Business And Finance's Evolving Narrative On Climate Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Business and Finance's Evolving Narrative on Climate Risk: From Threat to Opportunity

The narrative surrounding climate risk in the business and finance sectors is undergoing a dramatic shift. No longer viewed solely as a looming threat, climate change is increasingly recognized as a significant source of both risk and opportunity. This evolution is driven by a confluence of factors, including growing scientific evidence, heightened regulatory scrutiny, and a surge in investor demand for sustainable investments. This article explores this evolving landscape, examining the key drivers and implications for businesses and financial institutions.

The Rising Tide of Climate-Related Risks:

For years, the primary focus on climate risk was its potential to disrupt operations and damage assets. Extreme weather events, such as hurricanes and floods, directly impact physical infrastructure, leading to significant financial losses. [Link to a reputable source on climate-related financial losses]. Beyond physical risks, businesses face transition risks stemming from policy changes, technological advancements, and shifting consumer preferences. The transition to a low-carbon economy necessitates significant investment in new technologies and operational changes, posing challenges for companies unprepared for the shift.

From Threat to Opportunity: The Emergence of Sustainable Finance:

However, the narrative is changing. The growing awareness of climate risk has spurred a parallel rise in sustainable finance. Investors are increasingly demanding transparency and accountability from companies regarding their environmental, social, and governance (ESG) performance. [Link to an article about the growth of ESG investing]. This demand fuels the development of green bonds, sustainable investment funds, and other financial instruments designed to channel capital towards climate-friendly projects and businesses.

Key Drivers of the Narrative Shift:

Several key factors are accelerating this transformation:

- Increased Regulatory Scrutiny: Governments worldwide are implementing stricter regulations to address climate change, including carbon pricing mechanisms, emissions reduction targets, and mandatory climate-related financial disclosures. [Link to a relevant government website or regulatory document]. This regulatory pressure compels businesses to incorporate climate risk into their strategic planning and financial reporting.

- Growing Scientific Consensus: The overwhelming scientific consensus on anthropogenic climate change strengthens the case for urgent action. The escalating frequency and intensity of extreme weather events provide stark evidence of the real-world impacts of climate change, making it harder for businesses to ignore the issue. [Link to IPCC report or similar scientific source].

- Investor Pressure: Institutional investors, such as pension funds and asset managers, are increasingly integrating ESG factors into their investment decisions. They are demanding greater transparency and accountability from companies regarding their climate-related risks and opportunities. This pressure drives companies to adopt more sustainable practices and disclose their climate-related information.

- Technological Advancements: The rapid advancement of renewable energy technologies, energy efficiency solutions, and other climate-friendly innovations presents significant opportunities for businesses. Companies that can successfully navigate this technological shift will gain a competitive advantage.

Navigating the New Landscape:

For businesses and financial institutions, navigating this evolving landscape requires a proactive and strategic approach. This includes:

- Integrating climate risk into strategic planning: Assessing and managing climate-related risks and opportunities should be an integral part of overall business strategy.

- Improving data transparency and disclosure: Companies need to provide accurate and comprehensive information on their climate-related impacts and performance.

- Investing in sustainable technologies and practices: Embracing sustainable practices can reduce operational costs, enhance brand reputation, and unlock new business opportunities.

- Engaging with stakeholders: Building strong relationships with investors, customers, and other stakeholders is crucial for successful navigation of the evolving climate risk landscape.

Conclusion:

The narrative on climate risk in the business and finance sectors is evolving rapidly. While climate change presents significant challenges, it also offers substantial opportunities for innovation and growth. By proactively addressing climate risk and embracing sustainable practices, businesses and financial institutions can not only mitigate potential losses but also unlock new sources of value creation. The future of business and finance is undeniably intertwined with the future of our planet, and adapting to this new reality is no longer optional—it's essential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Business And Finance's Evolving Narrative On Climate Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Convocatoria Completa Del Celta Excepto Abqar

