Business And Finance's Honest Conversation On Climate Change

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance Finally Have an Honest Conversation About Climate Change

The climate crisis isn't just an environmental issue; it's a massive financial one. For years, the business and finance worlds tiptoed around the elephant in the room – the devastating economic consequences of unchecked climate change. But a seismic shift is underway. A more honest and urgent conversation about climate risk is finally taking place, driven by mounting evidence, increasing regulatory pressure, and a growing awareness of the potential for both catastrophic losses and lucrative green opportunities.

The Stakes Are Higher Than Ever

The impacts of climate change are no longer hypothetical. Extreme weather events – from hurricanes and wildfires to droughts and floods – are becoming more frequent and intense, causing billions of dollars in damage and disrupting global supply chains. [Link to a reputable source on climate change economic impacts, e.g., a report from the IPCC or World Bank]. This translates directly to financial losses for businesses across all sectors, impacting everything from insurance premiums to asset valuations.

Financial Institutions Leading the Charge

Leading financial institutions are recognizing the inherent risks and are beginning to take action. Many are incorporating climate-related financial disclosures (TCFD) into their reporting, providing greater transparency about their exposure to climate-related risks. [Link to a relevant TCFD resource]. This move reflects a growing understanding that ignoring climate change is no longer a viable option. Moreover, several major banks are committing to significant reductions in their carbon footprints and actively investing in renewable energy projects. This isn't just about ethical responsibility; it's about mitigating financial risk and capitalizing on a burgeoning green economy.

Beyond Risk Management: Embracing the Green Opportunity

The shift towards a low-carbon economy presents enormous opportunities for businesses and investors. The global market for renewable energy, green technology, and sustainable products and services is experiencing explosive growth. Companies that are proactively adapting to the changing climate landscape and investing in sustainable solutions are likely to be the winners in the long run. This includes:

- Investing in renewable energy infrastructure: Solar, wind, and other renewable energy sources are becoming increasingly cost-competitive with fossil fuels.

- Developing climate-resilient products and services: Businesses that can adapt to the changing climate and offer solutions to climate-related challenges will be in high demand.

- Adopting sustainable business practices: Reducing carbon emissions, improving energy efficiency, and minimizing waste can significantly lower operating costs and enhance a company's reputation.

Challenges Remain: Bridging the Gap Between Awareness and Action

Despite the growing awareness, significant challenges remain. Accurate climate risk assessment is complex and requires sophisticated data and modeling. Furthermore, a lack of consistent global regulations and standards makes it difficult for businesses to navigate the evolving landscape. There's a need for greater collaboration between governments, businesses, and investors to develop effective policies and frameworks to support the transition to a low-carbon economy.

The Future of Finance is Green

The conversation has changed. Ignoring climate change is no longer a financially viable option. Businesses and financial institutions are increasingly recognizing the urgent need to integrate climate risk into their strategies and embrace the opportunities presented by the green economy. This transition won't be easy, but it's essential for the long-term health of the planet and the global economy. The future of finance is undeniably green, and those who fail to adapt risk being left behind.

Call to Action: Learn more about climate-related financial risks and opportunities by visiting [link to a relevant resource, e.g., a government website or NGO]. Engage in the conversation and advocate for policies that promote a sustainable future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Honest Conversation On Climate Change. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fc Bayern Wirtz Sendet Botschaft Nach Liverpool Besuch In England

May 15, 2025

Fc Bayern Wirtz Sendet Botschaft Nach Liverpool Besuch In England

May 15, 2025 -

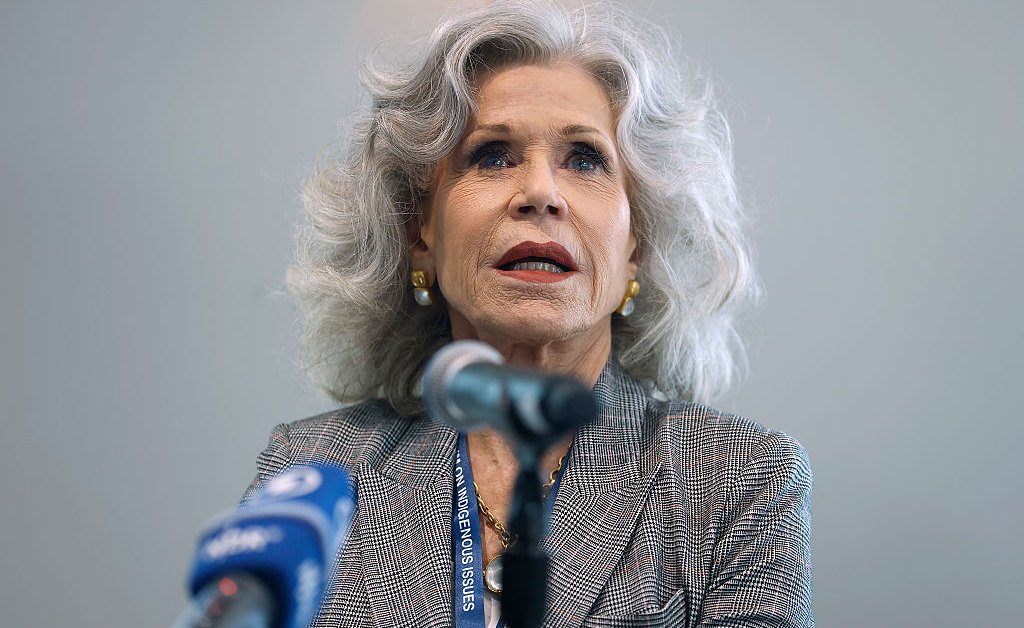

Jane Fondas Ecuador Rainforest Campaign A Deep Dive

May 15, 2025

Jane Fondas Ecuador Rainforest Campaign A Deep Dive

May 15, 2025 -

Who Will Coach The Bruins Next Season Analyzing Four Leading Contenders

May 15, 2025

Who Will Coach The Bruins Next Season Analyzing Four Leading Contenders

May 15, 2025 -

Trumps Tariff Retreat A Strategic Shift Or Concessions To China

May 15, 2025

Trumps Tariff Retreat A Strategic Shift Or Concessions To China

May 15, 2025 -

Mendizorroza Y La Ceramica Escenarios Decisivos Para El Descenso Y La Lucha Por Europa

May 15, 2025

Mendizorroza Y La Ceramica Escenarios Decisivos Para El Descenso Y La Lucha Por Europa

May 15, 2025