$5 Billion+ Poured Into Bitcoin ETFs: Is This A Bull Market Signal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: Is This a Bull Market Signal?

The cryptocurrency market is buzzing after a staggering influx of over $5 billion into Bitcoin exchange-traded funds (ETFs) in recent weeks. This massive investment has sparked intense debate: is this a significant bullish signal, pointing towards a sustained price increase for Bitcoin, or merely a temporary surge driven by specific market factors? Let's delve into the details and explore the potential implications.

The ETF Rush: A Closer Look

The recent surge in Bitcoin ETF investments represents a significant shift in institutional interest. Several factors likely contributed to this influx:

-

SEC Approvals: The much-anticipated approval of Bitcoin futures ETFs in the US opened the floodgates for institutional investors seeking regulated exposure to Bitcoin. This regulatory clarity reduced the perceived risk, encouraging larger-scale participation.

-

Grayscale's GBTC Transformation: The conversion of Grayscale Bitcoin Trust (GBTC) to an ETF is another significant factor. This move unlocked substantial value for existing GBTC holders and further solidified the ETF's role as a primary vehicle for Bitcoin investment.

-

Growing Institutional Adoption: Beyond ETFs, we're seeing a broader trend of institutional adoption of Bitcoin. Major corporations and financial institutions are increasingly adding Bitcoin to their portfolios, indicating growing confidence in the asset's long-term potential.

Is This a Bull Market Signal? The Case for Optimism

The sheer volume of investment into Bitcoin ETFs suggests a strong underlying belief in the future price of Bitcoin. This influx of capital can create positive feedback loops:

-

Increased Liquidity: Greater liquidity in the Bitcoin market makes it easier for investors to buy and sell, potentially reducing price volatility and attracting further investment.

-

Price Support: The substantial amount of capital locked in ETFs acts as a significant support level for the Bitcoin price. Large-scale sell-offs become less likely as ETF holders are less inclined to quickly liquidate their positions.

-

Mainstream Adoption: The growing acceptance of Bitcoin ETFs by regulatory bodies and institutional investors signals a growing level of mainstream acceptance, further boosting confidence and potentially attracting retail investors.

Potential Counterarguments: A Cautious Approach

While the influx of capital into Bitcoin ETFs is undeniably bullish, it's crucial to avoid overinterpreting this data. Several factors temper the exuberance:

-

Macroeconomic Uncertainty: Global macroeconomic conditions, including inflation and interest rate hikes, continue to impact investor sentiment across all asset classes, including cryptocurrencies.

-

Regulatory Landscape: The regulatory environment for cryptocurrencies remains uncertain in many jurisdictions. Future regulatory changes could impact Bitcoin's price and investor confidence.

-

Market Cycles: Bitcoin's price is inherently volatile and subject to cyclical market patterns. The current ETF-driven price increase may simply be a temporary phase within a larger market cycle.

Conclusion: A Balanced Perspective

The $5 billion+ poured into Bitcoin ETFs is a significant event with considerable bullish implications. Increased institutional adoption and regulatory clarity are major contributing factors. However, it's essential to maintain a balanced perspective, considering macroeconomic uncertainties and the inherent volatility of the cryptocurrency market. While this could be a strong bullish signal, it's not a guarantee of sustained price growth. Investors should conduct thorough research and manage their risk accordingly.

Further Reading:

- [Link to a reputable article on Bitcoin ETF approvals]

- [Link to a reputable article on Grayscale's GBTC conversion]

- [Link to a reputable article on macroeconomic factors impacting crypto]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5 Billion+ Poured Into Bitcoin ETFs: Is This A Bull Market Signal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