May 14, 2025

Convocatoria Completa Del Celta Excepto Abqar

May 14, 2025 -

S And P 500 Climbs Erasing 2023 Losses On Nvidia Led Tech Boom

May 14, 2025

S And P 500 Climbs Erasing 2023 Losses On Nvidia Led Tech Boom

May 14, 2025 -

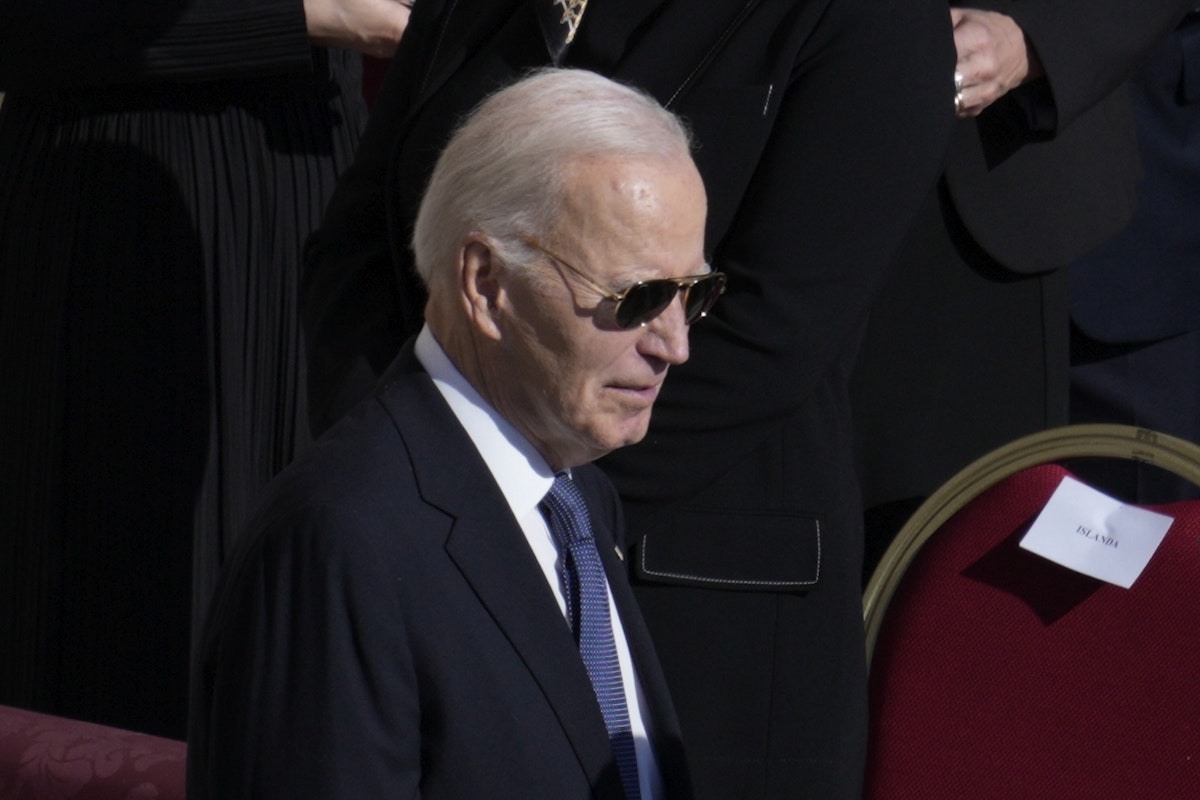

Bidens Staff And The Presidents Declining Health An Inside Look

May 14, 2025

Bidens Staff And The Presidents Declining Health An Inside Look

May 14, 2025 -

Tech Sector Drives S And P 500 Recovery Erasing Projected 2025 Losses

May 14, 2025

Tech Sector Drives S And P 500 Recovery Erasing Projected 2025 Losses

May 14, 2025 -

Report Rick Tocchet Officially Named Head Coach Of Philadelphia Flyers

May 14, 2025

Report Rick Tocchet Officially Named Head Coach Of Philadelphia Flyers

May 14, 2025