Clean Energy Tax Policy: Impacts And Implications For America's Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Policy: Impacts and Implications for America's Future

America stands at a crossroads. The urgent need to combat climate change necessitates a rapid transition to clean energy, and tax policy plays a pivotal role in shaping this transition. This article delves into the multifaceted impacts and implications of current and proposed clean energy tax policies on America's economic, environmental, and social landscape.

The Current State of Clean Energy Tax Incentives:

The United States has implemented various tax incentives to encourage investment in clean energy technologies. These include:

- Investment Tax Credit (ITC): This credit provides a significant tax reduction for investors in solar, wind, geothermal, and other renewable energy projects. The ITC has been instrumental in driving down the cost of renewable energy and boosting deployment. However, its fluctuating rates and potential expiration dates create uncertainty for investors.

- Production Tax Credit (PTC): This credit incentivizes the production of renewable energy, providing a per-kilowatt-hour credit for electricity generated from wind, solar, and other qualifying sources. Similar to the ITC, its stability is crucial for long-term investment planning.

- Energy Efficiency Tax Credits: These credits encourage homeowners and businesses to adopt energy-efficient technologies, such as solar water heaters, energy-efficient windows, and heat pumps. These incentives directly contribute to reduced energy consumption and lower carbon emissions.

Impacts of Clean Energy Tax Policies:

The impacts of these policies are far-reaching:

- Economic Growth: Investments in clean energy create jobs in manufacturing, installation, maintenance, and research & development. This stimulates economic growth, particularly in rural communities where renewable energy projects are often located. A recent study by the National Renewable Energy Laboratory (NREL) highlights the significant job creation potential of the clean energy sector. [Link to NREL study]

- Environmental Benefits: By incentivizing the adoption of clean energy sources, these policies directly reduce greenhouse gas emissions, contributing to the fight against climate change. This transition helps improve air quality and public health.

- Energy Independence: Investing in domestic renewable energy sources reduces reliance on foreign fossil fuels, enhancing America's energy security and reducing vulnerability to global energy price fluctuations.

- Technological Innovation: Tax incentives drive innovation by making investment in research and development of new clean energy technologies more attractive. This fosters competition and leads to the development of more efficient and cost-effective clean energy solutions.

Challenges and Future Implications:

Despite the positive impacts, challenges remain:

- Policy Uncertainty: The fluctuating nature of tax incentives creates uncertainty for investors, hindering long-term planning and investment. Consistent and long-term policy support is crucial for sustained growth in the clean energy sector.

- Equity Concerns: The benefits of clean energy tax policies must be distributed equitably to ensure that all communities benefit from the transition. Addressing potential job displacement in fossil fuel-dependent regions is crucial for a just transition.

- Infrastructure Needs: Expanding the grid infrastructure to accommodate increased renewable energy generation is essential for successful integration. Significant investment in transmission and distribution infrastructure is needed.

Looking Ahead:

The future of clean energy in America depends heavily on the continued evolution and strengthening of tax policies. Policymakers must consider:

- Extending and expanding existing tax credits: Providing long-term certainty for investors will unlock further investment and accelerate the transition.

- Investing in grid modernization: A robust and modernized grid is essential for effectively integrating renewable energy sources.

- Addressing equity concerns: Policies should prioritize equitable distribution of benefits and support for workers and communities affected by the transition.

The clean energy transition presents both opportunities and challenges. Smart and strategically designed tax policies are essential to navigate this transition effectively, securing a cleaner, more prosperous, and sustainable future for America. The time for decisive action is now. Learn more about current clean energy initiatives by visiting the Department of Energy website. [Link to DOE website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Policy: Impacts And Implications For America's Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ellen De Generes Social Media Comeback A Touching Response From Fans

May 21, 2025

Ellen De Generes Social Media Comeback A Touching Response From Fans

May 21, 2025 -

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025

The Putin Trump Dynamic A Power Shift And Its Global Implications

May 21, 2025 -

160 Japanese Firms Compete In Nature Conservation Aiming For Enhanced Corporate Value Across 13 Industries

May 21, 2025

160 Japanese Firms Compete In Nature Conservation Aiming For Enhanced Corporate Value Across 13 Industries

May 21, 2025 -

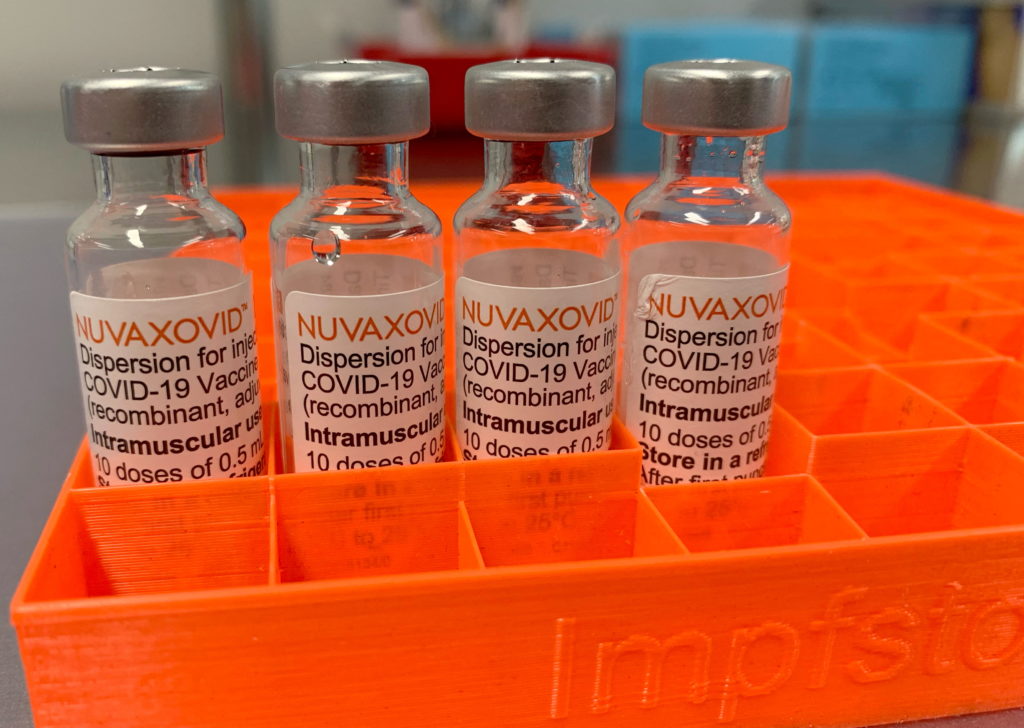

Fda Greenlights Novavax Covid 19 Vaccine But With Strict Usage Conditions

May 21, 2025

Fda Greenlights Novavax Covid 19 Vaccine But With Strict Usage Conditions

May 21, 2025 -

Jamie Lee Curtis Discusses Her Deep Connection With Lindsay Lohan A Heartfelt Interview

May 21, 2025

Jamie Lee Curtis Discusses Her Deep Connection With Lindsay Lohan A Heartfelt Interview

May 21, 2025