Falling Mortgage Refinance Rates: Your May 19, 2025 Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Falling Mortgage Refinance Rates: Your May 19, 2025 Guide

Are you feeling the pinch of high interest rates on your current mortgage? Good news! Mortgage refinance rates are falling, offering a potential lifeline for homeowners looking to lower their monthly payments and save money. This guide, updated for May 19, 2025, will help you understand the current landscape and determine if refinancing is right for you.

Why are Mortgage Refinance Rates Falling?

Several factors contribute to the recent decline in refinance rates. These include:

- Easing Inflation: While inflation remains a concern, recent economic indicators suggest a slowing pace, influencing the Federal Reserve's monetary policy decisions. This often translates to lower interest rates across the board.

- Increased Competition: The mortgage lending market is competitive. Lenders are vying for your business, often resulting in more favorable rates for borrowers.

- Shifting Market Demand: A potential decrease in demand for new mortgages can also impact refinance rates, as lenders adjust their offerings to attract borrowers.

It's crucial to remember that these factors are interconnected and constantly shifting. Staying informed about current economic trends is key to making smart financial decisions.

Is Refinancing Right for You?

Before diving into the process, consider these key questions:

- What's your current interest rate? A significant difference between your current rate and current refinance rates is crucial to justify the costs associated with refinancing.

- How long do you plan to stay in your home? The longer you plan to stay, the more likely you are to recoup the costs of refinancing.

- What are the closing costs? These fees can significantly impact your overall savings. Shop around and compare offers from multiple lenders to find the best deal.

- What's your credit score? A higher credit score typically qualifies you for better rates. Checking your credit report before applying can help you identify any issues and potentially improve your score.

Finding the Best Refinance Rate:

Navigating the mortgage refinance market can be overwhelming. Here's how to find the best rate for your situation:

- Check Multiple Lenders: Don't settle for the first offer you receive. Compare rates and fees from several banks, credit unions, and online lenders. Use online comparison tools to streamline the process.

- Understand the Different Loan Types: Explore various refinance options, including rate-and-term refinancing, cash-out refinancing, and ARM refinancing, to find the best fit for your financial goals. Consider consulting a financial advisor for personalized advice.

- Negotiate: Don't be afraid to negotiate with lenders. They often have some flexibility in their rates and fees.

- Read the Fine Print: Carefully review all documents before signing anything. Understand all terms and conditions to avoid any surprises.

Beyond the Numbers: The Bigger Picture

Refinancing your mortgage is a significant financial decision. While lower monthly payments are attractive, consider the long-term implications. Factor in closing costs, potential penalties for early payoff, and your overall financial goals. Seeking advice from a qualified financial advisor can provide valuable insights and help you make an informed decision.

Stay Updated: Mortgage rates are dynamic. Check reputable financial websites and news sources regularly for the latest updates on mortgage refinance rates. Sites like [link to reputable financial news source] and [link to another reputable source] offer valuable insights.

Call to Action: Ready to explore your refinance options? Start by comparing rates from multiple lenders today. Remember, informed decisions lead to better financial outcomes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Falling Mortgage Refinance Rates: Your May 19, 2025 Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Record Investments In Bitcoin Etfs Analyzing The 5 B Influx

May 20, 2025

Record Investments In Bitcoin Etfs Analyzing The 5 B Influx

May 20, 2025 -

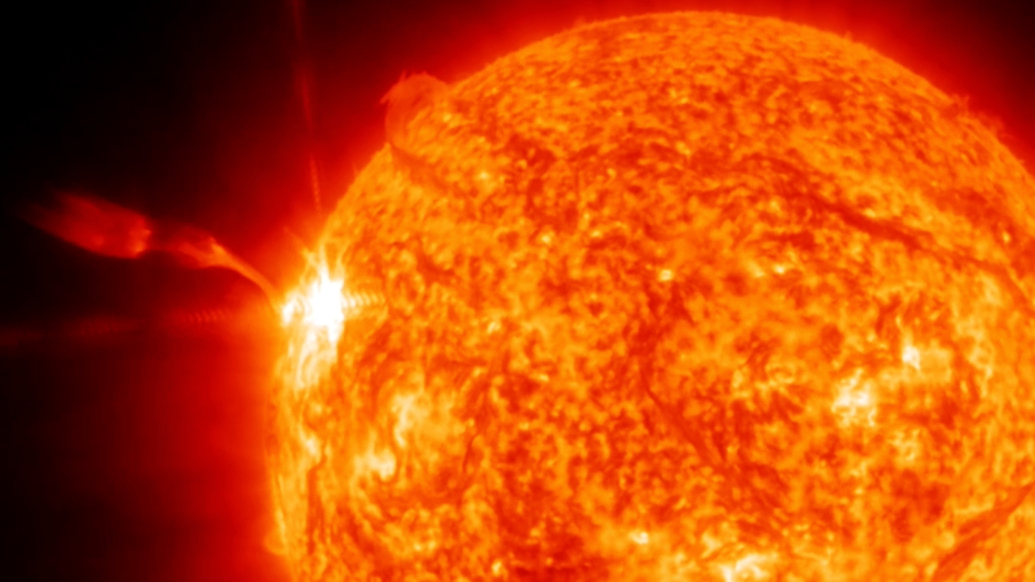

Geomagnetic Storm Major Solar Flare Impacts Radio Communications Globally

May 20, 2025

Geomagnetic Storm Major Solar Flare Impacts Radio Communications Globally

May 20, 2025 -

Jon Jones Aspinall Comments Spark Fury Fans React To Strip The Duck Remark

May 20, 2025

Jon Jones Aspinall Comments Spark Fury Fans React To Strip The Duck Remark

May 20, 2025 -

Jenn Stergers Emotional Account Life After The Brett Favre Sext Scandal

May 20, 2025

Jenn Stergers Emotional Account Life After The Brett Favre Sext Scandal

May 20, 2025 -

Prostate Cancer And Gleason Score 9 What Patients Need To Know

May 20, 2025

Prostate Cancer And Gleason Score 9 What Patients Need To Know

May 20, 2025