Moody's Downgrade Unshaken: Wall Street Rallies, S&P 500 Extends Winning Streak

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unshaken: Wall Street Rallies, S&P 500 Extends Winning Streak

Wall Street shrugged off Moody's downgrade of US government debt, with major indices rallying and the S&P 500 extending its impressive winning streak. The unexpected resilience showcased investor confidence, defying predictions of a market downturn following the credit rating agency's action. This unexpected surge highlights the complex interplay of factors influencing market behavior and raises questions about the long-term impact of Moody's decision.

The news sent ripples across global markets earlier this week, with Moody's citing rising US debt levels and the deterioration of governance as the primary reasons for the downgrade. This marked the second downgrade of US government debt this year, following a similar action by Fitch Ratings. Many analysts predicted significant market volatility and potential sell-offs. However, the reality presented a different picture altogether.

Market Resilience: A Deeper Dive

The S&P 500 closed higher, extending its winning streak to [insert number] sessions, a testament to the market's unexpected strength. The Dow Jones Industrial Average also experienced a substantial gain, while the Nasdaq Composite mirrored this positive trend. This counterintuitive reaction underscores the complexities of the financial markets and the numerous factors influencing investor sentiment.

Several key factors might explain this surprising resilience:

-

Anticipation: The market might have already priced in the potential for a downgrade, minimizing the immediate impact of the announcement. This suggests that the market's reaction was less about the news itself and more about the subsequent implications.

-

Economic Data: Positive economic indicators, such as robust job growth and resilient consumer spending, could have offset the negative sentiment associated with the downgrade. Strong economic fundamentals often bolster investor confidence, outweighing concerns about credit ratings.

-

Interest Rate Expectations: The Federal Reserve's recent pause on interest rate hikes, and hints at a potential end to the tightening cycle, might have played a crucial role in boosting investor confidence. Lower interest rates can stimulate economic activity and make borrowing more attractive for businesses and consumers.

-

Long-Term Perspective: Many investors may view the downgrade as a short-term setback, maintaining a long-term optimistic outlook on the US economy and its potential for growth.

Beyond the Headlines: Long-Term Implications

While the immediate market reaction was positive, the long-term implications of Moody's downgrade remain uncertain. Higher borrowing costs for the US government could potentially lead to reduced government spending or increased taxation, impacting various sectors of the economy. The downgrade also raises questions about the future stability of US government bonds and the potential impact on global financial markets.

It's crucial to note that market performance is influenced by a multitude of factors beyond credit ratings. Geopolitical events, inflation rates, and technological advancements all play significant roles. Therefore, while the Moody's downgrade is a noteworthy development, it's only one piece of a complex puzzle.

Looking Ahead: What to Watch

Investors should continue to monitor key economic indicators, Federal Reserve policy decisions, and geopolitical developments to gauge the broader market outlook. The coming weeks and months will provide further clarity on the long-term consequences of Moody's action and the overall health of the US economy. Further analysis of the impact on borrowing costs and government spending will be crucial in understanding the full ramifications of this downgrade. Stay tuned for further updates.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unshaken: Wall Street Rallies, S&P 500 Extends Winning Streak. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

