Clean Energy Tax Policy: Analyzing The Economic Implications For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Policy: Analyzing the Economic Implications for America

America's transition to clean energy is accelerating, driven by climate concerns and technological advancements. However, the economic implications of this shift are complex and far-reaching, significantly shaped by the nation's tax policies. This article delves into the current landscape of clean energy tax incentives, exploring both the benefits and potential drawbacks for the American economy.

The Current State of Clean Energy Tax Incentives:

The Inflation Reduction Act (IRA), signed into law in 2022, represents a landmark shift in US clean energy policy. This legislation provides substantial tax credits and incentives for various clean energy technologies, including:

-

Solar and Wind Energy: Significant tax credits are offered for the development and deployment of solar and wind power projects, boosting investment in these renewable energy sources. These credits aim to reduce the cost of renewable energy, making it more competitive with fossil fuels.

-

Energy Storage: Incentives are also provided for energy storage technologies, crucial for addressing the intermittency of solar and wind power. This support is vital for grid stability and the wider adoption of renewables.

-

Electric Vehicles (EVs): The IRA includes substantial tax credits for the purchase of new and used electric vehicles, stimulating demand and driving innovation within the EV sector. This encourages the transition away from gasoline-powered vehicles, reducing greenhouse gas emissions.

-

Carbon Capture: Tax credits are available for carbon capture, utilization, and storage (CCUS) technologies. While controversial, CCUS is seen by some as a crucial tool in mitigating emissions from existing fossil fuel infrastructure.

Economic Benefits of Clean Energy Tax Policy:

The economic benefits of a robust clean energy tax policy are multifaceted:

-

Job Creation: The clean energy sector is a significant job creator. Investments spurred by tax incentives lead to jobs in manufacturing, installation, maintenance, and research & development. This can revitalize communities and reduce unemployment.

-

Economic Growth: Clean energy investments stimulate economic growth by boosting innovation and creating new industries. This can lead to increased productivity and a more competitive economy.

-

Reduced Healthcare Costs: The transition to clean energy can lead to reduced healthcare costs associated with air pollution. Cleaner air improves public health, reducing respiratory illnesses and other health problems.

-

Energy Independence: A shift towards domestic renewable energy sources enhances America's energy independence, reducing reliance on volatile global fossil fuel markets.

Potential Challenges and Concerns:

While the benefits are substantial, implementing a successful clean energy tax policy presents challenges:

-

Equity Concerns: Ensuring equitable access to clean energy benefits for all communities is crucial. Policies must address potential disparities in access to incentives and avoid exacerbating existing inequalities.

-

Distributional Effects: The transition away from fossil fuels could lead to job losses in the fossil fuel industry. Retraining and support programs are essential to mitigate these effects and ensure a just transition.

-

Inflationary Pressures: Significant government spending on clean energy initiatives could potentially contribute to inflationary pressures. Careful fiscal management is crucial to minimize these risks.

-

Technological Readiness: The effectiveness of clean energy tax policy depends on the availability and affordability of clean energy technologies. Continued investment in research and development is essential.

Conclusion:

Clean energy tax policy plays a pivotal role in shaping America's economic future. The IRA offers a significant opportunity to accelerate the transition to a cleaner energy system, creating jobs, stimulating economic growth, and improving public health. However, careful consideration of potential challenges, including equitable access, job displacement, and inflationary pressures, is vital to ensure a successful and sustainable transition. Further research and ongoing evaluation of the economic impact of these policies are necessary to refine strategies and maximize benefits for all Americans. The future of American energy, and indeed the global climate, hinges on the effectiveness of these initiatives.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Policy: Analyzing The Economic Implications For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

