Clean Energy Tax Credits: A Critical Economic Debate For America

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy Tax Credits: A Critical Economic Debate for America

America stands at a crossroads, grappling with the urgent need for a transition to clean energy while navigating complex economic considerations. At the heart of this challenge lies the ongoing debate surrounding clean energy tax credits – powerful incentives designed to accelerate the adoption of renewable energy sources and technologies. But are these credits truly delivering on their promise, or are they creating unintended consequences? This article delves into the critical economic arguments surrounding this crucial policy.

The Allure of Clean Energy Tax Credits:

The primary goal of clean energy tax credits, such as the Investment Tax Credit (ITC) for solar and wind energy and the Production Tax Credit (PTC) for wind energy, is simple: to make renewable energy more economically competitive with fossil fuels. By reducing the upfront costs of investing in solar panels, wind turbines, and other clean technologies, these credits aim to stimulate innovation, job creation, and a faster transition away from carbon-intensive energy sources. Proponents argue that these benefits far outweigh the costs, citing potential for:

- Economic Growth: The clean energy sector is a rapidly expanding industry, creating high-skilled jobs in manufacturing, installation, maintenance, and research. Tax credits fuel this growth, fostering economic dynamism and diversification.

- Energy Independence: Reducing reliance on foreign oil and gas through domestic renewable energy production enhances national security and economic stability.

- Environmental Protection: The transition to cleaner energy sources is crucial for mitigating climate change and improving air quality, leading to significant long-term health and environmental benefits. This aligns with the broader goals of the [link to relevant government initiative, e.g., Biden administration's climate plan].

The Counterarguments: Concerns and Criticisms:

However, the economic impact of clean energy tax credits isn’t universally lauded. Critics raise several concerns:

- Cost to Taxpayers: The substantial financial outlay required to fund these credits raises questions about their overall efficiency and whether the benefits justify the expense. Some argue that the funds could be better allocated to other pressing economic needs.

- Market Distortions: Critics suggest that tax credits may distort the energy market, creating an uneven playing field and potentially hindering the development of other promising clean energy technologies that don't receive the same level of support.

- Equity Concerns: The distribution of benefits from these credits is not always equitable, with some arguing that they disproportionately benefit larger corporations and wealthy investors rather than smaller businesses and communities.

Finding a Sustainable Path Forward:

The debate surrounding clean energy tax credits highlights the need for a nuanced and data-driven approach. Policymakers must carefully consider:

- Targeted Incentives: Focusing incentives on specific technologies or regions could maximize efficiency and ensure that the benefits reach those most in need.

- Transparency and Accountability: Robust monitoring and evaluation of these programs are critical to assess their effectiveness and identify areas for improvement.

- Phased Approach: A gradual phasing out of some credits, coupled with the introduction of new incentives for emerging technologies, could ensure a smooth and sustainable transition.

Conclusion:

Clean energy tax credits represent a critical component of America's economic and environmental future. While they offer significant potential benefits, careful consideration of their economic impacts and potential drawbacks is essential. A balanced approach that incorporates targeted incentives, transparency, and a phased implementation strategy is crucial to ensuring that these policies effectively support a just and sustainable transition to a cleaner energy future. The ongoing debate necessitates continued research, open dialogue, and a commitment to evidence-based policymaking. What are your thoughts on the role of clean energy tax credits in shaping America's economic landscape? Share your perspective in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy Tax Credits: A Critical Economic Debate For America. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

