Clean Energy And Economic Growth: Analyzing The Tax Policy Debate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Clean Energy and Economic Growth: Analyzing the Tax Policy Debate

The relationship between clean energy investment and economic growth is a hot topic, especially within the ongoing tax policy debate. Proponents argue that incentivizing renewable energy sources like solar and wind power not only combats climate change but also stimulates job creation and fosters economic expansion. Opponents, however, raise concerns about the economic costs and potential negative impacts on certain industries. This article delves into the complexities of this debate, examining the arguments from both sides and exploring the potential economic ramifications of different tax policies.

The Case for Clean Energy Tax Incentives

Advocates for clean energy tax incentives highlight several key economic benefits. Firstly, the clean energy sector is a significant job creator. From manufacturing solar panels to installing wind turbines and developing smart grid technologies, the industry offers a diverse range of employment opportunities, often in underserved communities. A study by the National Renewable Energy Laboratory (NREL) [link to NREL study] shows a strong correlation between clean energy investment and job growth.

Furthermore, investing in clean energy technologies fosters innovation and technological advancement. Government incentives can encourage research and development, leading to breakthroughs in efficiency and cost reduction, making renewable energy sources even more competitive with fossil fuels. This technological leap can create new industries and export opportunities, boosting a nation's overall economic competitiveness.

Finally, transitioning to a clean energy economy can reduce long-term economic risks associated with climate change. The costs of extreme weather events, sea-level rise, and other climate-related disasters are substantial and are projected to increase significantly. Investing in clean energy mitigation strategies can lessen these economic burdens in the long run.

Counterarguments and Economic Concerns

Opponents of substantial clean energy tax incentives often raise concerns about the potential economic costs. They argue that subsidies for renewable energy can distort markets, leading to inefficient allocation of resources. Some fear that the transition away from fossil fuels could negatively impact jobs in the traditional energy sector, necessitating significant retraining and workforce adaptation programs.

Another concern revolves around the potential for increased energy costs for consumers. While the long-term cost of renewable energy is decreasing, the initial investment can be substantial. Carefully designed tax policies are crucial to minimizing the burden on consumers and ensuring a just transition.

Navigating the Tax Policy Landscape

Finding the optimal balance between promoting clean energy and managing economic risks is a crucial challenge for policymakers. Effective tax policies should consider:

- Targeted Incentives: Focusing on specific technologies or sectors that show the greatest potential for economic growth and environmental impact.

- Phased Implementation: Gradually increasing incentives to allow for a smoother transition and minimize disruptions to existing industries.

- Investment in Workforce Development: Providing training and retraining programs to support workers in the transition to clean energy jobs.

- Revenue Neutrality: Designing tax policies that don't increase the overall budget deficit, perhaps through carbon taxes or other revenue-generating mechanisms.

Conclusion: A Path Towards Sustainable Economic Growth

The debate surrounding clean energy and economic growth is complex, but the potential benefits of a transition to a sustainable energy system are undeniable. Well-designed tax policies are critical to navigating the challenges and maximizing the opportunities presented by this transition. By carefully considering the economic impacts and implementing strategies that support both environmental sustainability and economic prosperity, governments can chart a course towards a future where clean energy and economic growth go hand in hand. Further research and open dialogue are essential to inform the development of effective and equitable policies that benefit all stakeholders.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Clean Energy And Economic Growth: Analyzing The Tax Policy Debate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

