Slight Dip In U.S. Treasury Yields Follows Fed's Projected Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slight Dip in U.S. Treasury Yields Follows Fed's Projected Rate Cut

U.S. Treasury yields experienced a modest decline following the Federal Reserve's projection of a potential interest rate cut later this year. This move reflects market anticipation of a less aggressive monetary policy stance by the central bank in response to easing inflationary pressures and concerns about economic growth. The shift, while subtle, signals a potential change in the trajectory of the bond market and has implications for investors and the broader economy.

The Federal Open Market Committee (FOMC) hinted at a potential rate reduction in its latest statement, citing a softening of inflation and the possibility of a slower economic expansion. This projection, while not a definitive commitment to a rate cut, was enough to trigger a shift in investor sentiment and influence Treasury yields.

Understanding the Connection: Interest Rates and Treasury Yields

Treasury yields move inversely to bond prices. When investors anticipate lower interest rates, the demand for existing bonds with higher yields increases, driving up their prices and subsequently lowering their yields. This is precisely what occurred following the Fed's projection. The expectation of a future rate cut made existing Treasury bonds more attractive, leading to the observed dip in yields.

Market Reaction and Analysis

The dip in yields was relatively modest, reflecting the uncertainty surrounding the economic outlook. While inflation has cooled from its peak, it remains above the Fed's target, and concerns persist about the resilience of the labor market. These factors contribute to the cautious approach adopted by the market. Analysts are closely monitoring key economic indicators, such as inflation data (CPI and PPI), employment figures (Nonfarm Payrolls), and consumer confidence indices, to gauge the likelihood and timing of a potential rate cut.

Several experts believe the Fed's projection signals a pivot from its aggressive rate-hiking cycle of the past year. This pivot, while welcomed by some, raises concerns for others. Lower interest rates can stimulate economic growth but also risk reigniting inflationary pressures if implemented prematurely. The delicate balancing act faced by the Fed is a key focus for market observers.

What This Means for Investors

The recent dip in Treasury yields presents both opportunities and challenges for investors. Lower yields generally translate into lower returns on fixed-income investments, potentially prompting some investors to shift their portfolios towards other asset classes, such as equities or alternative investments. However, the relative safety and stability of Treasury bonds remain attractive to risk-averse investors, particularly in times of economic uncertainty.

Key Takeaways:

- Slight Decrease: U.S. Treasury yields experienced a minor decline.

- Fed's Influence: The Federal Reserve's projected rate cut influenced investor sentiment.

- Inverse Relationship: Treasury yields move inversely to bond prices.

- Economic Uncertainty: The market remains cautious due to lingering economic uncertainties.

- Investor Considerations: Investors need to carefully consider the implications for their portfolios.

This situation warrants careful monitoring. Investors and economists alike are awaiting further economic data releases to gain a clearer picture of the economic outlook and the future direction of interest rates. Staying informed about economic developments and consulting with financial advisors is crucial for making informed investment decisions in this dynamic market environment. [Link to reputable financial news source] for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slight Dip In U.S. Treasury Yields Follows Fed's Projected Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

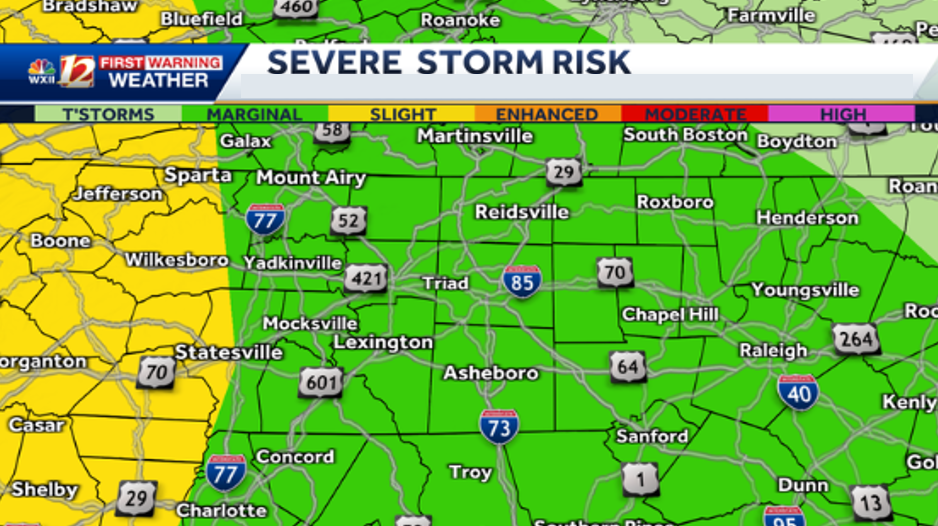

Overnight Storms And Heavy Rain Severe Weather Warning For North Carolina

May 21, 2025

Overnight Storms And Heavy Rain Severe Weather Warning For North Carolina

May 21, 2025 -

Institutional Interest In Ethereum Explodes 200 M Investment After Upgrade

May 21, 2025

Institutional Interest In Ethereum Explodes 200 M Investment After Upgrade

May 21, 2025 -

Enhanced Corporate Value Through Nature Conservation A Japanese Initiative Involving 160 Companies Across 13 Sectors

May 21, 2025

Enhanced Corporate Value Through Nature Conservation A Japanese Initiative Involving 160 Companies Across 13 Sectors

May 21, 2025 -

Trumps Diplomatic Push Mediating Between Putin And Zelensky Amidst Intensified Russian Strikes

May 21, 2025

Trumps Diplomatic Push Mediating Between Putin And Zelensky Amidst Intensified Russian Strikes

May 21, 2025 -

J D Vance On Bidens Cancer Doubts About Presidential Capabilities Emerge

May 21, 2025

J D Vance On Bidens Cancer Doubts About Presidential Capabilities Emerge

May 21, 2025