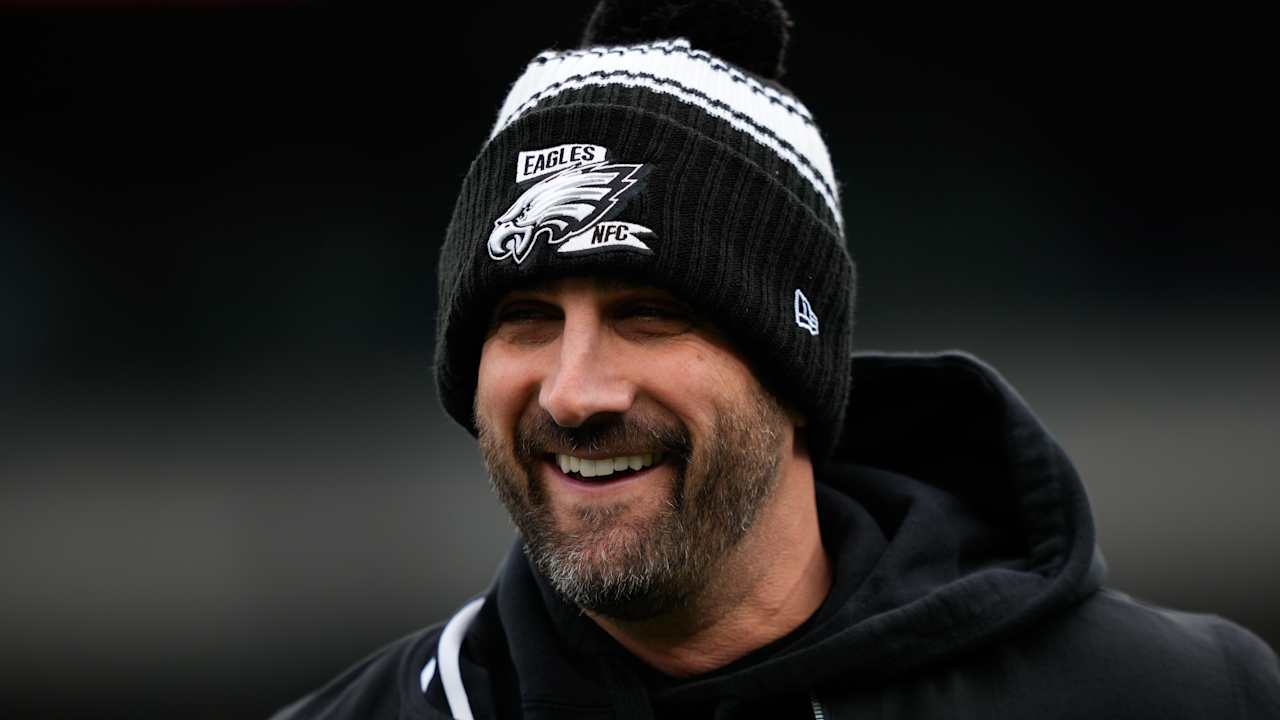

Nick Siriannis Contract Extension Eagles Coach Remains In Philadelphia After Super Bowl Lvii

May 20, 2025

Nick Siriannis Contract Extension Eagles Coach Remains In Philadelphia After Super Bowl Lvii

May 20, 2025 -

Transparency Concerns Jon Jones Blasts Ufc Over Aspinall Injury Update

May 20, 2025

Transparency Concerns Jon Jones Blasts Ufc Over Aspinall Injury Update

May 20, 2025 -

Stricter Regulations Hit Spains Tourist Rental Market 65 000 Listings Impacted

May 20, 2025

Stricter Regulations Hit Spains Tourist Rental Market 65 000 Listings Impacted

May 20, 2025 -

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025

Bidens Cancer Diagnosis Political Figures Offer Messages Of Hope

May 20, 2025 -

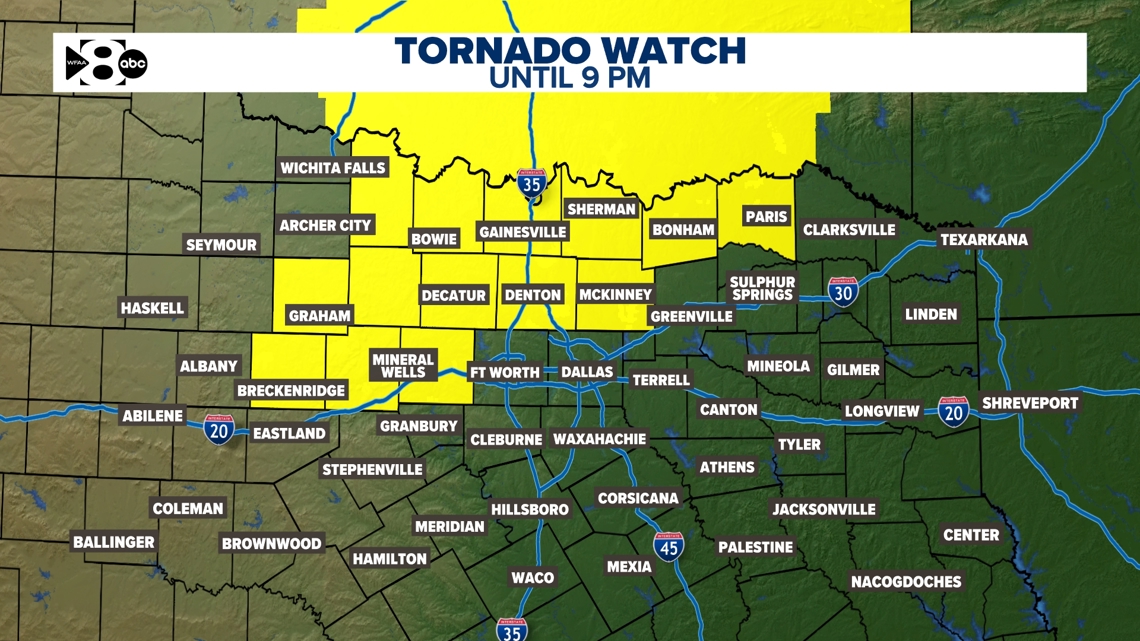

Dfw Forecast Tuesday Cold Front After Monday Evening Storms

May 20, 2025

Dfw Forecast Tuesday Cold Front After Monday Evening Storms

May 20, 2025