Chinese EV Maker NIO Reports Q1 Earnings: What To Expect

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese EV Maker NIO Reports Q1 Earnings: What to Expect

Chinese electric vehicle (EV) giant NIO is set to report its first-quarter 2024 earnings, and investors are eagerly anticipating the results. The report, expected [Insert Expected Release Date Here], will offer crucial insights into the company's performance amidst a rapidly evolving global EV market and ongoing challenges in China's automotive sector. This article delves into the key factors influencing NIO's Q1 performance and what investors should be watching for.

NIO's Q1 2024: Navigating a Complex Landscape

NIO, known for its premium EVs and battery-as-a-service (BaaS) model, faces a multifaceted landscape. China's EV market, while still a significant growth area, is becoming increasingly competitive. Established players and a surge of new entrants are vying for market share, resulting in price wars and pressure on profit margins. Furthermore, macroeconomic factors, including fluctuating raw material costs and overall economic conditions in China, could significantly impact NIO's financial performance.

Key Metrics to Watch: Beyond Vehicle Deliveries

While vehicle delivery numbers are always a headline grabber, a comprehensive analysis of NIO's Q1 earnings requires a deeper dive. Here are the key metrics investors should focus on:

- Vehicle Deliveries: The overall number of vehicles delivered in Q1 will provide a snapshot of market demand for NIO's products. Any significant deviation from analysts' expectations will likely move the stock price.

- Revenue Growth: Sustained revenue growth is crucial for demonstrating NIO's ability to scale its operations and maintain profitability. Investors will be keen to see the overall revenue figures and the breakdown by vehicle model.

- Gross Margin: With intense competition, maintaining healthy gross margins is vital for NIO's long-term success. Pressure on pricing could significantly impact this key metric.

- Research and Development (R&D) Expenses: NIO's continued investment in R&D reflects its commitment to innovation and future product development. Investors will want to see a balance between innovation and cost control.

- Battery-as-a-Service (BaaS) Performance: The performance of NIO's BaaS model will be a key indicator of its long-term business strategy. Growth in BaaS subscriptions and revenue will signal its success.

- Guidance for Q2 and Full Year 2024: NIO's forward-looking guidance will provide valuable insight into its expectations for the rest of the year. This will be a critical factor in shaping investor sentiment.

Challenges and Opportunities for NIO

NIO's success hinges on its ability to overcome several challenges:

- Intense Competition: The Chinese EV market is fiercely competitive. NIO needs to differentiate itself through innovative technology, superior customer service, and a strong brand image.

- Supply Chain Issues: Global supply chain disruptions could continue to impact production and delivery timelines. Efficient supply chain management will be crucial.

- Pricing Pressure: Maintaining profitability while navigating price wars requires a strategic approach to cost management and product differentiation.

However, NIO also has significant opportunities:

- Expanding Overseas Markets: International expansion could significantly boost NIO's revenue streams and reduce reliance on the Chinese market.

- Technological Innovation: Continued investment in R&D and innovative technologies will help NIO maintain a competitive edge.

- Growing Demand for EVs: The global transition to electric vehicles presents a massive long-term growth opportunity.

Conclusion: A Crucial Report for NIO

NIO's Q1 2024 earnings report will be a significant event for investors. The results will offer a clear picture of the company's performance and its ability to navigate the complex challenges and opportunities in the dynamic Chinese and global EV markets. A comprehensive analysis of the key metrics mentioned above will be crucial in understanding the long-term prospects of this leading Chinese EV maker. Stay tuned for updates following the official release. What are your predictions for NIO's Q1 performance? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese EV Maker NIO Reports Q1 Earnings: What To Expect. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unraveling The Mystery Scientists Study A Peculiar Pulsating Star

Jun 03, 2025

Unraveling The Mystery Scientists Study A Peculiar Pulsating Star

Jun 03, 2025 -

Increased Steel And Aluminum Tariffs Trumps Justification And The Risks

Jun 03, 2025

Increased Steel And Aluminum Tariffs Trumps Justification And The Risks

Jun 03, 2025 -

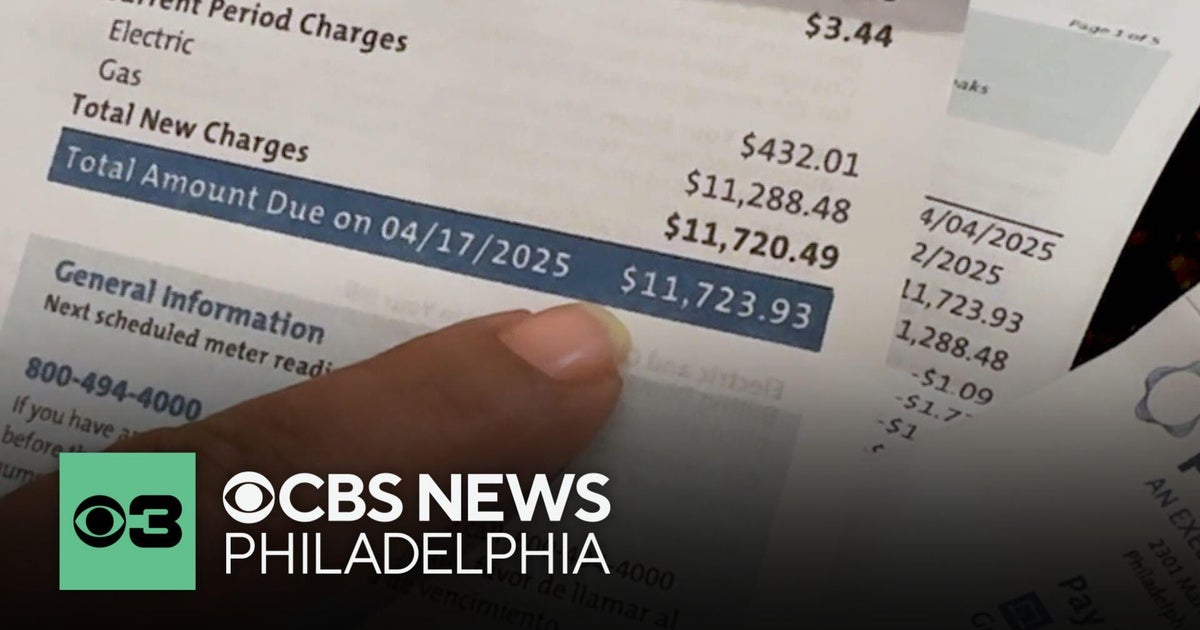

Months Of Missing Bills Lead To 12 000 Peco Bill Surprise For Pennsylvania Resident

Jun 03, 2025

Months Of Missing Bills Lead To 12 000 Peco Bill Surprise For Pennsylvania Resident

Jun 03, 2025 -

Investing In Hims And Hers Hims A Risky But Potentially Rewarding Venture

Jun 03, 2025

Investing In Hims And Hers Hims A Risky But Potentially Rewarding Venture

Jun 03, 2025 -

Nio Q1 Earnings Looming Stock Drop Presents Opportunity

Jun 03, 2025

Nio Q1 Earnings Looming Stock Drop Presents Opportunity

Jun 03, 2025