Clean Energy Taxes: The Economic Implications For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Taxes: The Economic Implications for America

The transition to clean energy is a defining challenge of our time. While crucial for environmental sustainability, the economic implications of this shift, particularly the role of clean energy taxes, are complex and hotly debated. This article explores the potential economic effects of various clean energy tax policies on American businesses, consumers, and the overall economy.

The Current Landscape: A Mix of Incentives and Penalties

Currently, the US employs a mixed approach. We see tax credits and incentives aimed at boosting renewable energy adoption (like the Investment Tax Credit for solar and wind), alongside existing taxes on fossil fuels (like the federal gasoline tax). This creates a dynamic environment where the economic impacts are constantly evolving. The effectiveness of these policies is a subject of ongoing research and analysis, with studies often yielding conflicting results depending on the methodologies and assumptions used.

Potential Economic Benefits of Clean Energy Taxes:

Proponents of clean energy taxes argue they offer significant economic advantages:

-

Job Creation: Investing in renewable energy technologies like solar panel manufacturing, wind turbine installation, and battery storage creates numerous high-skilled and blue-collar jobs. This sector is experiencing rapid growth, potentially offsetting job losses in traditional fossil fuel industries through targeted retraining programs and investment in new skills development.

-

Technological Innovation: Tax policies can incentivize research and development into more efficient and cost-effective clean energy technologies. This fosters innovation, driving down the price of renewable energy and making it more competitive with fossil fuels. This is crucial for achieving widespread adoption and reducing reliance on volatile global energy markets.

-

Economic Diversification: A transition away from fossil fuels can lead to a more diversified economy, reducing vulnerability to price shocks and geopolitical instability associated with oil and natural gas. This creates resilience and long-term stability for the US economy.

-

Improved Public Health: Reducing air pollution through cleaner energy sources leads to significant public health improvements, reducing healthcare costs associated with respiratory illnesses and other pollution-related ailments. This translates to tangible economic benefits.

Potential Economic Challenges of Clean Energy Taxes:

However, the transition is not without its challenges:

-

Increased Energy Costs: For consumers, the upfront cost of transitioning to renewable energy sources can lead to higher energy bills, particularly in the short term. This can disproportionately affect low-income households, requiring careful policy design to mitigate this impact (e.g., targeted subsidies or rebates).

-

Job Displacement in Fossil Fuel Industries: The decline of the fossil fuel industry will inevitably lead to job losses in coal mining, oil drilling, and related sectors. Retraining initiatives and investments in new industries are crucial for a just transition, minimizing social and economic disruption.

-

Regional Economic Disparities: The economic impacts of clean energy policies are not evenly distributed geographically. Regions heavily reliant on fossil fuels may face significant economic hardship, requiring targeted support and diversification strategies. Understanding these regional disparities is essential for equitable policymaking.

-

International Competitiveness: High carbon taxes could potentially make US businesses less competitive internationally, especially if other countries don't implement similar policies. This requires a global perspective and international cooperation to ensure a level playing field.

Conclusion: A Path Towards a Sustainable Future

The economic implications of clean energy taxes are multifaceted and depend heavily on the specific policy design, implementation, and accompanying support measures. While challenges exist, the potential long-term economic benefits of a transition to clean energy – including job creation, technological innovation, and improved public health – are substantial. Careful consideration of these economic factors, coupled with effective policy design and targeted support for affected communities, is crucial for navigating this transition successfully and building a sustainable and prosperous future for America. Further research and ongoing dialogue are essential to optimize these policies and minimize potential negative impacts.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Taxes: The Economic Implications For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

