Clean Energy Tax Reform: Shaping Economic Growth And Environmental Sustainability In The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Reform: Shaping Economic Growth and Environmental Sustainability in the US

The United States is at a crossroads, grappling with the urgent need for environmental sustainability while simultaneously striving for robust economic growth. Clean energy tax reform presents a powerful solution, offering a pathway to achieve both goals simultaneously. By incentivizing investment in renewable energy sources and green technologies, these reforms are poised to reshape the nation's energy landscape and drive a new era of economic prosperity.

The Current Landscape: A Need for Change

The existing tax system has, for too long, favored fossil fuels, hindering the growth of the clean energy sector. This imbalance has resulted in a slower transition to a greener economy and a continued reliance on carbon-intensive energy sources. The consequences are undeniable: rising greenhouse gas emissions, contributing to climate change, and a missed opportunity to create high-paying jobs in a burgeoning industry.

Key Aspects of Clean Energy Tax Reform

Several key elements define the current push for clean energy tax reform:

-

Extension and Expansion of Tax Credits: The extension and expansion of tax credits for renewable energy technologies, such as solar, wind, and geothermal, are crucial. These credits incentivize businesses and individuals to invest in these clean energy solutions, making them more financially viable. This includes exploring options like direct pay for tax credits, which benefits businesses that don't pay corporate income taxes.

-

Investment Tax Credits (ITCs) for Renewable Energy: Robust ITCs significantly reduce the upfront costs associated with building renewable energy projects. This lowers the barrier to entry for smaller developers and encourages wider adoption of clean energy sources across various sectors.

-

Production Tax Credits (PTCs) for Renewable Energy: PTCs provide incentives based on the amount of renewable energy produced, providing a long-term financial incentive for sustained operation and production.

-

Tax Credits for Energy Storage: Energy storage technologies, such as batteries, are critical for the reliable integration of renewable energy sources into the grid. Tax credits for energy storage are vital to accelerating their deployment and improving the overall efficiency and reliability of renewable energy systems.

-

Clean Vehicle Tax Credits: Incentivizing the purchase of electric vehicles (EVs) and other clean transportation options through tax credits is a significant component of reducing emissions from the transportation sector, a major contributor to greenhouse gas emissions. This also stimulates innovation and growth within the EV manufacturing industry.

Economic Benefits: Job Creation and Innovation

Clean energy tax reform isn't just about environmental protection; it's a powerful engine for economic growth. The sector is a significant job creator, with opportunities spanning manufacturing, installation, maintenance, and research and development. These are high-skilled, well-paying jobs that can revitalize communities and contribute to a more equitable economy. Furthermore, the transition to clean energy stimulates innovation, leading to technological advancements and increased competitiveness in the global market. The US can become a leader in this burgeoning industry, attracting investment and expertise from around the world.

Environmental Sustainability: A Crucial Step Towards a Greener Future

The environmental benefits of clean energy tax reform are undeniable. By shifting away from fossil fuels and towards renewable energy sources, the US can significantly reduce its carbon footprint, mitigating the effects of climate change and protecting our natural resources. This transition is vital for ensuring a healthy planet for future generations.

Challenges and Considerations

While the benefits are clear, implementing effective clean energy tax reform requires careful consideration of several challenges:

-

Funding Mechanisms: Securing sufficient funding for these tax credits requires careful consideration of the overall budget and potential impacts on other areas.

-

Equity and Access: Ensuring that the benefits of these reforms reach all communities, including low-income and disadvantaged areas, is crucial for equitable economic growth.

-

Policy Stability: Long-term policy stability is vital to attract the significant investments needed for the clean energy transition. Frequent changes in tax incentives can create uncertainty and hinder progress.

