Clean Energy Taxes And The American Economy: A Complex Equation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Taxes and the American Economy: A Complex Equation

The push for a greener America is colliding with the complexities of the national economy, sparking intense debate about the role of clean energy taxes. Are they a necessary evil to combat climate change, or a crippling burden on businesses and consumers? The answer, as with most economic questions, is nuanced. This article delves into the multifaceted impact of clean energy taxes on the American economy, examining both the potential benefits and drawbacks.

The Case for Clean Energy Taxes:

Proponents argue that taxes on carbon emissions and fossil fuels are crucial for incentivizing the transition to cleaner energy sources. These taxes, often referred to as carbon taxes or pollution taxes, aim to internalize the environmental costs associated with burning fossil fuels. This means making polluters pay for the damage they cause, like air pollution and climate change.

-

Environmental Benefits: The most compelling argument centers around the environmental benefits. By making fossil fuels more expensive, clean energy taxes encourage businesses and individuals to adopt renewable energy alternatives like solar, wind, and geothermal power. This shift can lead to significant reductions in greenhouse gas emissions, mitigating the effects of climate change. [Link to EPA data on greenhouse gas emissions]

-

Economic Diversification: The transition to clean energy creates new jobs and economic opportunities. The burgeoning renewable energy sector requires skilled workers in manufacturing, installation, maintenance, and research. This diversification can strengthen the economy and reduce dependence on volatile fossil fuel markets. [Link to a report on clean energy job growth]

-

Public Health Improvements: Reduced air pollution, a direct consequence of transitioning to clean energy, leads to improved public health outcomes. Fewer respiratory illnesses and other pollution-related health problems translate to lower healthcare costs and increased productivity. [Link to a study on the health benefits of clean air]

The Challenges and Concerns:

Opponents raise concerns about the potential economic downsides of clean energy taxes.

-

Increased Energy Costs: The most immediate concern is the potential for increased energy prices for consumers and businesses. This could lead to higher production costs, reduced competitiveness, and a decreased standard of living for some households. [Link to an article discussing energy price impacts]

-

Regressive Impact: Critics argue that clean energy taxes disproportionately affect low-income households who spend a larger percentage of their income on energy. This regressive impact requires careful consideration and potentially mitigating policies, such as tax rebates or direct payments to low-income families.

-

Economic Competitiveness: Some worry that higher energy costs could make American businesses less competitive in the global market, particularly those energy-intensive industries. This requires a strategic approach to ensure a level playing field, potentially through carbon border adjustments or international cooperation.

Finding a Balance: Policy Considerations:

The key to successfully implementing clean energy taxes lies in thoughtful policy design. This includes:

-

Revenue Recycling: Reinvesting tax revenue into programs that support clean energy development, energy efficiency improvements, and assistance for low-income households can mitigate the regressive impact and stimulate economic growth.

-

Phased Implementation: A gradual increase in taxes allows businesses and consumers time to adapt and invest in cleaner technologies, reducing the economic shock.

-

Carbon Border Adjustments: Implementing tariffs on imports from countries with less stringent environmental regulations can level the playing field and prevent carbon leakage – the phenomenon where polluting industries move to countries with less regulation.

Conclusion:

The debate surrounding clean energy taxes and their impact on the American economy is far from settled. While there are legitimate concerns about potential economic downsides, the long-term environmental and public health benefits are undeniable. Finding the right balance requires careful policy design, a commitment to revenue recycling, and a willingness to address the challenges in a fair and equitable manner. The future of the American economy and the planet depends on getting this equation right. Further research and public discussion are vital to navigating this complex issue effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Taxes And The American Economy: A Complex Equation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025 -

