market continues to be a source of intense debate, with recent data sparking conflicting interpretations. CNBC's Daily Open dove headfirst into this complexity, dissecting the latest figures and their implications for the Federal Reserve's monetary policy and the broader economy. The divergence in opinions highlights the challenges in interpreting economic indicators and underscores the uncertainty facing investors.

Headline Numbers vs. Underlying Trends:

The initial headline figures often grab the most attention, but CNBC's analysis rightly focused on delving deeper. While the headline employment numbers might seem positive at first glance, the Daily Open explored nuances such as the participation rate, wage growth, and sector-specific employment changes. These underlying trends paint a more comprehensive picture than a simple snapshot of job creation. For example, a strong headline number could be masking weaknesses in certain sectors or a stagnation in real wage growth, impacting consumer spending and overall economic health.

The Fed's Tightrope Walk:

The latest jobs data significantly influences the Federal Reserve's decision-making process regarding interest rate hikes. CNBC's analysts discussed how the seemingly positive employment numbers could strengthen the argument for continued rate increases to combat inflation. However, they also acknowledged the risks associated with aggressively raising rates, potentially triggering a recession. The delicate balancing act the Fed faces was a central theme of the Daily Open segment. Finding the sweet spot between cooling inflation and avoiding a significant economic downturn remains a monumental challenge.

Expert Opinions and Market Reactions:

CNBC's Daily Open featured prominent economists and market analysts offering their unique perspectives on the data. This diversity of opinion served to highlight the complexities inherent in interpreting economic indicators. Some analysts viewed the data as signaling continued economic strength, while others expressed concerns about potential vulnerabilities. This divergence in opinion underscores the uncertainty permeating the market, making it crucial for investors to stay informed and carefully consider the risks. The segment also tracked market reactions to the jobs report, highlighting the immediate impact on stocks, bonds, and other financial instruments.

Looking Ahead: What to Watch For:

The discussion didn't end with a definitive conclusion. Instead, CNBC's Daily Open emphasized the ongoing nature of economic analysis and the need to monitor future data releases. Key indicators to watch include:

- Inflation data: CPI and PPI figures will be crucial in assessing the effectiveness of the Fed's monetary policy.

- Consumer spending: A slowdown in consumer spending could indicate a weakening economy.

- Further employment reports: Consistency in job growth (or a lack thereof) will be a key indicator of future economic performance.

Conclusion: Navigating Economic Uncertainty:

CNBC's Daily Open provided a valuable service by dissecting the latest US jobs data beyond the headline numbers. The segment effectively highlighted the inherent complexities in interpreting economic indicators and the divergence of expert opinions. By understanding these nuances, investors and policymakers can better navigate the uncertainties facing the US economy and make more informed decisions. Stay tuned for further analysis from CNBC as the economic landscape continues to evolve. For more detailed insights into market trends and economic analysis, visit .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding The Divergence: CNBC's Daily Open On The Latest US Jobs Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unstoppable Van Gisbergen Completes Chicago Sweep

Jul 07, 2025

Unstoppable Van Gisbergen Completes Chicago Sweep

Jul 07, 2025 -

Red Dead Online Strange Tales Update Details Zombies Robots And More

Jul 07, 2025

Red Dead Online Strange Tales Update Details Zombies Robots And More

Jul 07, 2025 -

From Wife To Coach The Key To Majchrzaks Wimbledon Run

Jul 07, 2025

From Wife To Coach The Key To Majchrzaks Wimbledon Run

Jul 07, 2025 -

Decoding The Divergence Cnbcs Daily Open On The Latest Us Jobs Data

Jul 07, 2025

Decoding The Divergence Cnbcs Daily Open On The Latest Us Jobs Data

Jul 07, 2025 -

Exciting News Proteas Test Squad Welcomes Two New Players

Jul 07, 2025

Exciting News Proteas Test Squad Welcomes Two New Players

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

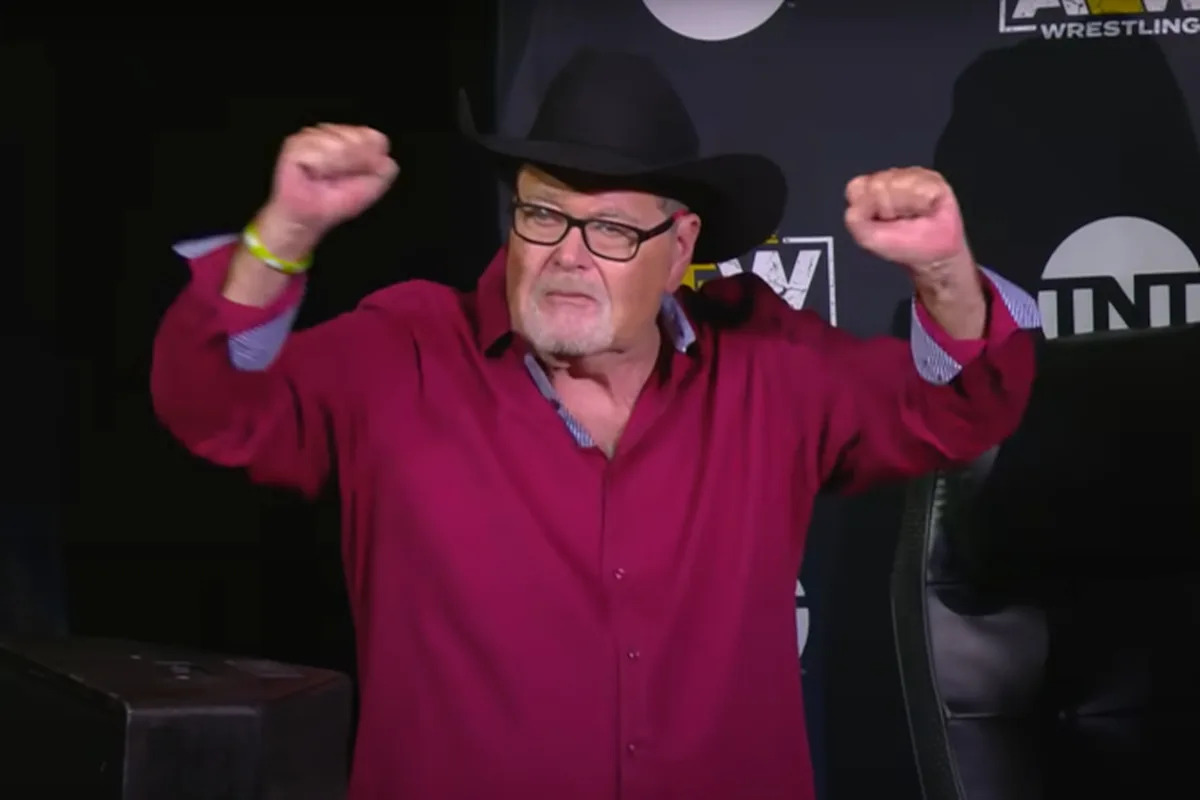

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025