Asian Markets Monday, June 2, 2025: Economic Data To Watch

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Asian Markets Monday, June 2, 2025: Economic Data to Watch Closely

Asian markets are bracing for a busy Monday, June 2nd, 2025, with a slew of crucial economic data releases poised to significantly impact trading activity across the region. Investors will be keenly focused on indicators that could signal shifts in monetary policy and overall economic health. From inflation figures to manufacturing PMIs, the day's releases hold the potential for considerable market volatility.

Key Economic Indicators to Watch:

-

China's Manufacturing PMI (Caixin): This influential indicator provides insights into the health of China's vast manufacturing sector. A strong reading could boost investor confidence, while a weaker-than-expected number could trigger concerns about slowing growth and impact global supply chains. Analysts will be particularly scrutinizing any signs of weakening demand, given China's role as a global manufacturing powerhouse. [Link to a reputable source for China's PMI data]

-

Japan's Consumer Price Index (CPI): Inflation remains a key concern globally, and Japan's CPI will offer valuable clues about the effectiveness of the Bank of Japan's monetary policy. Persistent inflationary pressures could force a reconsideration of current interest rate strategies, potentially impacting the Yen and broader Asian markets. [Link to a reputable source for Japan's CPI data]

-

India's Industrial Production: Data on India's industrial output will provide a barometer of the nation's economic growth trajectory. As a rapidly developing economy, India's performance significantly influences regional and global market sentiment. Strong growth figures could attract further foreign investment. [Link to a reputable source for India's Industrial Production data]

Beyond the Numbers: Geopolitical Factors in Play

While economic data will dominate the headlines, geopolitical factors continue to cast a long shadow over Asian markets. Ongoing trade tensions, regional security concerns, and global supply chain disruptions could all contribute to market uncertainty. Investors are advised to carefully consider these broader contexts when interpreting the day's economic releases.

Market Predictions and Analyst Opinions:

Several leading analysts predict a mixed bag for Asian markets on Monday. Some anticipate a positive response to strong economic data from key players like China and India, while others warn of potential corrections based on persistent inflationary pressures and geopolitical risks. [Link to a reputable financial news source providing analyst commentary]

How to Navigate Market Volatility:

The upcoming economic releases highlight the importance of a well-diversified investment portfolio and a robust risk management strategy. Investors are encouraged to consult with financial advisors to tailor their investment approaches to the specific risks and opportunities presented by the current market environment. Staying informed about economic developments and geopolitical events is crucial for navigating this potentially volatile period.

Conclusion:

Monday, June 2nd, 2025, promises to be a pivotal day for Asian markets. The release of key economic indicators will provide critical insights into the region's economic health and future trajectory. Investors should closely monitor the data and consider the broader geopolitical landscape to make informed investment decisions. Remember to always conduct thorough research and seek professional advice before making any significant investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Asian Markets Monday, June 2, 2025: Economic Data To Watch. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

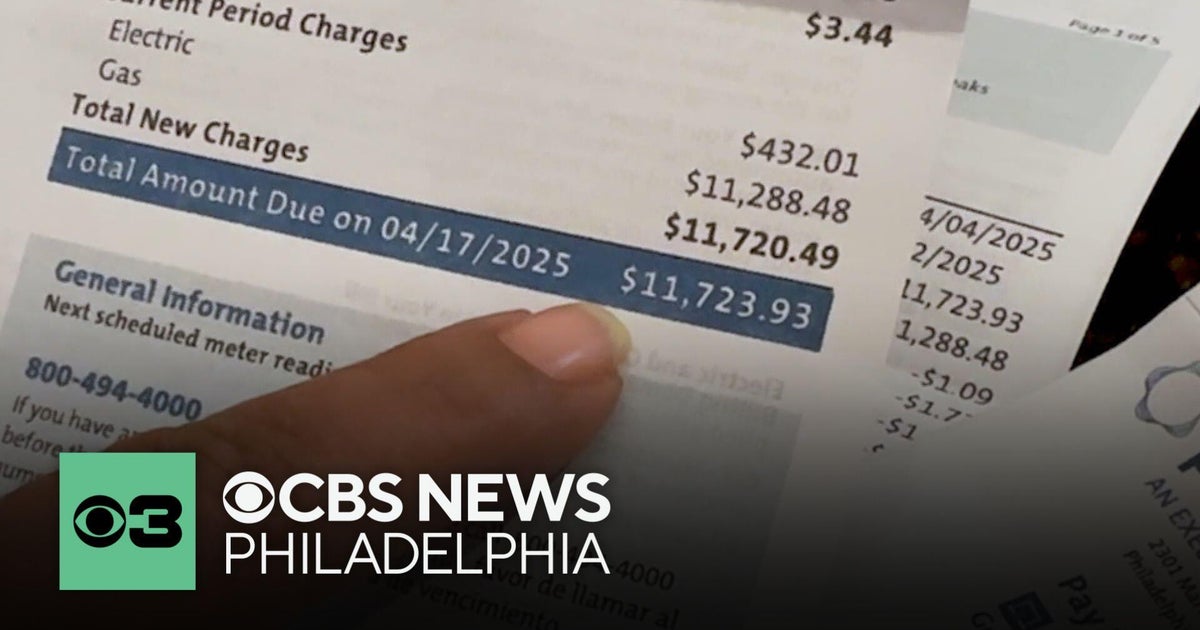

Peco Billing Error 12 000 Bill After Months Without Statements

Jun 03, 2025

Peco Billing Error 12 000 Bill After Months Without Statements

Jun 03, 2025 -

Miley Cyrus Reflects On Maturing Relationship With Parents

Jun 03, 2025

Miley Cyrus Reflects On Maturing Relationship With Parents

Jun 03, 2025 -

One Month Manhunt Concludes Arrest Made In North Texas Capital Murder Case

Jun 03, 2025

One Month Manhunt Concludes Arrest Made In North Texas Capital Murder Case

Jun 03, 2025 -

New Discovery Scientists Investigate A Strange Pulsating Star

Jun 03, 2025

New Discovery Scientists Investigate A Strange Pulsating Star

Jun 03, 2025 -

Brazils Finance Ministry A Green Economic Future

Jun 03, 2025

Brazils Finance Ministry A Green Economic Future

Jun 03, 2025