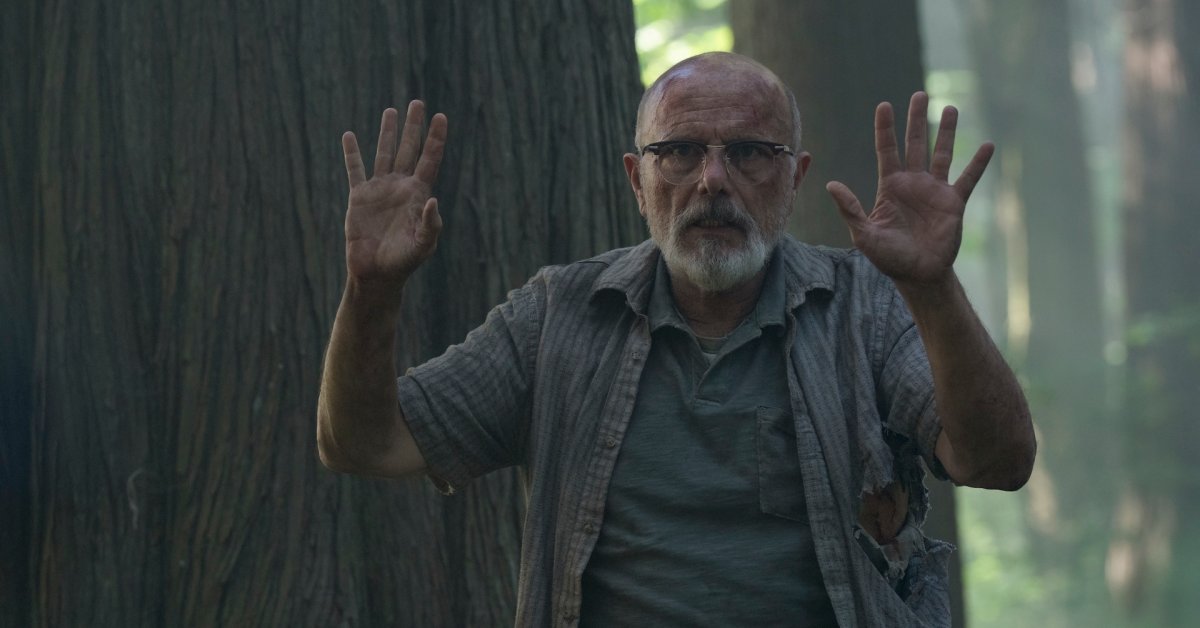

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative Season 2

May 20, 2025

Reframing The Relationship How The Last Of Us Show Diverges From The Games Narrative Season 2

May 20, 2025 -

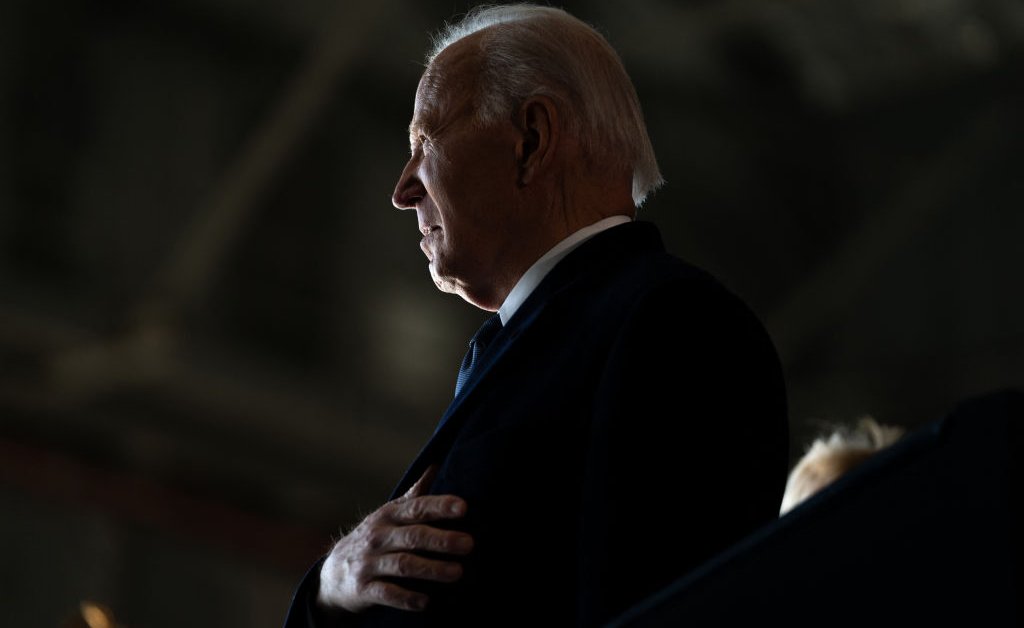

Bidens Cancer Diagnosis A Wave Of Support From Political Figures

May 20, 2025

Bidens Cancer Diagnosis A Wave Of Support From Political Figures

May 20, 2025 -

Impact Of Feds Rate Cut Projection Lower Us Treasury Yields

May 20, 2025

Impact Of Feds Rate Cut Projection Lower Us Treasury Yields

May 20, 2025 -

Record Bitcoin Etf Investments Exceed 5 Billion Future Market Outlook

May 20, 2025

Record Bitcoin Etf Investments Exceed 5 Billion Future Market Outlook

May 20, 2025 -

From Unknown Author To Bestseller Taylor Jenkins Reids Publishing Success Story

May 20, 2025

From Unknown Author To Bestseller Taylor Jenkins Reids Publishing Success Story

May 20, 2025