Over $5 Billion Invested In Bitcoin ETFs: What's Fueling This Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: What's Fueling This Explosive Growth?

The cryptocurrency market has seen a surge of interest recently, with Bitcoin Exchange-Traded Funds (ETFs) attracting over $5 billion in investments. This significant influx of capital represents a major milestone for Bitcoin's mainstream adoption and signifies a shift in how institutional and retail investors perceive the leading cryptocurrency. But what's driving this explosive growth? Let's delve into the factors fueling this investment boom.

The Rise of Regulated Bitcoin Access:

One of the primary catalysts behind the surge in Bitcoin ETF investments is the increasing regulatory clarity surrounding cryptocurrencies in key markets. The approval of the first Bitcoin futures ETF in the US marked a turning point, paving the way for a more regulated and accessible investment vehicle. This regulatory green light instilled confidence among institutional investors previously hesitant to directly engage with the volatile cryptocurrency market. This newfound legitimacy is crucial for attracting larger sums of capital.

Institutional Investor Demand:

Hedge funds, pension funds, and other institutional investors are increasingly incorporating Bitcoin into their portfolios as a hedge against inflation and potential market downturns. The ETF structure offers a convenient and familiar investment vehicle, allowing these large players to gain exposure to Bitcoin without the complexities and risks associated with directly holding the cryptocurrency. This strategic shift by institutional investors represents a significant force behind the $5 billion figure.

Retail Investor Interest:

While institutional investors play a significant role, retail investors are also contributing to the growth. The accessibility of Bitcoin ETFs through traditional brokerage accounts makes Bitcoin investment simpler and more attractive to a wider range of investors. This democratization of access lowers the barrier to entry and expands the pool of potential investors.

Growing Belief in Bitcoin's Long-Term Potential:

Despite market volatility, many investors believe in Bitcoin's long-term potential as a store of value and a decentralized form of currency. The increasing adoption of Bitcoin by businesses and the ongoing development of Bitcoin's underlying technology further bolster this belief. This positive outlook translates into sustained investment despite short-term price fluctuations.

Spot Bitcoin ETFs: The Next Frontier?

While futures-based Bitcoin ETFs currently dominate the market, the potential approval of spot Bitcoin ETFs represents the next significant hurdle and could further accelerate investment. A spot ETF would directly track the price of Bitcoin, offering investors potentially more direct exposure and potentially higher returns. The SEC's ongoing review of several spot ETF applications is eagerly awaited by market participants.

The Future of Bitcoin ETFs:

The $5 billion investment milestone demonstrates the growing acceptance and institutionalization of Bitcoin. As regulatory clarity improves and more investment vehicles become available, we can expect even greater capital inflows into Bitcoin ETFs. The future of Bitcoin ETFs looks bright, reflecting the broader trend toward greater mainstream adoption of cryptocurrencies.

Disclaimer: Investing in Bitcoin ETFs carries inherent risks. This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Consider your risk tolerance and investment goals before investing in any cryptocurrency-related products.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: What's Fueling This Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eas Star Wars Battlefront A Silent Comeback After Years Of Silence