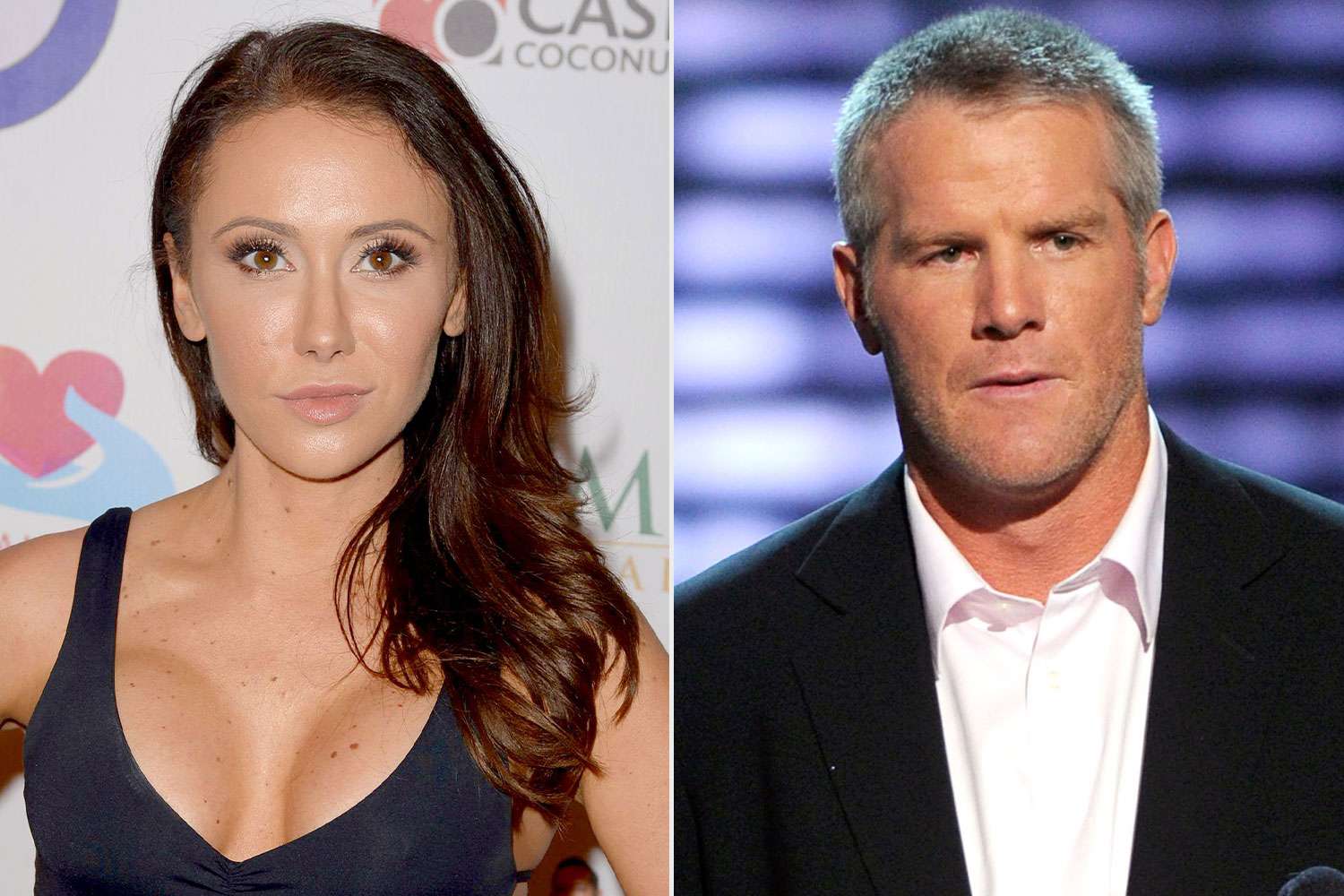

Dehumanized Jenn Sterger Reflects On The Aftermath Of The Brett Favre Scandal

May 20, 2025

Dehumanized Jenn Sterger Reflects On The Aftermath Of The Brett Favre Scandal

May 20, 2025 -

Big Changes Ahead Creator Confirms New Peaky Blinders Series

May 20, 2025

Big Changes Ahead Creator Confirms New Peaky Blinders Series

May 20, 2025 -

Impact Of Feds Rate Cut Projection A Decline In U S Treasury Yields

May 20, 2025

Impact Of Feds Rate Cut Projection A Decline In U S Treasury Yields

May 20, 2025 -

Watch Now A Powerful Ww 1 Drama Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now A Powerful Ww 1 Drama Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Fans React To Jon Jones Cryptic I M Done Message Ufc Career In Jeopardy

May 20, 2025

Fans React To Jon Jones Cryptic I M Done Message Ufc Career In Jeopardy

May 20, 2025