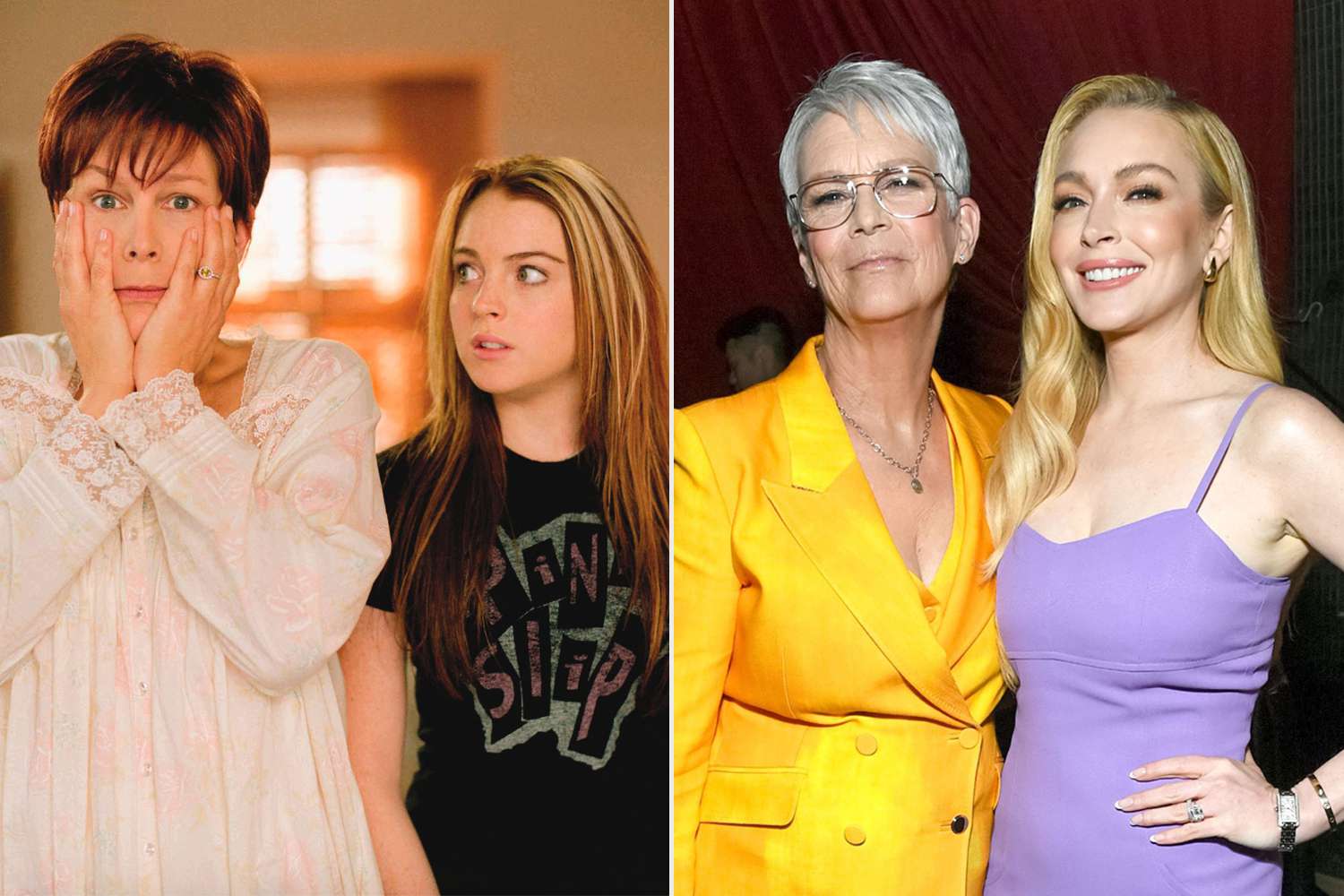

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Her Friendship With Lindsay Lohan

May 21, 2025

Freaky Friday Reunion Jamie Lee Curtis Reveals Update On Her Friendship With Lindsay Lohan