Conclusion: A Necessary Investment for a Sustainable Future

Clean energy tax reform is not just a policy choice; it's a necessary investment in the future of the United States. By fostering economic growth while simultaneously addressing climate change, these reforms offer a win-win scenario. The time for action is now. Let's embrace this opportunity to create a more sustainable, prosperous, and equitable future for all Americans. Learn more about the specifics of current clean energy tax incentives through resources like the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Reform: Shaping Economic Growth And Environmental Sustainability In The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mercedes Benzs Electric G Wagon A Special Gift For League Of Legends Uzi

May 21, 2025

Mercedes Benzs Electric G Wagon A Special Gift For League Of Legends Uzi

May 21, 2025 -

The Phoenician Scheme A Deeper Look At Wes Andersons Understated Style

May 21, 2025

The Phoenician Scheme A Deeper Look At Wes Andersons Understated Style

May 21, 2025 -

Brett Favres Fallout A J Perez Discusses Threats And The Impact On Untold

May 21, 2025

Brett Favres Fallout A J Perez Discusses Threats And The Impact On Untold

May 21, 2025 -

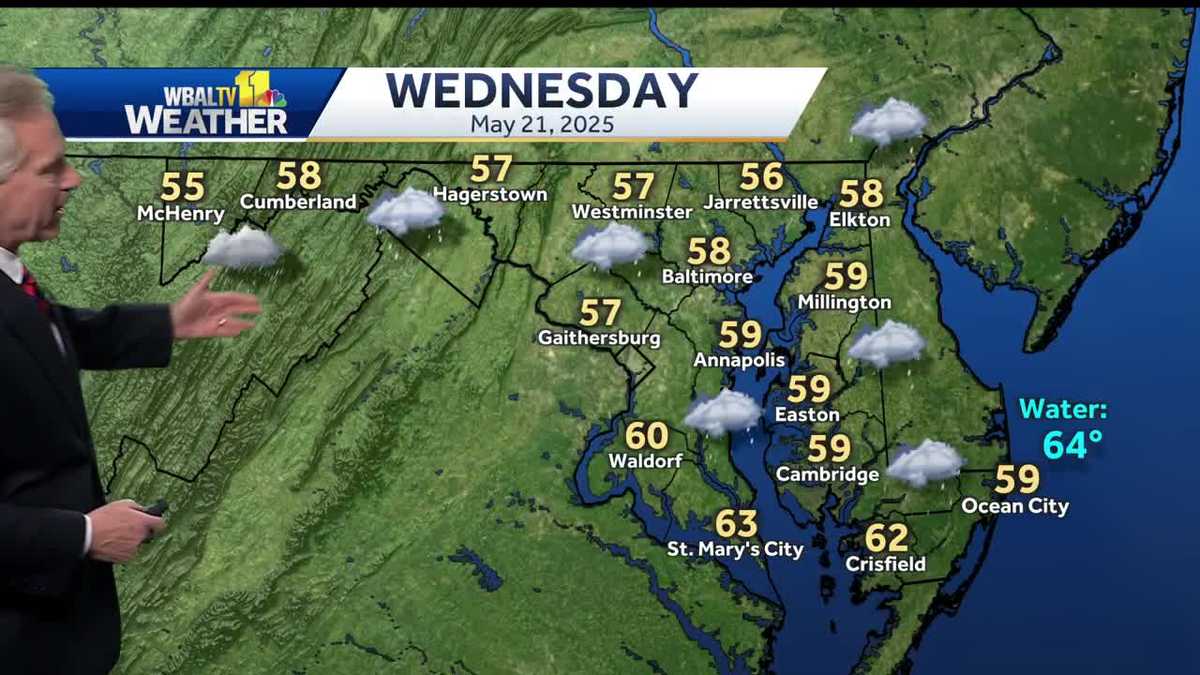

Chilly Weather And Rain To Impact Region On Wednesday

May 21, 2025

Chilly Weather And Rain To Impact Region On Wednesday

May 21, 2025 -

Brett Favres Controversies Explored A J Perez Discusses Untold And Legal Fallout

May 21, 2025

Brett Favres Controversies Explored A J Perez Discusses Untold And Legal Fallout

May 21, 2025