A Candid Look At Jamie Lee Curtis And Lindsay Lohans Relationship

May 21, 2025

A Candid Look At Jamie Lee Curtis And Lindsay Lohans Relationship

May 21, 2025 -

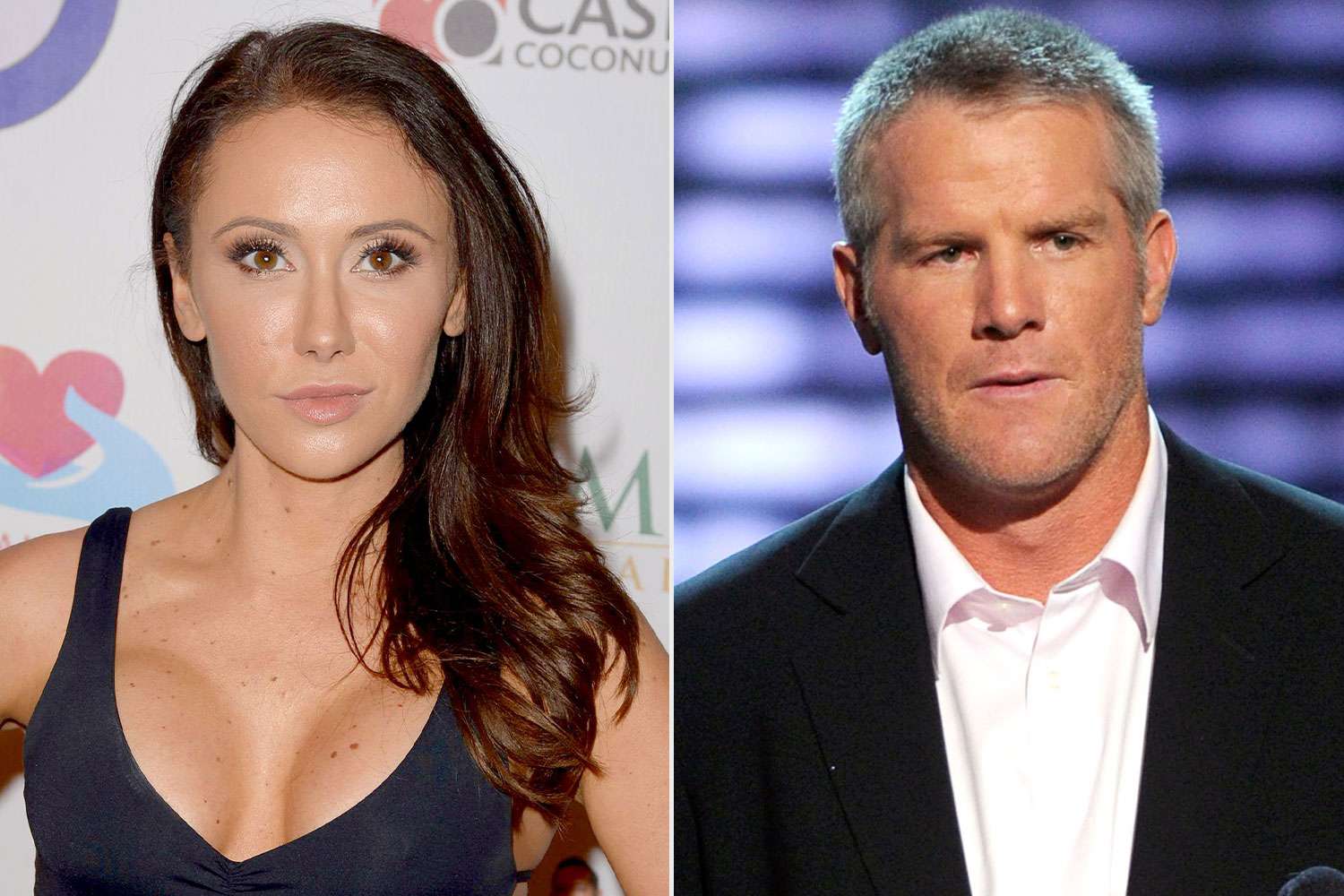

Jenn Sterger Reflects On Brett Favre Scandal The Personal Cost Of Public Humiliation

May 21, 2025

Jenn Sterger Reflects On Brett Favre Scandal The Personal Cost Of Public Humiliation

May 21, 2025 -

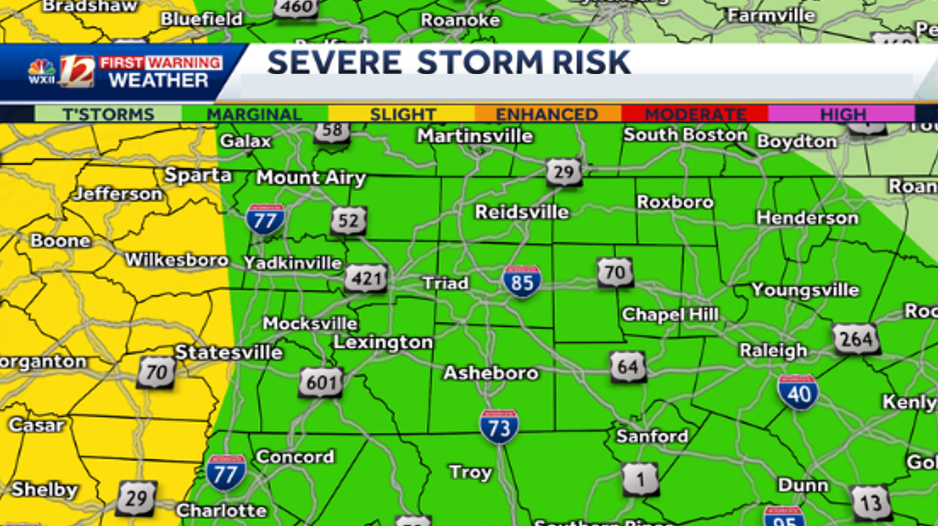

Overnight Storms Bring Severe Weather Threat To North Carolina

May 21, 2025

Overnight Storms Bring Severe Weather Threat To North Carolina

May 21, 2025 -

Taylor Jenkins Reids Path To Success A Study In Publishing Dominance

May 21, 2025

Taylor Jenkins Reids Path To Success A Study In Publishing Dominance

May 21, 2025 -

Solo Levelings Award Winning Success A Look At Its Rising Popularity

May 21, 2025

Solo Levelings Award Winning Success A Look At Its Rising Popularity

May 21, 2025