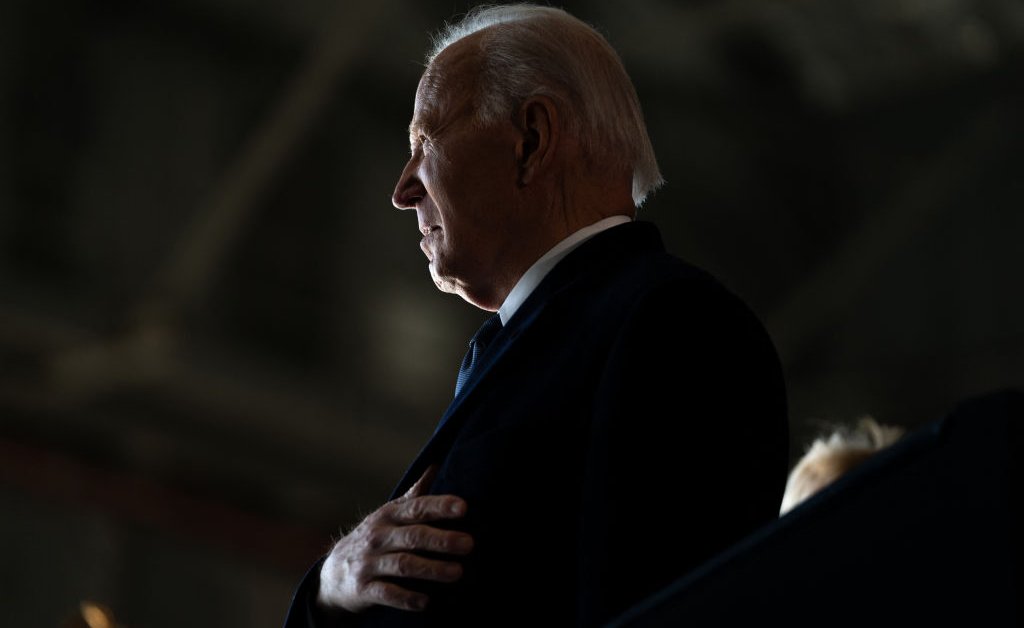

International Support Floods In For President Biden Post Cancer Announcement

May 21, 2025

International Support Floods In For President Biden Post Cancer Announcement

May 21, 2025 -

New Rayman Game On The Horizon Ubisoft Milans Open Positions

May 21, 2025

New Rayman Game On The Horizon Ubisoft Milans Open Positions

May 21, 2025 -

Solo Levelings Award Winning Success A Look At The Future

May 21, 2025

Solo Levelings Award Winning Success A Look At The Future

May 21, 2025 -

Venezuelan Migrants Lose Protections Supreme Court Upholds Trump Era Policy

May 21, 2025

Venezuelan Migrants Lose Protections Supreme Court Upholds Trump Era Policy

May 21, 2025 -

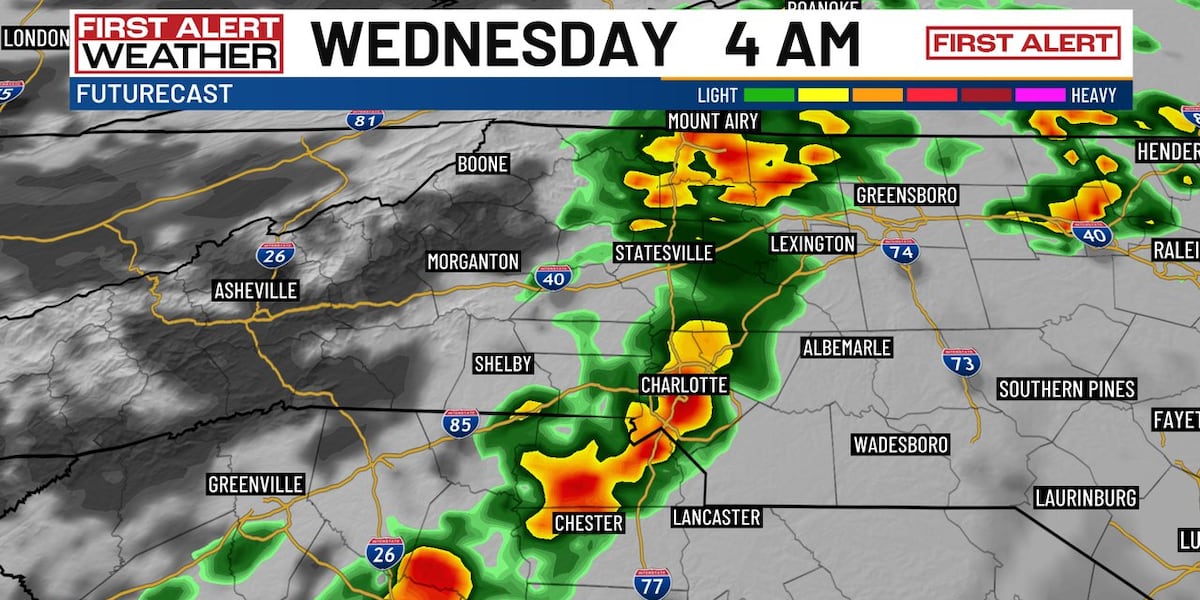

Severe Weather Possible Overnight Storms Target Charlotte Temperatures To Plummet

May 21, 2025

Severe Weather Possible Overnight Storms Target Charlotte Temperatures To Plummet

May 21, 2025