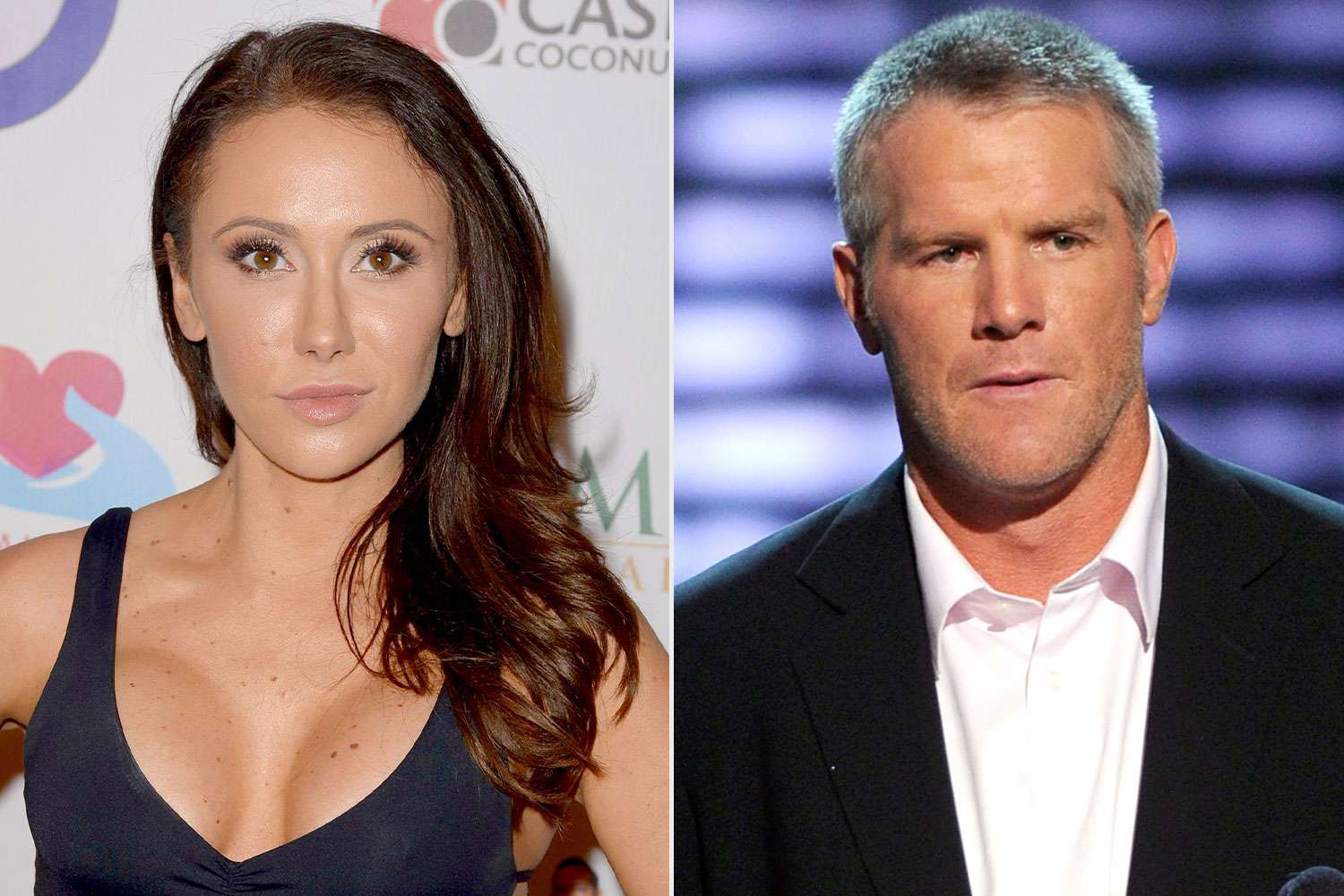

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On The Aftermath

May 20, 2025 -

Untold Brett Favre A J Perez Details Threats And The Series Future

May 20, 2025

Untold Brett Favre A J Perez Details Threats And The Series Future

May 20, 2025 -

Helldivers 2 Masters Of Ceremony Warbond Rewards Available May 15th

May 20, 2025

Helldivers 2 Masters Of Ceremony Warbond Rewards Available May 15th

May 20, 2025 -

Jamie Lee Curtis And Lindsay Lohans Unexpected Friendship A Look Back

May 20, 2025

Jamie Lee Curtis And Lindsay Lohans Unexpected Friendship A Look Back

May 20, 2025