Chinese EV Maker NIO's Q1 2024 Results: A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO's Q1 2024 Results: A Deep Dive into Revenue, Deliveries, and Future Outlook

NIO, a leading player in the burgeoning Chinese electric vehicle (EV) market, recently released its Q1 2024 financial results, revealing a mixed bag of successes and challenges. While delivery numbers showed impressive growth, certain factors point to a more complex picture for the company's future. This deep dive analyzes NIO's performance, highlighting key takeaways for investors and EV enthusiasts alike.

Record Deliveries, but Revenue Falls Short of Expectations:

NIO announced record vehicle deliveries for Q1 2024, exceeding analyst predictions. This surge in deliveries is largely attributed to the successful launch of new models and increased consumer demand fueled by government incentives and growing awareness of sustainable transportation. However, despite the strong delivery numbers, overall revenue fell slightly short of expectations. This discrepancy highlights the ongoing pressure on profitability within the competitive Chinese EV landscape. The company cited increased competition and pricing pressures as contributing factors.

Analyzing the Numbers: Key Financial Highlights:

- Vehicle Deliveries: [Insert exact Q1 2024 delivery figures here]. This represents a [percentage]% increase compared to Q1 2023.

- Revenue: [Insert exact Q1 2024 revenue figures here]. This figure is [higher/lower] than expected and represents a [percentage]% [increase/decrease] compared to Q1 2023.

- Gross Profit Margin: [Insert exact Q1 2024 gross profit margin here]. A key indicator of profitability, this figure reflects the company's efficiency in managing production costs.

- Net Loss: [Insert exact Q1 2024 net loss figures here]. While NIO continues to operate at a net loss, the figures should be analyzed in context with the company's growth trajectory and investments in R&D.

Challenges and Opportunities for NIO in the Chinese EV Market:

The Chinese EV market is incredibly dynamic, marked by intense competition from both established automakers and emerging startups. NIO faces several challenges:

- Intense Competition: Companies like BYD, Tesla, and several other Chinese EV manufacturers are fiercely competing for market share, leading to price wars and pressure on profit margins.

- Supply Chain Disruptions: Global supply chain issues continue to impact production and delivery timelines, adding to operational challenges.

- Pricing Pressure: Maintaining profitability while navigating competitive pricing strategies is a crucial balancing act for NIO.

However, NIO also possesses significant opportunities:

- Innovation and Technology: NIO's focus on advanced technology, including battery swap technology and autonomous driving capabilities, provides a strong competitive advantage.

- Expanding Market Reach: Continued expansion into new markets both within China and internationally can drive growth.

- Brand Loyalty: Cultivating strong brand loyalty amongst its customer base is crucial for long-term success.

Looking Ahead: NIO's Future Outlook:

NIO's Q1 2024 results paint a complex picture. While record deliveries are encouraging, the revenue shortfall and ongoing challenges underscore the need for strategic adjustments. The company's future success hinges on its ability to navigate intense competition, manage costs effectively, and continue to innovate in the rapidly evolving EV market. Investors will be closely watching NIO's strategies for maintaining profitability while driving further growth. Further analysis of their future product roadmap and market penetration strategies will be crucial in determining their long-term prospects.

Call to Action: What are your thoughts on NIO's Q1 2024 performance? Share your insights in the comments below! [Optional: Link to a relevant discussion forum or social media page].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO's Q1 2024 Results: A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Dimon Highlights Top Priority For Trump Administration

Jun 03, 2025

Jamie Dimon Highlights Top Priority For Trump Administration

Jun 03, 2025 -

Another Dte Rate Hike Looms Threatening Michigan Families Financial Stability

Jun 03, 2025

Another Dte Rate Hike Looms Threatening Michigan Families Financial Stability

Jun 03, 2025 -

Rising Dte Rates A Looming Financial Crisis For Michigan Households

Jun 03, 2025

Rising Dte Rates A Looming Financial Crisis For Michigan Households

Jun 03, 2025 -

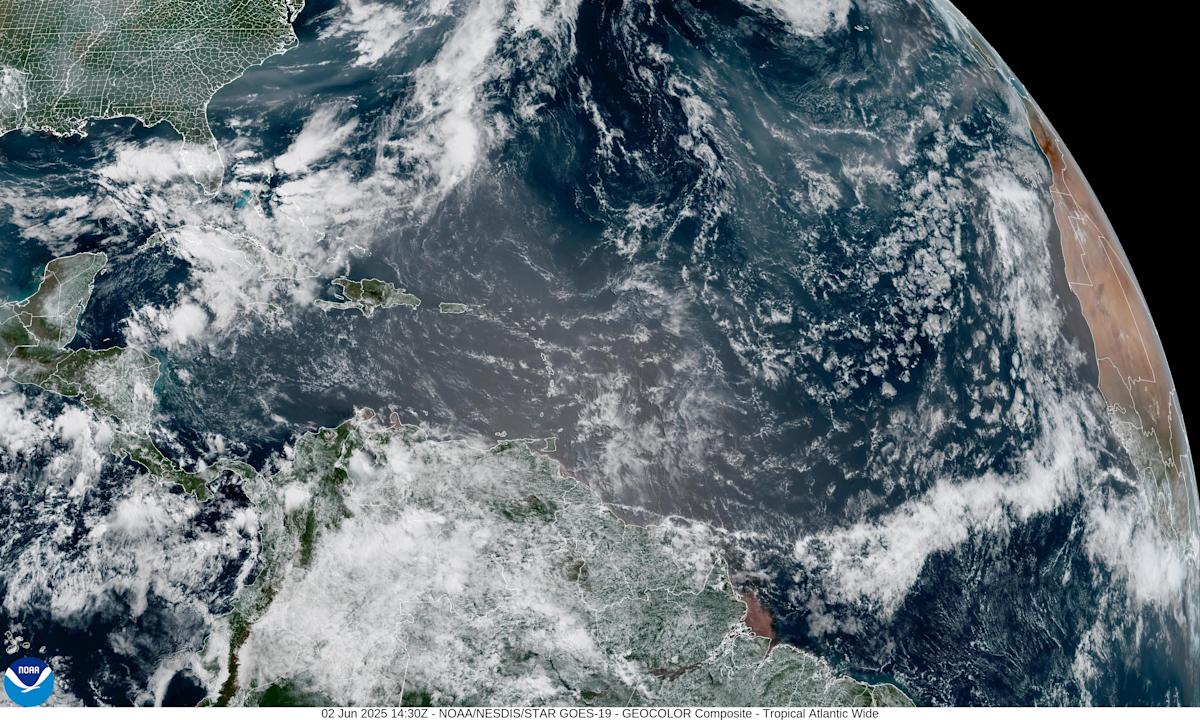

Air Quality Alert Florida Faces Health Risks From Dust And Smoke

Jun 03, 2025

Air Quality Alert Florida Faces Health Risks From Dust And Smoke

Jun 03, 2025 -

Asian Markets Monday June 2 2025 Economic Data To Watch

Jun 03, 2025

Asian Markets Monday June 2 2025 Economic Data To Watch

Jun 03, 2025