May 21, 2025 -

Big Budget Rayman Game In Development At Ubisoft Milan

May 21, 2025

Big Budget Rayman Game In Development At Ubisoft Milan

May 21, 2025 -

Improving Tourist Conduct In Bali A Call For International Assistance

May 21, 2025

Improving Tourist Conduct In Bali A Call For International Assistance

May 21, 2025 -

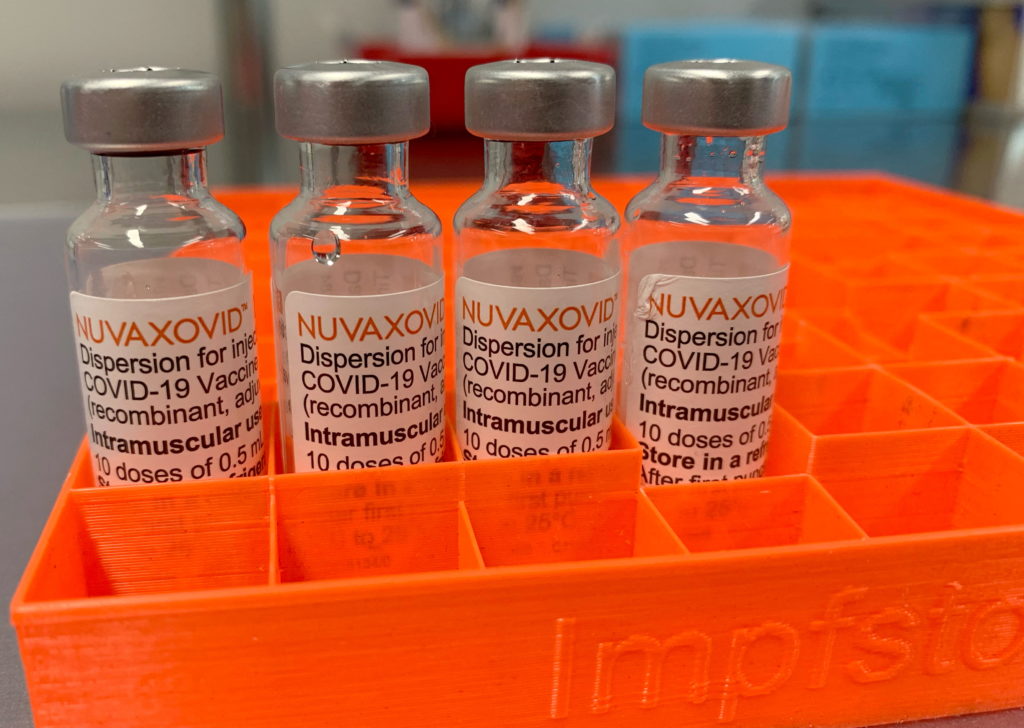

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025 -

Analysis Putin Demonstrates Unwavering Autonomy From Trumps Agenda

May 21, 2025

Analysis Putin Demonstrates Unwavering Autonomy From Trumps Agenda

May 21, 2025

Latest Posts

-

Ubisoft Milan Hiring For Unannounced Rayman Project

May 21, 2025

Ubisoft Milan Hiring For Unannounced Rayman Project

May 21, 2025 -

Health Concerns Emerge Vance Questions Bidens Presidency Following Cancer Announcement

May 21, 2025

Health Concerns Emerge Vance Questions Bidens Presidency Following Cancer Announcement

May 21, 2025 -

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025

Esports Star Uzi Gifted Electric G Wagon By Mercedes Benz

May 21, 2025 -

Riots 2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Affordable

May 21, 2025

Riots 2025 League Of Legends Hall Of Famer Revealed Will The Skin Be Affordable

May 21, 2025 -

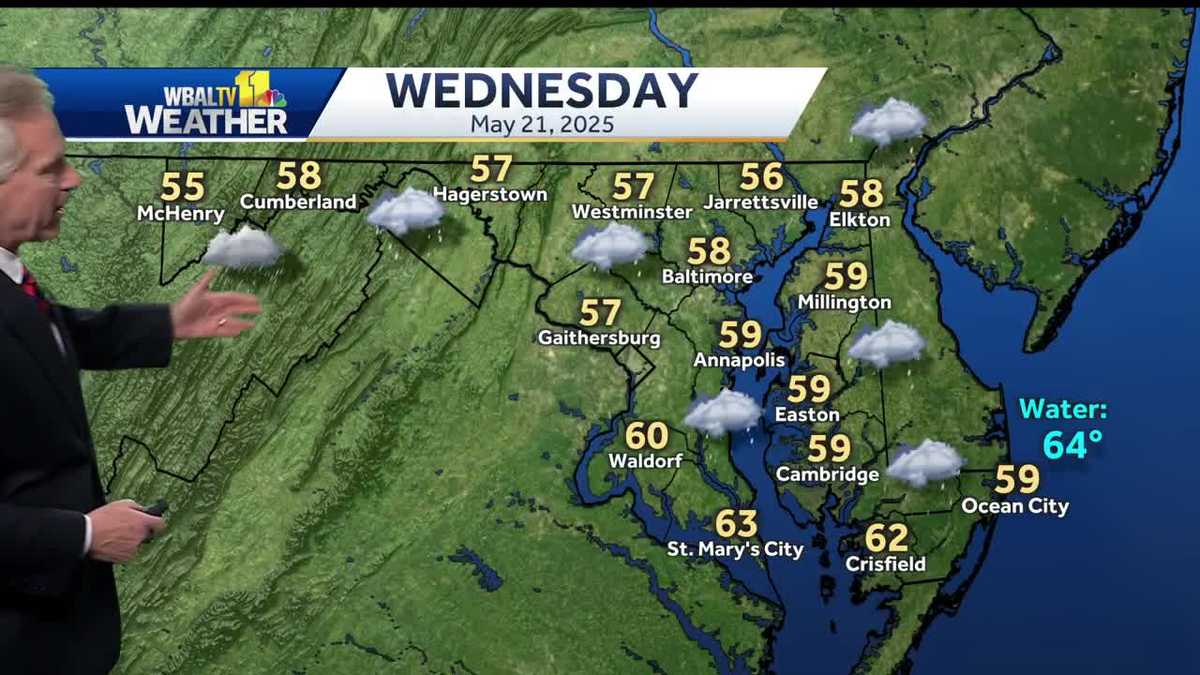

Chilly Rain To Soaked The Region Throughout Wednesday

May 21, 2025

Chilly Rain To Soaked The Region Throughout Wednesday

May 21, 2025