May 20, 2025

Eas Star Wars Battlefront A Silent Comeback After Years Of Silence

May 20, 2025 -

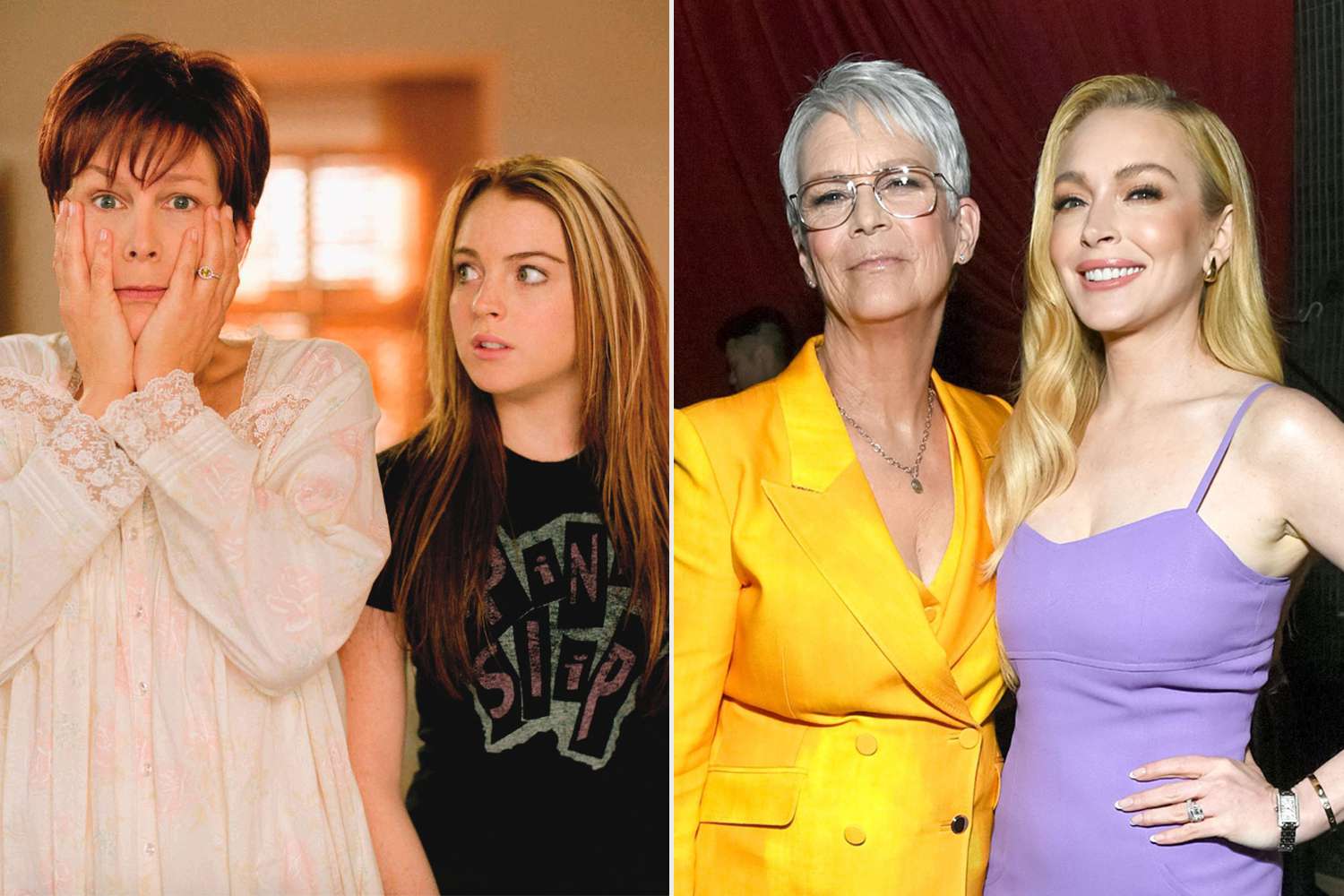

Unexpected Friendship Jamie Lee Curtis Opens Up About Lindsay Lohans Honesty

May 20, 2025

Unexpected Friendship Jamie Lee Curtis Opens Up About Lindsay Lohans Honesty

May 20, 2025 -

Jamie Lee Curtis Reveals Update On Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Reveals Update On Relationship With Lindsay Lohan Post Freaky Friday

May 20, 2025 -

Confirmed New Peaky Blinders Series Expect The Unexpected

May 20, 2025

Confirmed New Peaky Blinders Series Expect The Unexpected

May 20, 2025 -

The Putin Trump Dynamic Shifts A Power Imbalance Revealed

May 20, 2025

The Putin Trump Dynamic Shifts A Power Imbalance Revealed

May 20, 2025