Rigetti (RGTI) Q1 Earnings Miss Sends Stock Into Freefall: Quantum Leap Or Market Misstep?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rigetti (RGTI) Q1 Earnings Miss Sends Stock into Freefall: Quantum Leap or Market Misstep?

Rigetti Computing (RGTI), a prominent player in the burgeoning field of quantum computing, experienced a significant downturn following its release of underwhelming first-quarter earnings. The stock plummeted, leaving investors questioning whether this represents a temporary setback or a more fundamental issue within the company's trajectory. This article delves into the details of the earnings miss, analyzes potential contributing factors, and explores the future outlook for Rigetti and the broader quantum computing market.

Q1 Earnings: A Disappointing Report Card

Rigetti's Q1 2024 earnings report revealed a wider-than-expected loss, significantly impacting investor confidence. The company missed revenue projections, raising concerns about its ability to effectively commercialize its quantum computing technology. While the company highlighted progress in its technological development, the market reacted negatively to the lack of tangible financial results. This underscores the current challenge faced by many quantum computing companies: balancing long-term technological advancement with near-term financial viability.

Factors Contributing to the Stock Decline:

Several factors likely contributed to the sharp decline in Rigetti's stock price. These include:

- Missed Revenue Expectations: The most immediate factor was the failure to meet anticipated revenue targets. This suggests challenges in securing contracts and generating revenue from its quantum computing services.

- Increased Competition: The quantum computing landscape is becoming increasingly competitive, with established tech giants and emerging startups vying for market share. This intense competition puts pressure on Rigetti to demonstrate a clear competitive advantage.

- Investor Sentiment: The overall market sentiment towards technology stocks has been somewhat cautious recently, potentially exacerbating the negative reaction to Rigetti's earnings report. Investors may be more risk-averse in the current economic climate.

- High Development Costs: The development of quantum computing technology is inherently capital-intensive. Rigetti's significant research and development expenses may be contributing to its current financial challenges.

Is this a temporary setback or a long-term problem?

The question remains: Is Rigetti's current predicament a temporary setback, or does it reflect deeper underlying issues? While the Q1 earnings were undoubtedly disappointing, it's crucial to consider the long-term potential of the quantum computing industry. Many analysts still believe that quantum computing holds immense promise, and Rigetti possesses some key advantages, including its advanced fabrication capabilities.

The Future of Rigetti and Quantum Computing:

The future success of Rigetti hinges on several key factors:

- Accelerated Commercialization: Rigetti needs to demonstrate a clear path towards commercial success by securing more contracts and generating substantial revenue streams.

- Strategic Partnerships: Collaborations with industry leaders could provide Rigetti with access to resources, expertise, and broader market reach.

- Technological Innovation: Continued advancements in quantum computing technology are essential for maintaining a competitive edge.

- Investor Confidence: Regaining investor confidence will be crucial for securing further funding and supporting long-term growth.

Conclusion:

The recent stock decline of Rigetti following its Q1 earnings miss raises important questions about the company's near-term prospects. However, the long-term potential of quantum computing remains significant. Whether Rigetti can navigate the challenges it faces and capitalize on the industry's growth remains to be seen. Only time will tell if this represents a temporary market misstep or a more serious hurdle in its quest to become a quantum computing leader. Further developments and future earnings reports will be crucial in shaping the narrative around Rigetti's future. Investors should closely monitor the company's progress and strategic initiatives.

Keywords: Rigetti, RGTI, Quantum Computing, Earnings, Stock, Market, Investment, Technology, Revenue, Competition, Innovation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rigetti (RGTI) Q1 Earnings Miss Sends Stock Into Freefall: Quantum Leap Or Market Misstep?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Assad Meeting Follows Announcement Of Syria Sanctions Removal

May 15, 2025

Trump Assad Meeting Follows Announcement Of Syria Sanctions Removal

May 15, 2025 -

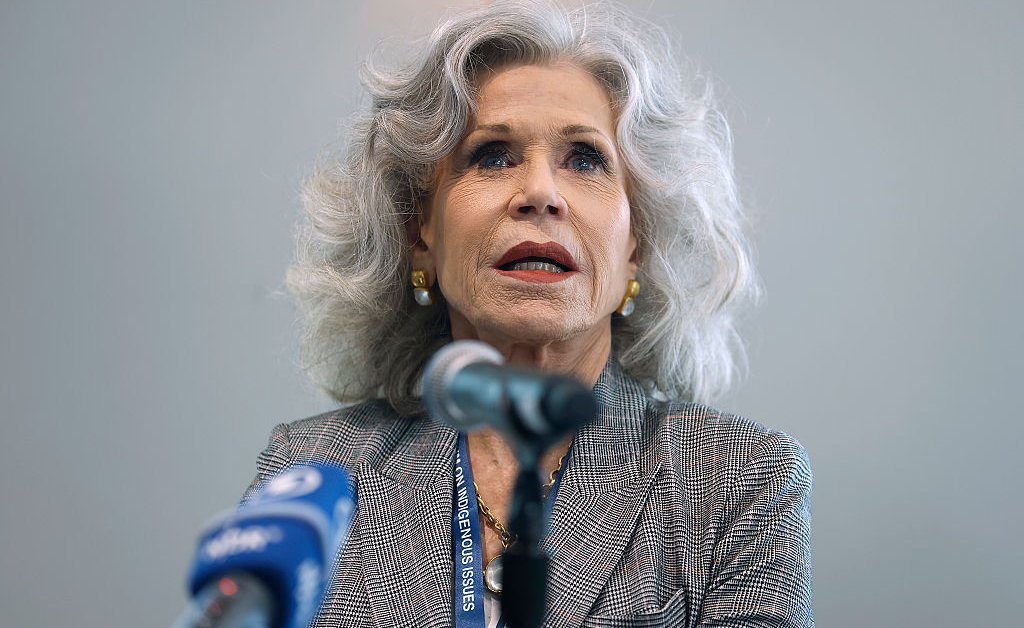

Jane Fonda Fights For Ecuador A Rainforest Conservation Campaign

May 15, 2025

Jane Fonda Fights For Ecuador A Rainforest Conservation Campaign

May 15, 2025 -

Alaves Vs Valencia Past Results Team News And Betting Odds La Liga Ea Sports

May 15, 2025

Alaves Vs Valencia Past Results Team News And Betting Odds La Liga Ea Sports

May 15, 2025 -

Sin Abqar Coudet Llama A Toda La Plantilla Del Celta

May 15, 2025

Sin Abqar Coudet Llama A Toda La Plantilla Del Celta

May 15, 2025 -

2025 Soccer Pick Rayo Vallecano Vs Betis Prediction And Betting Odds

May 15, 2025

2025 Soccer Pick Rayo Vallecano Vs Betis Prediction And Betting Odds

May 15, 2025